FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

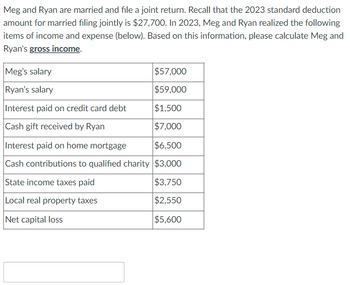

Transcribed Image Text:Meg and Ryan are married and file a joint return. Recall that the 2023 standard deduction

amount for married filing jointly is $27,700. In 2023, Meg and Ryan realized the following

items of income and expense (below). Based on this information, please calculate Meg and

Ryan's gross income.

$57,000

$59,000

$1,500

$7,000

Meg's salary

Ryan's salary

Interest paid on credit card debt

Cash gift received by Ryan

Interest paid on home mortgage

$6,500

Cash contributions to qualified charity $3,000

State income taxes paid

$3,750

Local real property taxes

$2,550

Net capital loss

$5,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rahul and Ruby are married taxpayers. They are both under age 65 and in good health. For 2020 they have a total of $107,700 in wages and $330 in interest income. Rahul and Ruby's deductions for adjusted gross income amount to $2,285 and their itemized deductions equal $16,230. They claim two exemptions for the year on their joint tax return. Table for the standard deduction Filing Status Standard Deduction Single $12,400 Married, filing jointly 24,800 Married, filing separately 12,400 Head of household 18,650 Qualifying widow(er) 24,800 a. What is the amount of Rahul and Ruby's adjusted gross income?$fill in the blank b. In order to minimize taxable income, Rahul and Ruby will in the amount of $fill in the blank c. What is their taxable income?$fill in the blankarrow_forwarda. Compute the following: Gross income and AGI Standard deduction (single) Taxable income Income tax Gross income and AGI b. Assume that Toby and Nancy get married in 2023 and file a joint return. What is their taxable income and income tax? Round your final answer to the nearest whole dollar. Toby Filing Single $ Standard deduction (married, filing jointly) Taxable income Income tax Nancy Filing Single Married Filing Jointly c. How much income tax can Toby and Nancy save if they get married in 2023 and file a joint return?arrow_forwardGeorge and Wanda received $29,100 of Social Security benefits this year ($11,000 for George, $18.300 for Wanda). They also received $4,800 of interest from jointly owned City of Ranburne Bonds and dividend income. What amount of the Social Security benefits must George and Wanda include in their gross income under the following independent situations? Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable. Required: a. George and Wanda file married joint and receive $8,750 of dividend income from stocks owned by George b. George and Wanda file married separate and receive $8,750 of dividend income from stocks owned by George c. George and Wands file married joint and receive $32.200 of dividend income from stocks owned by George d. George and Wanda file married joint and receive $16,100,of dividend income from stocks owned by George Complete this question by entering your answers in the…arrow_forward

- Please explain every step. Thank youarrow_forwardI just need introduction paragraph for this question because already I have solution for this question.definetly will upvote.arrow_forwardIn 2019, Margaret and John Murphy (both over age 65) are married taxpayers who file a joint tax return with AGI of $26,100. During the year they incurred the following expenses: Medical insurance premiums $1,300 Premiums on an insurance policy that pays $100 per day for each day Margaret is hospitalized 400 Medical care lodging (two people, one night) 65 Hospital bills 2,100 Doctor bills 850 Dentist bills 200 Prescription drugs and medicines 340 Psychiatric care 350 In addition, they drove 80 miles for medical transportation, and their insurance company reimbursed them $800 for the above expenses. On the following segment of Schedule A of Form 1040, calculate the Murphy’s medical expense deduction.arrow_forward

- Chris 45 and Alison 46 are marries and they will file a joint return . During the year they earned 82500 wages. They also jad investment income consisting of 200 interest income from a savng account 350 interest income from a certificate of deposit held with another bank 250 interest income from a us treasury 500 tax exempt interest income from municipal bond and 1700 in ordinart dividends from a mutual fund what amout will cris and allison report for taxable interest in their 1040arrow_forwardharrow_forwardQuestion 27 of 50. Mark and Carrie are married, and they will file a joint return. They both work full-time, and their 2021 income totaled $89,000, all from wages. They have one dependent child, Aubrey (5). During the year, they spent $9,000 for Aubrey's child care. Neither Mark nor Carrie received any dependent care benefits from their employer. What amount may they use to calculate the Child and Dependent Care Credit? $0 $3,000 $8,000 $9,000 Mark for follow uparrow_forward

- Aaron and Liz are married for 8 years and have the following income items as follows: Aaron's salary $44,000 Liz's salary 46,000 Rent on apartment purchased by Liz 12 years ago 9,000 Interest income on a joint saving account 600 Which of the following allocation of the income to Aaron and Liz is correct if they live in California and file their returns as married filing separately?arrow_forwardPlease answer all parts! William and Annette Johnson (both age 45) are married taxpayers who file a joint return. They have a son, Sean, age 7. During the tax year, they had the following receipts: 1 Salary ($75,000 for William, $62,000 for Annette) $137,000 2. Interest Income · City of Normal school bonds $1,000 · Ford Motor Company bonds 1,200 · PNC Bank certificate of deposit 600 2,800 3. Annual gift from parents 26,000 4. Lottery winnings 1,000 5. Short-term capital loss (from stock investment) ( 5,000) 6. Federal income tax refund from last year return 2,400 7. Child support from Annette's ex-husband 8,000 8. State income tax refund from the prior year (they used standard deduction in the prior year) 700 They also have the following facts related to their…arrow_forwardOn May 1, 2020. Alex and Toni formed a partnership and agreed to share profits and losses in the ratio 4:6, respectively , alex contributed a parcel of land that costs 15,000. toni contributed 50,000 cash. the land can be sold for 20,000 on may 1,2020.what amount should be recorded alex and toni's capital accountsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education