Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

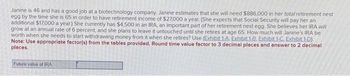

Transcribed Image Text:Janine is 46 and has a good job at a biotechnology company. Janine estimates that she will need $886,000 in her total retirement nest

egg by the time she is 65 in order to have retirement income of $27,000 a year. (She expects that Social Security will pay her an

additional $17,000 a year) She currently has $4,500 in an IRA, an important part of her retirement nest egg. She believes her IRA will

grow at an annual rate of 6 percent, and she plans to leave it untouched until she retires at age 65. How much will Janine's IRA be

worth when she needs to start withdrawing money from it when she retires? Use (Exhibit 1-A. Exhibit 1-8. Exhibit 1-C. Exhibit 1-D).

Note: Use appropriate factor(s) from the tables provided. Round time value factor to 3 decimal places and answer to 2 decimal

places.

Future value of IRA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Erin wants a monthly retirement income of $10,000. She will retire on her birthday at age 67 with a $3,000 per month social security monthly benefit and a $3,000 per month defined benefit pension. She expects to die on her birthday at age 90 and would like to leave $100,000 to each of her 4 children. She expects that her assets will grow at 9.9% per year. Her marginal tax rate is 24% and she expects a 2.6% annual rate of inflation. How much will she need to have saved when she retires to assure her desired monthly retirement income along with her desire to pass on some money to her kids?arrow_forwardAn individual is considering contributing $4,000 per year to either a traditional or a Roth IRA. Payments would begin in one year. If she uses the traditional IRA, her contributions would be fully deductible. She is 40-years old and is in a 28 percent tax bracket. On either IRA she can earn 7 percent. When she retires at age 65, she believes she will be in a 15 percent tax bracket. She invests not only the $4,000 per year, but any tax savings due to the deductibility of her contributions in a taxable investment earning a pretax rate of 7 percent. She will withdraw all her money upon retirement and may owe taxes then, depending on the type of IRA chosen. What is the after-tax future value of the traditional IRA including the invested tax deductions? Group of answer choices $237,545.47 $268,796.81 $215,046.73 $245,384.26 $252,996.15arrow_forwardLina, age 32, has a high-deductible health plan (HDHP) at her work. She is single and contributes $3,000 each year to her HSA plan. She rarely uses the funds, so she has built up a balance. If Lina took $10,000 from the HSA for a down payment toward buying a house, what would the tax outcome be?arrow_forward

- Adriana is financially responsible for her aged parents. She has a 5 year old son and wants to provide income for her parents and the son for 15 years should she die. Adriana earns $48,000 after taxes and believes that her parents and son could live on 60 percent of her current income. She anticipates college expenses for her son to be $55,000 and funeral expenses to be $18,000. If government Social security benefits is calculated to be $18,200 per year to be paid for 15 years. She has no existing life insurance but has an investment worth $32,000. If the insurance funds could be invested at 4 percent after taxes and inflation, how much life insurance does Adriana needarrow_forwardLike many married couples, Morgan and Thomas Jensen are trying their best to save for two important investment objectives: (1) an education fund to put their two children through college; and (2) a retirement nest egg for themselves. They want to set aside $100,000 per child by the time each one starts college. Given that their children are now 10 and 12 years old, Morgan and Thomas have 6 years remaining for one child and 8 for the other. As far as their retirement plans are concerned, the Jensens both hope to retire in 20 years, when they reach age 65. Both Morgan and Thomas work, and together, they currently earn about $90,000 a year. The Jensens started a college fund some years ago by investing $6,000 a year in bank CDs. That fund is now worth $67,000 (assume that the fund is split in half for each child). They also have $52,000 that they received from an inheritance invested in several mutual funds and another $22,000 in a tax-sheltered retirement account. Morgan and Thomas…arrow_forwardJohn and Denise are partners at a law firm. They have decided to set aside a fund for their loyal secretary who will retire in 10 years. John wants to make a $100 monthly deposit into an account while denise wants to make a lump - sum deposit today. How much will be in the account in 10 years if the interest rate is 10% compounded monthly and how much should Denise deposit in order to equal John's contribution?arrow_forward

