FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

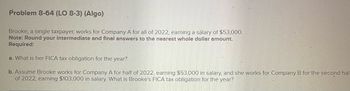

Transcribed Image Text:Problem 8-64 (LO 8-3) (Algo)

Brooke, a single taxpayer, works for Company A for all of 2022, earning a salary of $53,000.

Note: Round your intermediate and final answers to the nearest whole dollar amount.

Required:

a. What is her FICA tax obligation for the year?

b. Assume Brooke works for Company A for half of 2022, earning $53,000 in salary, and she works for Company B for the second hal-

of 2022, earning $103,000 in salary. What is Brooke's FICA tax obligation for the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information Problem 8-50 (LO 8-1) (Static) [The following information applies to the questions displayed below.] Lacy is a single taxpayer. In 2021, her taxable income is $42,000. What is her tax liability in each of the following alternative situations? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. Her $42,000 of taxable income includes $5,000 of qualified dividends.arrow_forwardGadubhaiarrow_forwardExercise 19-14 (Algorithmic) (LO. 5) Zack, a sole proprietor, has earned income of $36,145 in 2022 (after the deduction for one-half of self-employment tax). What is the maximum contribution Zack may make to a defined contribution Keogh plan? 58,000 Xarrow_forward

- Exercise 3-18 (Algorithmic) (LO. 2) Compute the 2020 standard deduction for the following taxpayers. If an amount is zero, enter "0". Click here to access the standard deduction table to use. а. Ellie is 15 and claimed as a dependent by her parents. She has $1,325 in dividends income and $3,680 in wages from a part-time job. b. Ruby and Woody are married and file a joint tax return. Ruby is age 66, and Woody is 69. Their taxable retirement income is $13,340. С. Shonda is age 68 and single. She is claimed by her daughter as a dependent. Her 2$ earned income is $270, and her interest income is $605. d. Frazier, age 40, is married but is filing a separate return. His wife itemizes her deductions.arrow_forward2.arrow_forwardRequired information Problem 8-77 (LO 8-5) (Algo) [The following information applies to the questions displayed below.] This year Lloyd, a single taxpayer, estimates that his tax liability will be $12,250. Last year, his total tax liability was $16,500. He estimates that his tax withholding from his employer will be $9,225. Problem 8-77 Part b (Algo) b. Assuming Lloyd does not make any additional payments, what is the amount of his underpayment penalty? Assume the federal short-term rate is 5 percent. Note: Do not round intermediate calculations. Round your final answers to 2 decimal places. Dates April 15th June 15th September 15th January 15th Total Actual Withholding Required Withholding Over (Under) Withheld Penalty Per Quarter $ 0.00arrow_forward

- Sami Terry is working as an Electrician for Siemens International in Toronto, Ontario. He earns $1500.00 on a bi-weekly basis. Sami’s Federal and provincial code for TD1 is 2(Hint: you can use 2021 tax deduction table or any other year if you prefer or PDOC). He has a cash taxable benefit of $30.00 and a non-taxable benefit of life insurance each pay period of $45.00 each pay period. He is also contributed $60.00 RPP each pay period. Required: Calculate Sami Terry’s Net Pay Check the following points if there are applicable only. Step One: Determine Gross Earnings Step Two: Determine Non-Cash Taxable Benefits Step Three: Determine CPP contributions (Use 5.45%) Step Four: Determine EI premium (Use 1.58%) Step Five: Determine QPIP premium Step Six: Determine federal & provincial tax Step Seven: Determine Northwest Territories/Nunavut (NT/NU) Payroll Tax Step Eight: Total Deductions Step Nine: Net Pay? Please Help me...arrow_forwardSagararrow_forwardLorna Hall’s real estate tax of $2,010.88 was due on December 14, 2019. Lorna lost her job and could not pay her tax bill until February 27, 2020. The penalty for late payment is 612%612% ordinary interest. (Use Days in a year table.)a. What is the penalty Lorna must pay? (Round your answer to the nearest cent.) Penalty Pay b. What is the total amount Lorna must pay on February 27? (Round your answer to the nearest cent.) Total Amountarrow_forward

- Louis files as a single taxpayer. In April of this year he received a $980 refund of state income taxes that he paid last year. How much of the refund, if any, must Louis include in gross income under the following independent scenarios? Assume the standard deduction last year was $12,400. (Leave no answer blank. Enter zero if applicable.) Problem 5-51 Part-b (Algo) b. Last year Louis had itemized deductions of $9,810 and he chose to claim the standard deduction. Louis’s itemized deductions included state income taxes paid of $2,335 and no other state or local taxes. Refund to be included in gross income- _______arrow_forwardT4.arrow_forwardManiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education