FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

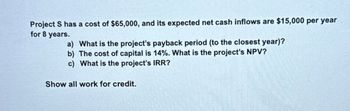

Transcribed Image Text:Project S has a cost of $65,000, and its expected net cash inflows are $15,000 per year

for 8 years.

a) What is the project's payback period (to the closest year)?

b) The cost of capital is 14%. What is the project's NPV?

c) What is the project's IRR?

Show all work for credit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A project requires an initial investment of $60 million and will then generate the same cash flow every year for 7 years. The project has an internal rate of return of 16% and a cost of capital of 10%. 1. What is the project's NPV (in $ million)?arrow_forwardA project has an initial cost of $40,000, expected net cash inflows of $12,000 per year for 12 years, and a cost of capital of 12%. What is the project's MIRR? (Hint: Begin by constructing a time line.) Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardA project has an initial cost of $ 55,000, expected net cash inflows of $10,000 per year for 10 years, and a cost of capital of 9%. What is the project's NPV ? (Hint: Begin by constructing a time line.) Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forward

- A project has an initial cost of $50,000, expected net cash inflows of $9,000 per year for 10 years, and a cost of capital of 10%. What is the project's NPV? (Hint: Begin by constructing a time line.) Do not round intermediate calculations. Round your answer to the nearest cent. ______$arrow_forwardThe initial cost of a project is $18 million. If a project returns $3 million at year 1 and that cash flow increases by $2 million each year afterwards, what is the payback period? The initial cost of a project is $18 million. If a project returns $3 million at year 1 and that cash flow increases by $2 million each year afterwards, what is the payback period? 5.77 years 4.25 years 3.33 years 2.66 yearsarrow_forwardA project has an initial cost of $60,000, expected net cash inflows of $12,000 per year for 9 years, and a cost of capital of 12%. What is the project's NPV? (Hint: Begin by constructing a time line.) Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forward

- A project requires an increase in inventories, accounts payable, and accounts receivable of $130,000, $95,000, and $65,000, respectively. If opportunity cost of capital is 4% and the project has a life of 14 years, and the working capital investments will be recovered at the end of the life of the project, what is the effect on the NPV of the project? Enter your answer rounded to two decimal places. Enter your response below. Numberarrow_forwardA project that provides annual cash flows of $22,500 for 7 years costs $84,000 today. a. If the required return is 12 percent, what is the NPV for this project? b. Determine the IRR for this project.arrow_forwardA project has an initial cost of $40,000, expected net cash inflows of $11,000 per year for 7 years, and a cost of capital of 13%. What is the project's MIRR? (Hint: Begin by constructing a time line.) Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward

- A project has an initial cost of $50,000, expected net cash inflows of $9,000 per year for 10 years, and a cost of capital of 14%. What is the project's MIRR? (Hint: Begin by constructing a time line.) Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardA project has an initial cost of $50,000, expected net cash inflows of $11,000 per year for 10 years, and a cost of capital of 14%. What is the project's NPV? (Hint: Begin by constructing a time line.) Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardA project has an initial cost of $40,000, expected net cash inflows of $9,000 per year for 7 years, and a cost of capital of 8%. What is the project's IRR? Round your answer to two decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education