- Yang Daiyu expects to retire in 30 years. She has decided that she would like to retire with enough money in savings to withdraw $4,500 per month for 24 years after she retires. Knowing she will be conservative with her retirement fund once retired, she believes that she will earn a rate of 3% per year from her retirement date onwards. Daiyu wonders how much she has to save per month in order to have that amount (calculated in (a)) at the time she retires. At the moment, she has about $9,000 in her savings account but she knows that will not be enough. She believes that she can earn an after-tax return of 5% compounded monthly on her savings. How much does Daiyu need to save each month for the next 30 years to reach her goal?arrow_forwardAs soon as she graduated from college, Kay began planning for her retirement. Her plans were to deposit $500 semiannually into an IRA (a retirement fund) beginning six months after graduation and continuing until the day she retired, which she expected to be 30 years later. Today is the day Kay retires. She just made the last $500 deposit into her retirement fund, and now she wants to know how much she has accumulated for her retirement. The fund earned 10 percent compounded semiannually since it was established. a. Compute the balance of the retirement fund assuming all the payments were made on time. b. Although Kay was able to make all of the $500 deposits she planned, 10 years ago she had to withdraw $10,000 from the fund to pay some medical bills incurred by her mother. Compute the balance in the retirement fund based on this information.arrow_forwardMarleen, who is 37 years old, is an employee of Zcrypt, Inc. (Zcrypt). Zcrypt sponsors a SEP IRA and would like to contribute the maximum amount to Marleen’s account for the plan year. If Marleen earns $32,000 per year, what is the maximum contribution Zcrypt can make on her behalf to the SEP IRA? $8,000 $19,000 $32,000 $56,000 Explanation:arrow_forward

- Bobbi Proctor does not want to“gamble”on Social Security taking care of her inretirement. Hence she wants to begin to plan now for retirement. She has enlisted the services of Hackney Financial Planning to assist her in meeting her goals. Proctor has determined that she would like to have a retirement annuity of$200,000 per year, with the first payment to be received 36 years from now at theend of her first year of retirement. She plans a long, enjoyable retirement of about 25 years. Proctor wishes to save $5,000 at the end of each of the next 15 years, and an unknown, equal end-of-period amount for the remaining 20 years before she begins her retirement. Hackney has advised Proctor that she can safely assume that all savings will earn 12 percent per annum until she retires, but only 8 percent thereafter. How much must Proctor save per year during the 20 years preceding retirement?arrow_forwardBillie Eilish is 20 and already worried about her future finances. She is currently happy but wants to be happier than ever by the time she retires. Hence, she wants to make some investments towards a couple of goals that she wants to achieve after retirement. First, she wants to be able to withdraw $100,000 each month to cover her clothing and make-up expenses for 20 years after she stops singing and retires at the age of 50. Second, she would like to donate $50,000,000 to NRDC at the age of 70. Lastly, the year she retires, she wants to buy a house in Hawaii that costs $10,000,000 today, with the price being estimated to increase by 2% each year. a. If she can earn 18% compounded monthly on her retirement account, how much does she need to deposit into her account each month, starting next month, until retirement to achieve her goals? b. If she decides to save and deposit $5,000 each month for the first 5 years only and then not to make any further deposits, what is the most she…arrow_forwardAnderson just landed his first job and is scheduled to start work on his 20th birthday. His parents have advised him that even though retirement seems like a long way off, it is important to start planning early. He has decided to deposit $4,500 into a retirement fund at the end of his first working year and hopes to increase this amount by 5% each year thereafter. The retirement fund is projected to pay an average rate of interest of 4%. If Danny plans to retire at age 65, and will therefore make 45 payments into the fund, how much is the retirement fund worth to him today?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education