FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

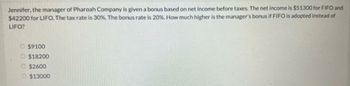

Transcribed Image Text:Jennifer, the manager of Pharoah Company is given a bonus based on net income before taxes. The net income is $51300 for FIFO and

$42200 for LIFO. The tax rate is 30%. The bonus rate is 20%. How much higher is the manager's bonus if FIFO is adopted instead of

LIFO?

$9100

O$18200

$2600

$13000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The sales manager is deciding between two possible compensation structures for sales staff. Under one plan, salespeople would receive a base compensation of $80,000 per year plus a 1% commission on all sales to their customers. Under the other plan, the base compensation would drop to $40,000 per year, but the commission rate would increase to 5%. What are the advantages and disadvantages, to the company of both plans? As the accounting manager, would you have a preference? Why or why not? (answer in text form please (without image), Note: .Every entry should have narration please)arrow_forwardSuppose two workers earn labor incomes of $20,000 per year in each of two tax accounting periods. One worker saves 20% of her labor earnings in the first period and spends all of her savings and accumulated interest in the final period. The other worker never saves any of her labor earnings. The market rate of interest is 10%.' a. Calculate the discounted present value of taxes paid over the two periods for each of the workers under a 15% comprehensive income tax. b. Calculate the discounted present value of taxes paid over the two periods under a comprehensive consumption tax. c. Comment on the equity and efficiency aspects of each of the two taxes.arrow_forwardA-1arrow_forward

- The minimum wage in Mississippi of $725 per hour and you work 50 weeks a year, 40 hours each week. How much will you get in gross wages for that whole entire year of working full time all but 2 weeks (off for travel, sickness, holidays, and vacation)? a. about $45,000 b. about $14,500 c. about $16,500 d. about $30,000 e. about $25,000arrow_forwardPls solve this question correctly instantly in 5 min i will give u 3 like for surearrow_forwardIn benefit cliff discussion: program provides $6,600 of benefits to a family with two kids, one under age 6. Benefits begin to phaseout at $150K, and are completely phased out at $400K. How much benefit will the household receive if their earnings are 350K? $ Earnings benefits $400,000 $150,000 $6,600 Below $6,600 Above $6,600 $150,000 $6,600 Earnings + Benefits Earnings Benefits Workarrow_forward

- Yogesharrow_forwardPlz help this is all the infromation the question has to offerarrow_forwardThe manager of Pharoah is given a bonus based on net income before taxes. The net income after taxes is $75980 for FIFO and $64500 for LIFO. The tax rate is 30%. The bonus rate is 20%. How much higher is the manager's bonus if FIFO is adopted instead of LIFO?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education