Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

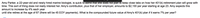

Transcribed Image Text:Amy Parker, a 22-year-old and newly hired marine biologist, is quick to admit that she does not plan to keep close tabs on how her 401(k) retirement plan will grow with time. This sort of thing does not really interest her. Amy's contribution, plus that of her employer, amounts to $2,100 per year starting at age 23. Amy expects this amount to increase by 4% each year until she retires at the age of 67 (there will be 45 EOY payments). What is the compounded future value of Amy's 401(k) plan if it earns 7% per year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Lindsay is 25 years old and has a new job in web development. She wants to make sure that she is financially sound in 30 years, so she plans to invest the same amount into a retirement account at the end of every year for the next 30 years. Note that because Lindsay invests at the end of the year, there is no interest earned on the contribution for the year in which she contributes. (a) Construct a data table that will show Lindsay the balance of her retirement account for various levels of annual investment and return. If Lindsay invests $14,000 at a return of 9% how much will she have (in dollars) in her retirement account at the end of 30 years. (Round your answer to the nearest dollar.) $ 790582 X (b) Develop the two-way table for annual investment amounts of $5,000 to $20,000 in increments of $1,000 and for returns of 0% to 12% in increments of 1%. Using the table, what are the minimum annual investments Lindsay must contribute (in dollars) for annual rates ranging from 7% to 11%…arrow_forwardYour client, Karna, has asked you for some advice. He would like to know how much he can contribute to his RRSP in the current year without over contributing. Karna has a carry forward amount of $16,000 and a pension adjustment of $6,000 from the previous year. In addition Karna has been divorced for the past three years and pays $2,500 per month in alimony. Given this scenario and based on the financial information below, how much can Karna contribute this year? Base Salary Commission Bonus Investment Portfolio Capital Gains Dividends $5,000 $6,000 Total taxable income $136,000 Select one: Current Year Previous Year $85,000 $80,000 $25,000 $30,000 $15,000 $18,000 a. $29,080 b. $27,100 c. $27,640 d. $29,260 $4,000 $5,000 $137,000arrow_forwardRuby is 25 and has a good job at a biotechnology company. She currently has $10,400 in an IRA, an important part of her retirement nest egg. She believes her IRA will grow at an annual rate of 8 percent, and she plans to leave it untouched until she retires at age 65. Ruby estimates that she will need $875,000 in her total retirement nest egg by the time she is 65 in order to have retirement income of $20,000 a year (she expects that Social Security will pay her an additional $15,000 a year). a. How much will Ruby's IRA be worth when she needs to start withdrawing money from it when she retires? Use Exhibit 1-A (Round FV factor to 3 decimal places and final answer to the nearest whole dollar.) Future value of IRA b. How much money will she have to accumulate in her company's 401(k) plan over the next 40 years in order to reach her retirement income goal? (Round your answer to the nearest whole dollar.) Required future value of 401(k)arrow_forward

- Bertha and Martha are twins, and just graduated from college. They plan to retire in 40 years. To that end, each has a 401-k tax-advantaged retirement account. Martha contributes $1,000 per month only for the first five years. Bertha does not contribute during the first 20 years but contributes $2,500 per month during the last 20 years. 14) How much would Martha’s account hold at retirement if she earned an annual rate of 11.5%? A) $3,347,918.85 B) $1,940,849.36 C) $2,999,789.12 *D) $4,425,537.6. First compute the FV of the 60-month annuity and then compound the lump-sum for the next 420 months. Use a periodic rate. 15) 15) How much would Bertha’s account hold at retirement if she also earned an annual rate of 11.5%? A) $3,350,918.25 *B) $2,312,752.65 C) $1,978,400.10 D) $2,711,542.16. Please show the work step by step through financial calculator.arrow_forwardLarry Kraft owns a restaurant that is open 7 days a week. He has 25 fulltimeemployees, but he has fairly high employee turnover. He believes thathe can stabilize his workforce if he has a pension plan for his employees.Larry hears about a small business retirement plan called the SIMPLE IRA.What are the qualifications and limitations for him to establish this plan?arrow_forwardGeorge Clausen (age 48) is employed by Kline Company and is paid an annual salary of $42, 640. He has just decided to join the company's Simple Retirement Account (IRA form) and has a few questions. Answer the following for Clausen: C) What would be his weekly take-home pay with the retirement contribution deducted? D) What would be his weekly take-home pay without the retirement contribution?arrow_forward

- 43. Bobbi Proctor does not want to “ gamble ” on Social Security taking care of her in retirement . Hence she wants to begin to plan now for retirement . She has enlisted the services of Hackney Financial Planning to assist her in meeting her goals . Proc tor has determined that she would like to have a retirement annuity of $ 200,000 per year , with the first payment to be received 36 years from now at the end of her first year of retirement . She plans a long , enjoyable retirement of about 25 years . Proctor wishes to save $ 5,000 at the end of each of the next 15 years , and an unknown , equal end - of - period amount for the remaining 20 years before she begins her retirement Hackney has advised Proctor that she can safely assume that all savings will earn 12 percent per annum until she retires , but only 8 percent thereafter . How much must Proctor save per year during the 20 years preceding retirement ? EBK CONTEMPORARY FINANCIAL MANAGEM chapter5, problem 43arrow_forwardDerek plans to retire on his 65th birthday. However, he plans to work part-time until he turns 75.00. During these years of part-time work, he will neither make deposits to nor take withdrawals from his retirement account. Exactly one year after the day he turns 75.0 when he fully retires, he will wants to have $3,392, 232.00 in his retirement account. He he will make contributions to his retirement account from his 26th birthday to his 65 th birthday. To reach his goal, what must the contributions be? Assume a 8.00% interest rate. Answer format: Currency: Round to: 2 decimal places.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education