FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

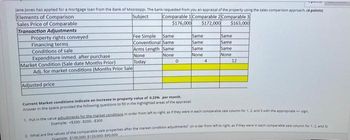

Transcribed Image Text:Jane Jones has applied for a mortgage loan from the Bank of Mississippi. The bank requested from you an appraisal of the property using the sales comparison approach. (4 points)

Elements of Comparison

Sales Price of Comparable

Transaction Adjustments

Property rights conveyed

Financing terms

Conditions of sale

Expenditure inmed. after purchase

Market Condition (Sale date Months Prior)

Adj. for market conditions (Months Prior Sale

Subject

Comparable 1 Comparable 2 Comparable 3

$176,000

$172,000

$163,000

Fee Simple

Same

Same

Same

Conventional Same

Same

Same

Arms Length Same

Same

Same

None

None

None:

None

Today

0

4

12

Adjusted price:

Current Market conditions indicate an increase in property value of 0.25% per month.

Answer in the space provided the following questions to fill in the highlighted areas of the appraisal

1. Put in the value adjustments for the market conditions in order from left to right, as if they were in each comparable sale column for 1, 2, and 3 with the appropriate + sign.

Example: $200-$200-$300

2. What are the values of the comparable sale properties after the market condition adjustments? (in order from left to right as if they were in each comparable sale column for 1, 2, and 33

Fxample: $100,000: $120,000: $90,000

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A builder is offering $131,554 loans for his properties at 9 percent for 25 years. Monthly payments are based on current market rates of 9.5 percent and are to be fully amortized over 25 years. The property would normally sell for $140,000 without any special financing. Required: a. At what price should the builder sell the properties to earn, in effect, the market rate of interest on the loan? Assume that the buyer would have the loan for the entire term of 25 years. b. At what price should the builder sell the properties to earn, in effect, the market rate of interest on the loan if the property is resold after 10 years and the loan repaid? Complete this question by entering your answers in the tabs below. Required A Required B At what price should the builder sell the properties to earn, in effect, the market rate of interest on the loan? Assume that the buyer would have the loan for the entire term of 25 years. (Do not round intermediate calculations. Round your final answer to the…arrow_forwardColleges Software Guides Search Contact A sale of OMR 39 to S. Yusof was entered in the books as OMR 29, correction will be: O a. Debit Cash 10 and Credit Sales 10 O b. Debit Sales 10 and Credit S. Yusof 10 O c. Debit S. Yusof 10 and Credit Sales 10 O d. Debit S. Yusof 10 and Credit Bank 10 is that part of the original cost of a fixed asset that is consumed during its period of a. Debtorsarrow_forwardCost ConceptT On February 3, Gallatin Repair Service extended an offer of $152,000 for land that had been priced for sale at $173,000. On February 28, Gallatin Repair Service accepted the seller's counteroffer of $165,000. On October 23, the land was assessed at a value of $248,000 for property tax purposes. On January 15 of the next year, Gallatin Repair Service was offered $264,000 for the land by a national retail chain. At what value should the land be recorded in Gallatin Repair Service's records?arrow_forward

- Kindly solve only part Barrow_forwardCan someone explain this to me, thank you! Help me find correct answer, as well.arrow_forwardUsing the information from the three office building land sales. Assume that you are valuing a similar building of 30,000 square feet. What is the appropriate land value? Sales Price Building Size Land Size Sale 1 $550,000 27,500 SF 2.50 acres Sale 2 $625,000 31,250 SF 2.50 acres Sale 3 $650,000 32,500 SF 3.25 acresarrow_forward

- Subject - accountarrow_forwardPlease do not give solution in image format ?arrow_forwardA company sells an office desk. You are provided with the following information: The original cost of the desk was $3,000. The desk is sold for $1,000. . . The value of the desk is $1,500. The opening UCC balance in Class 8 is $18,000 A new desk is purchased for $2,000. What amount is recorded as a disposition in Class 8? • O O a. $3,000 O b. $1,000 O c. $1,500 O d. d. $18,000 $2,000arrow_forward

- Heer Don't upload any image pleasearrow_forwardUpc Rosilyn trades an old parcel of land with an adjusted basis of $13,000 and an outstanding loan liability balance of $2,000 for a new parcel of land valued at $9,000 plus $3,000 cash from Bob's Company. Bob assumes Rosilyn's loan balance. What is Rosilyn's amount realized on the transaction? Oa. $13,000 Ob. $14,000 Oc, $3,000 Od. $9,000 Oe. $12,000 (Previous Next 1:57 A 5/11/202arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education