Concept explainers

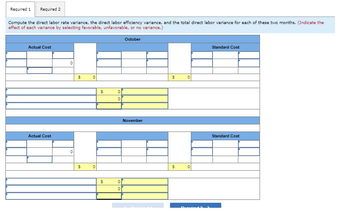

Javon Company set standards of 2 hours of direct labor per unit at a rate of $16.30 per hour. During October, the company actually uses 13,200 hours of direct labor at a $217,800 total cost to produce 6,900 units. In November, the company uses 17,200 hours of direct labor at a $284,660 total cost to produce 7,300 units of product.

AH = Actual Hours

SH = Standard Hours

AR = Actual Rate

SR = Standard Rate

(1) Compute the direct labor rate variance, the direct labor efficiency variance, and the total direct labor variance for each of these two months.

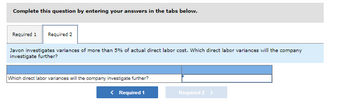

(2) Javon investigates variances of more than 5% of actual direct labor cost. Which direct labor variances will the company investigate further?

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

- Sharp Company manufactures a product for which the following standards have been set: Standard Quantity or Hours Standard Price or Rate Standard Cost Direct materials 3 feet $ 5 per foot $ 15 Direct labor ? hours ? per hour ? During March, the company purchased direct materials at a cost of $45,240, all of which were used in the production of 2,190 units of product. In addition, 4,500 direct labor-hours were worked on the product during the month. The cost of this labor time was $31,500. The following variances have been computed for the month: Materials quantity variance $ 1,950 U Labor spending variance $ 3,030 U Labor efficiency variance $ 780 U Required: 1. For direct materials: a. Compute the actual cost per foot of materials for March. b. Compute the price variance and the spending variance. 2. For direct labor: a. Compute the standard direct labor rate per hour. b. Compute the standard hours allowed for the month’s production. c. Compute the…arrow_forwardSharp Company manufactures a product for which the following standards have been set: Standard Standard Quantity Standard Price or or Hours Rate Cost $15 3 feet hours $5 per foot ? per hour ? ? Direct materials Direct labor During March, the company purchased direct materials at a cost of $54,630, all of which were used in the production of 2,875 units of product. In addition, 4,700 direct labor-hours were worked on the product during the month. The cost of this labor time was $47,000. The following variances have been computed for the month: Materials quantity variance Labor spending variance Labor efficiency variance Required: 1. For direct materials: a. Compute the actual cost per foot of materials for March. b. Compute the price variance and the spending variance. 2. For direct labor: a. Compute the standard direct labor rate per hour. b. Compute the standard hours allowed for the month's production. c. Compute the standard hours allowed per unit of product. $ 2,400 U $ 3,300 U $…arrow_forward[The following information applies to the questions displayed below.] Preble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labour-hours, and its standard costs per unit are as follows: Direct materials: 5 kg at $10.00 per kg Direct labour: 2 hours at $15 per hour Variable overhead: 2 hours at $5 per hour Total standard cost per unit The company planned to produce and sell 32,000 units in March. However, during March the company actually produced and sold 37,600 units and incurred the following costs: a. Purchased 200,000 kg of raw materials at a cost of $9.40 per kg. All of this material was used in production. b. Direct labour: 75,000 hours at a rate of $16 per hour. c. Total variable manufacturing overhead for the month was $558,750. 7. What is the variable overhead spending variance for March? (Do not round intermediate calculations. Round the actual overhead rate to two decimal places. Indicate the effect of each…arrow_forward

- Piper Corporation's standards call for 2,875 direct labor-hours to produce 1,150 units of product. During October the company worked 1,050 direct labor-hours and produced 900 units. The standard hours allowed for October would be: (Round your Intermediate calculations to 1 decimal place.) Multiple Cholce 2,875 hours 1,050 hours 2,250 hours 1,975 hoursarrow_forwardDomesticarrow_forward4. Case made 24,500 units during June, using 32,000 direct labor hours. They expected to use 31,450 hours per the standard cost card. Their employees were paid $15.75 per hour for the month of June. The standard cost card uses $15.50 as the standard hourly rate. NOTE: All dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345). For the variance conditions, your answer is either "F” (for Favorable) or "U” (for Unfavorable) - capital letter and no quotes. Complete the following table of variances and their conditions: Variance Variance Amount Favorable (F) or Unfavorable (U) Labor Rate ? ? Labor Time ? ? Total DL Cost Variance ? ?arrow_forward

