FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

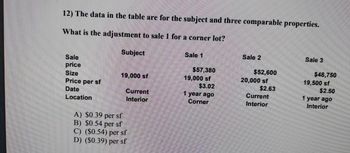

Transcribed Image Text:12) The data in the table are for the subject and three comparable properties.

What is the adjustment to sale 1 for a corner lot?

Sale

price

Size

Price per sf

Date

Location

Subject

19,000 sf

Current

Interior

A) $0.39 per sf

B) $0.54 per sf

C) ($0.54) per sf

D) ($0.39) per sf

Sale 1

$57,380

19,000 sf

$3.02

1 year ago

Corner

Sale 2

$52,600

20,000 sf

$2.63

Current

Interior

Sale 3

$48,750

19,500 sf

$2.50

1 year ago

Interior

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- How do I Figure out g and h? Please helparrow_forwardBook value Find the book value for the asset shown in the accompanying table, assuming that MACRS depreciation is being used E Recovery period (years) Elapsed time since purchase (years) Asset Installed cost A $987,000 2 The remaining book value is $ . (Round to the nearest dollar.) Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year* 5 years Recovery year 3 years 7 years 10 years 1 33% 20% 14% 10% 45% 32% 25% 18% 15% 19% 18% 14% 7% 12% 12% 12% 12% 9% 9% 5% 9% 8% 9% 7% 4% 6% 6% 10 6% 11 4% Totals 100% 100% 100% 100% *These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%)…arrow_forwardConsider the following cash flow statement for a property fully leased to a new tenant on a NNN basis beginning in Year 1. Potential Base Rent Free Rent and Concessions Absorption and Turnover Vacancy Total Rental Revenue Expense Recoveries Total Tenant Revenue Other Revenues Potential gross Revenue Vacancy and Collection Loss Effective Gross Revenue Recoverable Opex Non Recoverable Opex Total Opex Year 1 $750,000 $0 $0 $750,000 $350,000 $1,100,000 $0 $1,100,000 $0 $1,100,000 $350,000 $50,000 $400,000 Net Operating Income $700,000 What would the Year 1 NOI be if there were 3-months of downtime before the tenant's lease began AND the tenant had received 3-months of free base rent during the year? Group of answer choices $237,500 $150,000 $325,000 $425,000arrow_forward

- 5 - Our company has purchased a land for 472.000 TL including 18% VAT. Which of the following accounts is correct to use in the relevant accounting record ? a) 191 VAT Deductible 72.000 TL (Creditor) B) 250 Land and Lands Hs. 400.000 TL (Creditor) NS) 391 Calculated VAT Hs. 72.000 TL (Borrower) D) 252 Buildings Hs. 72.000 TL (Borrower) TO) 250 Land and Lands Hs. 400.000 TL (Borrower)arrow_forwardPROPERTY INFO Tenant Street Address City State Zip APN GLA Lot Size Year Built FINANCIAL SUMMARY Dollar General Purchase Price $1,519,661* 511 Old Route 15 Cap Rate 6.80% Port Trevorton Net Operating Income $103,337 PA Price / SF $167 1/864 Rent/SF $40 05-05-003 *Offering 2.5% Fee to Buy-Side Broker CONTACT INFORMATION 9,100 SF Listing Agent Nina McGaughy 1.31 AC Phone Number (424) 325-2624 2019 INVESTMENT HIGHLIGHTS Absolute Net (NNN) Investment Dollar General operates on an Absolute Net (NNN) Lease with tenant fully responsible for maintenance, insurance and taxes providing the landlord with a low maintenance asset DOLLAR GENERAL Corporate Guarantee Dollar General Corporation (NYSEDG) is a fortune 500 company with over 80 years in business and $25.6 billion in revenue FY'18. w Open! Future Rent Growth-10% Increases In Each Option Period There are 10% rental increases built into the lease in each option period, providing the landlord with positive rent growth and a hedge against…arrow_forwardSh3 Please help me. Solution Thankyou.arrow_forward

- What is the cost of the land, based upon the following data? Land purchase price $192,605 Broker's commission 15,004 Payment for the demolition and removal of existing building 4,204 Cash received from the sale of materials salvaged from the demolished building 1,211 $fill in the blank 1arrow_forwardAm. 398.arrow_forwardPlease help mearrow_forward

- signment/takeAssignmentMain.do?invoker%-D&etakeAssignmentSessionLocator%-&inprogress%3false The earliest date that condemned property can be replaced and still qualify for involuntary conversion (nonrecognition) treatment is: Oa. 2 years before the actual condemnation. Ob. 3 years after the date of the condemnation. Oc. the date of the threat of condemnation. Od. 2 years before the threat of condemnation. Oe, the date of the actual condemnation.arrow_forwardHow to round 15,748,516 to the place valuearrow_forwardPlease complete all parts do not give solution in image formatarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education