FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

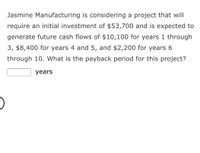

Transcribed Image Text:Jasmine Manufacturing is considering a project that will

require an initial investment of $53,700 and is expected to

generate future cash flows of $10,100 for years 1 through

3, $8,400 for years 4 and 5, and $2,200 for years 6

through 10. What is the payback period for this project?

years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A project requires an initial investment of $61.32 million to buy new equipment, and will provide after-tax cash flows of $22 million per year for 4 years. 1. What is the project's internal rate of return?arrow_forwardakshayarrow_forwardA project is projected to cost $2,000,000 to undertake. It will generate positive cash inflows as follows: Year 1 - $400,000; Year 2 500,000; Year 3 - $650,000; ear 4 - 750,000; Year 5 - 800,000. What is the project's Profitability Index if the required return is 10% ?arrow_forward

- Hoya Industries is considering a project with an initial cost today of $10,000. The project has a life of 3 years with cash inflows of $6,500 a year. Should the firm decide to wait one year to commence this project, the initial cost will increase by 10 percent, and the cash inflows will increase to $7,000 a year for three years. What is the value of the option to wait at a discount rate of 11 percent?arrow_forwardI need some help with this question Suppose you have $20,000 to invest in one of the following projects. Project Alpha requires an initial outlay of $10.900 and yields $12,000 in two years' time. Project Beta requires an outlay of $15,000 and yields say in the year and $8,850 the year after The cost of funds available is 5.5 % compounded Monthly. (A) Calculate the net present value for both projects. Answer to the nearest cent (B) Find the internal rate of return for both projects. Answer as a per cent to 2 decimals. (C) Which of these projects you would choose to invest in and why?arrow_forwardAurum, Inc. is considering the purchase of new mining equipment. The equipment will cost $1,500,000 and will produce an incremental cash flow of $400,000 per year over its five-year life. The disposal value is expected to be $20,000. The company has a required rate of return of 10%. What is the NPV of the project?arrow_forward

- ZLX is considering an project that requires a $3,560,000 initial investment, and is expected to provide incremental after-tax cash flows (OCF's) of $725,000 per year for 8 years, starting 1 year from today. If the required return is 10.9% compounded annually, what is the NPV of the project? Enter answer in dollars, rounded to the nearest dollar.arrow_forwardProject A requires an initial investment of $20,500, a cash inflow of $15,500 in the first year, and inflows of $10,000 each year for the next 2 years. What is the payback period for this project?arrow_forwardThe property is current selling for $400,000. You have forecasted, at the end of the fifth year we will assume the property will (or at least could) be sold for $500,000. If the required rate of return on projects of similar risk is 15%. ⦁ What is the net present value (NPV) of this investment project and should it be purchased? ⦁ What is the Internal Rate of Return offered by the project?arrow_forward

- Grayson Company is considering a purchase of equipment that costs $62,000 and is expected to offer annual cash inflows of $17,000. Grayson’s minimum required rate of return is 10%. How many years must the cash flows last for the investment to be acceptable ?arrow_forwardThe company XYZ is deciding whether or not to on a new project with an initial cost of 5.5 MM$. Net cash inflows are expected to be 9 MM$ for each of the first five years of operations. In the sixth year, the abandonment cost of the project is 35 MM$. a. Develop and plot the NPV profile for the projectb. Should the project be accepted at a rate of return of 8%? Should it be accepted at a rate of return of 15%? c. What is the project GRR if the available reinvestment rate is 8%? What if the rate is 15%?arrow_forwardA project with an initial cost of 30800 is expected to provide cash flow of 11,100 11,900, 15000 and 9500 over the next four year, respectively if the required return is 9.3 percent what is the projects profability index?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education