FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:enrollment_id=80494010#m02c-taxes-for-gig-workers/a01/p06

Taxes for Gig Workers

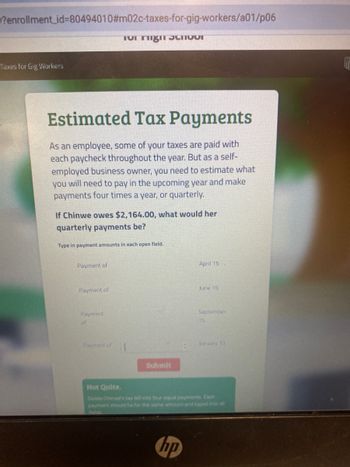

Estimated Tax Payments

As an employee, some of your taxes are paid with

each paycheck throughout the year. But as a self-

employed business owner, you need to estimate what

you will need to pay in the upcoming year and make

payments four times a year, or quarterly.

If Chinwe owes $2,164.00, what would her

quarterly payments be?

for might thvor

Type in payment amounts in each open field.

Payment of

Payment of

Payment

of

Submit

April 15

hp

June 15

September

15

Not Quite.

Divide Chinwe's tax bill into four equal payments Each

payment should be for the same amount and typed into all

fields

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- G, the Manager of ABC Co., was given a fringe benefit of a Household Expense account for the salary of his driver and other personal expenses in the amount of P20,000 per month for the current year. Compute the following: 1) Grossed Up Monetary of the Fringe Benefits 2) Fringe Benefits Tax Payable 3) If G is employed in an Offshore Banking unit, compute the fringe Benefits Tax. Upload your solutions in Spreadsheet Format.arrow_forwardTotal Cost of Empleyee R.D. Kagen employs Audrey Lopez at a salary of $33,800 a year. Kagen is subject to employer Social Security taxes at a rate of 6.2% and Medicare taxes at a rate of 1.45% on Lopez's salary. In addition, Kegen must pey SUTA tax et a rate of 5.4% and FUTA tax at a rate of 0.0% on the first $7,000 uf Lopez's salary. Compute the total cost to Kagen of emplaying Lopez for the year.arrow_forward1. Ms. Evelyn is tax compliance officer at the Bureau of internal revenue earning a monthly salary P35,196.00. How much is Ms. Evelyn's take home pay? 2. Allan S. Gala is a sales representative at a private pharmacy. He is given a monthly rice subsidy of P2,000.00. Over his monthly salary of P24,300.00. How much is his monthly net pay?arrow_forward

- Step by step solutionarrow_forward• X Corp. pays its employees monthly. The payroll information for Employee Barney listed below is for January, 2021, the first month of X's fiscal year. Salary: $40,000 Fed. Income Tax Withheld: $8,000 Federal and State Unemployment Tax: 6% Social Security Tax: 6.2% Medicare Tax: 1.45% Payroll tax expense related to this employee will be: O $7,140 $47,140 O $40,000 O $5,460arrow_forwardK t ht ences The employees of Ethereal Bank are paid on a semimonthly basis. All employees are single. There are no pre-tax deductions. Required: Compute the FICA taxes for the employees for the November 30 payroll. All employees have been employed for the entire calendar year. Note: Round "Social Security Tax" and "Medicare Tax" to 2 decimal places. Employee R. Bellagio B. Khumalo S. Schriver K. Saetang T. Ahmad M. Petrova Semimonthly Pay $ $ $ $ $ $ 9,519 6,719 6,838 8,200 10,700 9,050 YTD Pay for November 15 Pay Date Social Security Tax for November 30 Pay Date Medicare Tax for November 30 Pay Datearrow_forward

- Subject : accounting' Lacy Crawford has a regular hourly rate of $21.60. In a week when she worked 40 hours and had deductions of $110.60 for federal income tax, $53.60 for social security tax, and $12.50 for Medicare tax, her net pay wasarrow_forwardA-1arrow_forwardSupermarket Caridad offers its employees vacation benefits and contributes a 2% contribution to a 401K. The employees had total wages of $ 125,000 and vacation benefits of $ 28,460. Calculate how much the employer contributes for the 401k.Make the wage entries related to vacation pay.Make the wage entries related to the 401K contribution.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education