FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

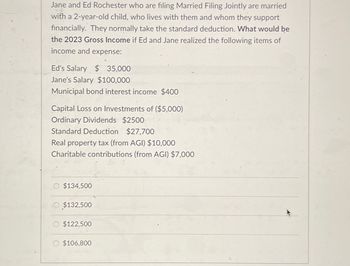

Transcribed Image Text:Jane and Ed Rochester who are filing Married Filing Jointly are married

with a 2-year-old child, who lives with them and whom they support

financially. They normally take the standard deduction. What would be

the 2023 Gross Income if Ed and Jane realized the following items of

income and expense:

Ed's Salary $ 35,000

Jane's Salary $100,000

Municipal bond interest income $400

Capital Loss on Investments of ($5,000)

Ordinary Dividends $2500

Standard Deduction $27,700

Real property tax (from AGI) $10,000

Charitable contributions (from AGI) $7,000

$134,500

O $132,500

$122,500

$106,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ! Required information [The following information applies to the questions displayed below.] Mickey and Jenny Porter file a joint tax return, and they itemize deductions. The Porters incur $3,425 in investment expenses. They also incur $5,375 of investment interest expense during the year. The Porters' income for the year consists of $178,500 in salary and $4,495 of interest income. a. What is the amount of the Porters' investment interest expense deduction for the year? Investment interest expense deductionarrow_forwardOf Roger's $12,000,000 federal gross estate, his will directs one specific bequest of $8,000,000 to his wife, Lori, and directs the debts and other expenses of $1,000,000 to be payable from the residuary of the estate. The residuary heirs are Roger's children. What is the amount of the marital deduction included on Roger's federal estate tax return? Question 16 options: $12,000,000 $ 8,000,000 $7,000,000 $0arrow_forwardThe Tax Formula for Individuals, A Brief Overview of Capital Gains and Losses (LO 1.3, 1.9) In 2020, Manon earns wages of $54,000. She also has dividend income of $2,800. Manon is single and has no dependents. During the year, Manon sold silver coins held as an investment for a $7,000 loss. Table for the standard deduction Filing Status Standard Deduction Single $12,400 Married, filing jointly 24,800 Married, filing separately 12,400 Head of household 18,650 Qualifying widow(er) 24,800 Calculate the following amounts for Manon: a. Adjusted gross income $fill in the blank b. Standard deduction $fill in the blank c. Taxable income $fill in the blankarrow_forward

- During 2023, Anmol Frank had the following transactions: Alimony received (divorce occured in 2017) Interest income on IBM bonds She borrowed money to buy a new car Value of BMW received as a gift from aunt Federal income tax withholding payments The taxpayer's AGI is: a. $74,000. b. $76,000. c. $79,000. d.) $81,000. e. $90,000.arrow_forwardLeslie and Jason, who are married filing jointly, paid the following expenses during 2022: Interest on a car loan $ 130 Interest on lending institution loan (used to purchase municipal bonds) 3,150 Interest on home mortgage (home mortgage principal is less than $750,000) 2,210 Required: What is the maximum amount that they can use in calculating itemized deductions for 2022?arrow_forwardVikrambhaiarrow_forward

- Harold and Kumar own a tax preparation business that they value at 1,000,000 based on their latest official valuation which includes $ 500,000 of real property. They are purchasing life insurance to fund their buy /sell agreement as neither one wants to work with the other one's spouse. The amount of life insurance that they should purchase on each other is? A. $250,000 each B. $500,000 each $1,000,000 each D. Nonearrow_forwardJohn and Mary file married filing joint and have the following details Modified Adjusted Gross Income $275,000 Wages $150,000 Taxable interest $20,000 Short term capital gains $15,000 Net self-employment income $90,000 What is their Net Investment Income Tax?arrow_forwardKristin and Logan have two young children. They have $7,000 of qualified child care expenses and AGI of $22,000 in 2020. What is their allowable child and dependent care credit considering their pre-credit tax liability? a. $1,860 b. $0 c. $7,000 d. $2,000 e. $6,000arrow_forward

- Lily Tucker (single) owns and operates a bike shop as a sole proprietorship. In 2023, she sells the following long-term assets used in her business: Asset Building Equipment Sales Price $ 230,000 80,000 Description Taxable income Tax liability Lily's taxable income before these transactions is $190,500. What are Lily's taxable income and tax liability for the year? Use Tax Rate Schedule for reference. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Cost $ 200,000 148,000 $ Amount Accumulated Depreciation $ 52,000 23,000 227,500arrow_forwardIndividual Retirement Accounts (LO 5.3) Phil and Linda are 25-year-old newlyweds and file a joint tax return. Linda is covered by a retirement plan at work, but Phil is not. If an amount is zero, enter "0". a. Assuming Phil's wages were $27,000 and Linda's wages were $18,500 for 2018 and they had no other income, what is the maximum amount of their deductible contributions to a traditional IRA for 2018? Phil $ Linda $ b. Assuming Phil's wages were $53,000 and Linda's wages were $70,000 for 2018 and they had no other income, what is the maximum amount of their deductible contributions to a traditional IRA for 2018? Phil $ Linda $arrow_forwardDear Expert Sarah and David are married, filing jointly, with three children (two in college). Their 2023 tax information is as follows: Wages: Sarah ($72,000), David ($110,000) Self-Employment Income (before QBI): Sarah ($68,000) Self- Employment Expenses: Sarah ($11,000) 401(k) contribution: David ($20, 500) Tuition and Qualified Education Expenses: $24,500 Itemized Deductions: Mortgage Interest: $11,500 State and Local Taxes: $10,000 (SALT limitation) Calculate Sarah and David's: Qualified Business Income (QBI) Adjusted Gross Income (AGI) Taxable Income Potential Education Creditsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education