Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:A builder is offering $131,554 loans for his properties at 9 percent for 25 years. Monthly payments are based on current market rates of

9.5 percent and are to be fully amortized over 25 years. The property would normally sell for $140,000 without any special financing.

Required:

a. At what price should the builder sell the properties to earn, in effect, the market rate of interest on the loan? Assume that the buyer

would have the loan for the entire term of 25 years.

b. At what price should the builder sell the properties to earn, in effect, the market rate of interest on the loan if the property is resold

after 10 years and the loan repaid?

Complete this question by entering your answers in the tabs below.

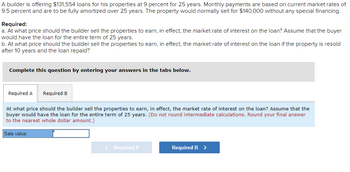

Required A Required B

At what price should the builder sell the properties to earn, in effect, the market rate of interest on the loan? Assume that the

buyer would have the loan for the entire term of 25 years. (Do not round intermediate calculations. Round your final answer

to the nearest whole dollar amount.)

Sale value

< Required A

Required B >

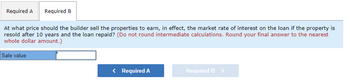

Transcribed Image Text:Required A Required B

At what price should the builder sell the properties to earn, in effect, the market rate of interest on the loan if the property is

resold after 10 years and the loan repaid? (Do not round intermediate calculations. Round your final answer to the nearest

whole dollar amount.)

Sale value

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- A builder is offering $117,767 loans for his properties at 9 percent for 25 years. Monthly payments are based on current market rates of 9.5 percent and are to be fully amortized over 25 years. The property would normally sell for $130,000 without any special financing. Required: a. At what price should the builder sell the properties to earn, in effect, the market rate of interest on the loan? Assume that the buyer would have the loan for the entire term of 25 years. Complete this question by entering your answers in the tabs below. Required A At what price should the builder sell the properties to earn, in effect, the market rate of interest on the loan? Assume that the buyer would have the loan for the entire term of 25 years. (Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount.) Sale value $ 116,134arrow_forwardA property is available for sale that could normally be financed with a fully amortizing $80,200 loan at a 10 percent rate with monthly payments over a 25-year term. Payments would be $728.78 per month. The builder is offering buyers a mortgage that reduces the payments by 50 percent for the first year and 25 percent for the second year. After the second year, regular monthly payments of $728.78 would be made for the remainder of the loan term. Required: a. How much would you expect the builder to have to give the bank to buy down the payments as indicated? b. Would you recommend the property be purchased if it was selling for $5,000 more than similar properties that do not have the buydown available?arrow_forwardA property is expected to have NOI of $100,000 the first year. The NOI is expected to increase by 5 percent per year thereafter. The appraised value of the property is currently $1.25 million and the lender is willing to make a $1,125,000 participation loan with a contract interest rate of 5.5 percent. The loan will be amortized with monthly payments over a 20-year term. In addition to the regular mortgage payments, the lender will receive 50 percent of the NOI in excess of $100,000 each year until the loan is repaid. The lender also will receive 50 percent of any increase in the value of the property. The loan includes a substantial prepayment penalty for repayment before year 5, and the balance of the loan is due in year 10. (If the property has not been sold, the participation will be based on the appraised value of the property.) Assume that the appraiser would estimate the value in year 10 by dividing the NOI for year 11 by an 8 percent capitalization rate. Assume that another…arrow_forward

- An owner of the ATRIUM Tower Office Building is currently negotiating a five-year lease with ACME Consolidated Corporation for 20,000 rentable square feet of office space. ACME would like a base rent of $11 per square foot (PSF) with step-ups of $1 per year beginning one year from now. Required: a. What is the present value of cash flows to ATRIUM under the above lease terms? (Assume a 10% discount rate.) b. The owner of ATRIUM believes that base rent of $11 PSF in (a) is too low and wants to raise that amount to $15 with the same $1 step-ups. However, now ATRIUM would provide ACME a $53,000 moving allowance and $130,000 in tenant improvements (Tls). What would be the present value of this alternative to ATRIUM? c. ACME informs ATRIUM that it is willing to consider a $14 PSF with the $1 annual stepups. However, under this proposal, ACME would require ATRIUM to buyout the one year remaining on its existing lease in another building. That lease is $6 PSF for 20,000 SF per year. If ATRIUM…arrow_forwardA builder is offering $137,381 loans for his properties at 9 percent for 25 years. Monthly payments are based on current market rates of 9.5 percent and are to be fully amortized over 25 years. The property would normally sell for $150,000 without any special financing. Required: a. At what price should the builder sell the properties to earn, in effect, the market rate of interest on the loan? Assume that the buyer would have the loan for the entire term of 25 years. Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount.) b. At what price should the builder sell the properties to earn, in effect, the market rate of interest on the loan if the property is resold after 10 years and the loan repaid? Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount.)arrow_forwardSuppose you want to purchase a property for $205,000 and you have $30,000 to put down as a down payment. The property has an existing mortgage that can be wrapped. This loan is a fixed-rate mortgage at 7 percent, monthly payments. This loan had an original balance of $150,000 and has 20 years remaining on its original 30-year term. The current market rate for a new fixed-rate loan is 10.50 percent for 20 years. The seller will give you a wrap loan for an amount equal to the purchase price minus the down payment at 8.75 percent, monthly payments. What is the effective equity yield for the wrap lender if the wrap loan is written for a term equal to the remaining term of the existing mortgage and both are held to maturity?arrow_forward

- A builder is offering $139,371 loans for his properties at 9 percent for 25 years. Monthly payments are based on current market rates of 9.5 percent and are to be fully amortized over 25 years. The property would normally sell for $150,000 without any special financing. Required: a. At what price should the builder sell the properties to earn, in effect, the market rate of interest on the loan? Assume that the buyer would have Give typing answer with explanation and conclusionarrow_forwardYou have a choice between the following two identical properties: Property A is priced at $150,000 with 80 percent financing at a 10.5 percent interest rate for 20 years. Property B is priced at $160,000 with an assumable mortgage of $100,000 at 9 percent interest with 20 years remaining. Monthly payments are $899.73. A second mortgage for $20,000 can be obtained at 13 percent interest for 20 years. All loans require monthly payments and are fully amortizing. a. With no preference other than financing, which property would you choose? b. How would your answer change if the seller of Property B provided a second mortgage for $20,000 at the same 9 percent rate as the assumable loan? c. How would your answer change if the seller of Property B provided a second mortgage for $30,000 at the same 9 percent rate as the assumable loan so that no additional down payment would be required by the buyer if the loan were assumed?arrow_forwardSuppose you obtain a five-year lease for a Porsche and negotiate a selling price of $157,000. the annual interest-rate is 8.4%, the residual value is $76,000, and you make a down payment of $5000. Find each of the following. A) the net capitalized cost B) the money factor (round to 4 decimal places) C) the average monthly finance charge (round to the nearest cent) D) the average monthly depreciation (round to the nearest cent) and E) the monthly lease amount (round to the nearest cent)arrow_forward

- Munabhaiarrow_forwardCompare the cost of the following lesing agreement with the finance charge on a loan for the same time period. The price of the car is $14,000, and its projected residual value at the end of four years is $3,000. Monthly payment $250 Capital cost reduction $1,000 Disposition charge $200 Other things being equal, one would want to finance this car rather than take this lease if the finance cost were less than Select one: a. $2,200 b. $2,000 c. $1,550 d. $1,450arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education