FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

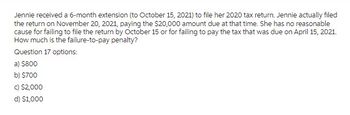

Transcribed Image Text:Jennie received a 6-month extension (to October 15, 2021) to file her 2020 tax return. Jennie actually filed

the return on November 20, 2021, paying the $20,000 amount due at that time. She has no reasonable

cause for failing to file the return by October 15 or for failing to pay the tax that was due on April 15, 2021.

How much is the failure-to-pay penalty?

Question 17 options:

a) $800

b) $700

c) $2,000

d) $1,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- A1arrow_forward6arrow_forwardDiscussion Question 1-42 (Algorithmic) (LO. 5) Rita files her income tax return 120 days after the due date of the return without obtaining an extension from the IRS. Along with the return, she remits a check for $98,000, which is the balance of the tax she owes. Note: Assume 30 days in a month. Disregarding the interest element, enter Rita's failure to file penalty and failure to pay penalty. Failure to pay penalty $ Failure to file penalty X Xarrow_forward

- Compute the penalty described for the following taxpayers. If an amount is zero, enter "0". If required, round your answers to two decimal places. Question Content Area a. Wilson filed his individual tax return on the original due date, but failed to pay $2,310 in taxes that were due with the return. If Wilson pays the taxes exactly 3 months late (not over 60 days), calculate the amount of his failure-to-pay penalty.$fill in the blank b. Joan filed her individual income tax return 5 months after it was due. She did not request an extension of time for filing. Along with her return, Joan remitted a check for $725, which was the balance of the taxes she owed with her return. Disregarding interest, calculate the total penalties that Joan will be required to pay, assuming the failure to file was not fraudulent.$fill in the blankarrow_forwardJasmine 29 is filing as a single tax payer in 2020 she recieve income from the following sources 39000 wages Alimony payment totaling 14328 her divorce was finalize in October 2019 Unemployment compensation of 6200 Jasmine also made a timely 2000 contribution to a traditional ira for 2020 She has no other income and will file a standard deduction What is Jasmine adjustable gross ? incomearrow_forwardLorna Hall’s real estate tax of $2,010.88 was due on December 14, 2019. Lorna lost her job and could not pay her tax bill until February 27, 2020. The penalty for late payment is 612%612% ordinary interest. (Use Days in a year table.)a. What is the penalty Lorna must pay? (Round your answer to the nearest cent.) Penalty Pay b. What is the total amount Lorna must pay on February 27? (Round your answer to the nearest cent.) Total Amountarrow_forward

- Clyde is a cash-method taxpayer who reports on a calendar-year basis. This year Paylate Corporation has decided to pay Clyde a year-end bonus of $1,450.Determine the amount Clyde should include in his gross income this year under the following circumstances. (Leave no answer blank. Enter zero if applicable.) Problem 5-53 Part-d (Algo) d. Clyde picked up the check in December, but the check could not be cashed immediately because it was postdated January 10. Amount to be included in gross income - ________arrow_forwardQuestion 1 Jahid (a mechanic) paid for the following items during the current tax year (2019-2020) and has approached you asking which of them are deductible from his salary income. He is a single tax resident for the year: Protective shoes and sunglasses with the cost of $600 all together Non-compulsory uniforms with the cost of $300 Compulsory uniforms with the cost of $700 Explain in detail (using a table for all the items above) with relevant tax laws and cases. Kindly use the four sections below for each case in your table. Facts of the scenario Relevant laws and cases Application of laws and cases Conclusionarrow_forwardCamila timely filed her 2020 tax return on April 15, 2021. Under ordinary circumstances, what is the last day she can file an amended tax return? April 15, 2023; October 15, 2023; April 18, 2024; October 15, 2024arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education