- Javon Company set standards of 2 hours of direct labor per unit at a rate of $15.10 per hour. During October, the company actually uses 11,000 hours of direct labor at a $168,300 total cost to produce 5,700 units. In November, the company uses 15,000 hours of direct labor at a $230,250 total cost to produce 6,100 units of product.AH = Actual HoursSH = Standard HoursAR = Actual RateSR = Standard Rate(1) Compute the direct labor rate variance, the direct labor efficiency variance, and the total direct labor variance for each of these two months.(2) Javon investigates variances of more than 5% of actual direct labor cost. Which direct labor variances will the company investigate further?arrow_forwardDuring the month of April, Lucena Company reported Direct Labor of P72,000 and Direct Labor was equal to 60% of Total Prime Cost. If total Manufacturing Cost during April amounted to P170,000, how much is the total Factory Overhead?arrow_forwardNolan Mills uses a standard cost system. During May, Nolan manufactured 15,000 pillowcases, using 27,400 yards of fabric costing $3.05 per yard and incurring direct labor costs of $18,297 for 3,210 hours of direct labor. The standard cost per pillowcase assumes 1.75 yards of fabric at $3.10 per yard, and 0.20 hours of direct labor at $5.95 per hour. a. Compute both the price variance and quantity variance relating to direct materials used in the manufacture of pillowcases in May. b. Compute both the rate variance and efficiency variance for direct labor costs incurred in manufacturing pillowcases in May. (For all requirements, Indicate the effect of each variance by selecting "Favorable" or "Unfavorable". Select "None" and enter "0" for no effect (i.e., zero variance). Round your answers to 2 decimal places.)arrow_forward

- Bullseye Company manufactures dartboards. Its standard cost information follows: Standard Price (Rate) Standard Quantity 2.50 sq. ft. 1 hrs. $2.90 per sq. ft. $11.00 per hr. $ 0.40 per hr. Direct materials (cork board) Direct labor Variable manufacturing overhead (based on direct labor hours) Fixed manufacturing overhead ($68,250+ 195,000 units) Bullseye has the following actual results for the month of September: Number of units produced and sold Number of square feet of corkboard used Cost of corkboard used Number of labor hours worked Direct labor cost Variable overhead cost Fixed overhead cost Required 1 Required 2 Required 3. 1 hrs. Complete this question by entering your answers in the tabs below. Direct Materials Price Variance Direct Materials Quantity Variance Direct Materials Spending Variance Required: 1. Calculate the direct materials price, quantity, and total spending variances for Bullseye. 2. Calculate the direct labor rate, efficiency, and total spending variances for…arrow_forwardRegent Corp. uses a standard cost system to account for the costs of its one product. Materials standards are 3 pounds of material at $14 per pound, and labor standards are 4 hours of labor at a standard wage rate of $11. During July Regent Corp. produced 3,300 units. Materials purchased and used totaled 10,100 pounds at a total cost of $142,650. Payroll totaled $146,780 for 13,150 hours worked. a. Calculate the direct materials price variance. (Do not round your intermediate calculations. Indicate the effect of variance by selecting "Favorable", "Unfavorable", or "None" for no effect (i.e., zero variance).) Price Variance b. Calculate the direct materials quantity variance. (Indicate the effect of variance by selecting "Favorable", "Unfavorable", or "None" for no effect (i.e., zero variance).) Quantity Variancearrow_forwardSharp Company manufactures a product for which the following standards have been set: Standard Direct materials Direct labor Quantity or Hours 3 feet ? hours Standard Price or Standard Rate $5 per foot ? per hour Cost $ 15 ? During March, the company purchased direct materials at a cost of $45,240, all of which were used in the production of 2,190 units of product. In addition, 4,500 direct labor-hours were worked on the product during the month. The cost of this labor time was $31,500. The following variances have been computed for the month: Materials quantity variance Labor spending variance Labor efficiency variance Required: 1. For direct materials: $1,950 U $ 3,030 и $ 780 U a. Compute the actual cost per foot of materials for March. b. Compute the price variance and the spending variance. 2. For direct labor: a. Compute the standard direct labor rate per hour. b. Compute the standard hours allowed for the month's production. c. Compute the standard hours allowed per unit of…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education