Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

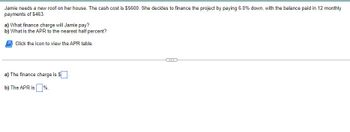

Transcribed Image Text:Jamie needs a new roof on her house. The cash cost is $5600. She decides to finance the project by paying 6.0% down, with the balance paid in 12 monthly

payments of $463.

a) What finance charge will Jamie pay?

b) What is the APR to the nearest half percent?

Click the icon to view the APR table.

a) The finance charge is $

b) The APR is

%.

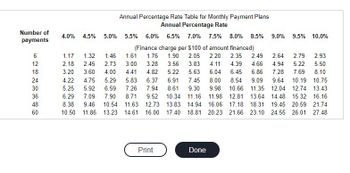

Transcribed Image Text:Number of

payments

6

12

18

24

30

36

48

60

4.0% 4.5% 5.0%

Annual Percentage Rate Table for Monthly Payment Plans

Annual Percentage Rate

5.5% 6.0% 6.5% 7.0% 7.5% 8.0% 8.5%

2.79 2.93

1.17 1.32 1.46

2.18 2.45 2.73

3.20 3.60 4.00

5.22

5.50

6.86 7.28 7.69

8.10

(Finance charge per $100 of amount financed)

1.61 1.76 1.90 2.05 2.20 2.35 2.49 2.64

3.00 3.28 3.56 3.83 4.11 4.39 4.66 4.94

4.41 4.82 5.22 5.63

6.04 6.45

5.83 6.37 6.91 7.45

8.00 8.54 9.09 9.64 10.19 10.75

8.61 9.30 9.98 10.66 11.35 12.04 12.74 13.43

9.52 10.34 11.16 11.98 12.81 13.64 14.48 15.32 16.16

17.18 18.31 19.45 20.59 21.74

4.22 4.75 5.29

5.25 5.92 6.59 7.26 7.94

6.29 7.09 7.90 8.71

8.38 9.46 10.54 11.63 12.73 13.83 14.94 16.06

10.50 11.86 13.23 14.61 16.00 17.40 18.81 20.23 21.66 23.10 24.55 26.01 27.48

Print

9.0% 9.5% 10.0%

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- My daughter wants to buy a new car. Here are the parameters. The car cost $12,000 with terms of 5% APR over five years. She has $3000 saved up and is ready to put down on the loan. 1. What is the actual annual percentage rate she will be charged if she pays all of the $3000 as a down payment for the five years? What will her monthly payments be? 2. Would it be better (cheaper) for her to pay $1000 down now, borrowing the rest, but in 1 year pay the other $2000 put towards principal? How will this affect the loan?arrow_forwardPlease show how to solve this using excel and please show all formulas in the spreadsheet please!! Steven decides to buy a house with price of $500,000, Steven puts 20% down payment and considers a 15-year fixed rate mortgage to pay the remaining balance. The lender offers him three choices of the mortgage with monthly payments shown in the table as a., b., and c. Assume that the origination cost is $8,000. A. If the loan will be outstanding for 15 years, what is the effective cost for each choice? Which choice is most ideal? explain? B. Which mortgage choices are not properly priced? explain?arrow_forward4) Brenda is buying a living room set for her home. At Furniture, Inc., she picks out a set for a total cash price of $1,899 The salesperson tells her if she qualifies for an installment loan, she may pay 10% down and finance the balance with payments of $88.35 per month for 24 months?arrow_forward

- Dan is planning to buy a new home that costs $130000 Find the following if Dan make a 5% downpayment. How much will Dan's down payment be? (Round to the nearest cent) How much will Dan owe after he makes the down payment? (Round to the nearest cent)arrow_forward6) Susan is looking to purchase her first home five years from today. The house costs $1,550,000. She will have to make a down payment of 10% of this amount and plans to take a loan from the bank for the difference. Bank charges are approximately 15% of the loan amount. She plans to start saving from today to cover both the down payment and the bank charges. a. How much will she need to save to cover both the down payment and bank charges? b. If she currently has $195,000 in her account and will make no further deposits over the next five years, what rate of interest must she earn on this account in order to achieve the savings target calculated in part (a) above?arrow_forwardChristina Sanders is concerned about the financing of a home. She saw a small Cape Cod–style house that sells for $90,000. If she puts 10% down, what will her monthly payment be at (a) 30 years, 5%; (b) 30 years, 512%512% ; (c) 30 years, 6%; and (d) 30 years, 612%612% ? What is the total cost of interest over the cost of the loan for each assumption? (Round your answers to the nearest cent.) can you please help me with all 4 answers? tyarrow_forward

- Angela wants to take the next five years off work to travel around the world. She estimates her annual cash needs at $34,000 (if she needs more, she will work odd jobs). Angela believes she can invest her savings at 8% until she depletes her funds. (Click the icon to view Present Value of $1 table.) of $1 table.) (Click the icon to view Future Value of $1 table.) of $1 table.) Read the requirements. (Click the icon to view Present Value of Ordinary Annuity (Click the icon to view Future Value of Ordinary Annuity Requirement 1. How much money does Angela need now to fund her travels? (Round your answer to the nearest whole dollar.) With the 8% interest rate, Angela needsarrow_forwardChristina Sanders is concerned about the financing of a home. She saw a small Cape Cod–style house that sells for $90,000. If she puts 10% down, what will her monthly payment be at (a) 30 years, 5%; (b) 30 years, 512%512% ; (c) 30 years, 6%; and (d) 30 years, 612%612% ? What is the total cost of interest over the cost of the loan for each assumption? (Round your answers to the nearest cent.)arrow_forwardBilly Dan and Betty Lou were recently married and want to start saving for their dream home. They expect the house they want will cost approximately $255,000. They hope to be able to purchase the house for cash in 7 years. To determine the appropriate discount factor(s) using tables, click here to view Tables I. II. II. or IV in the appendix. Alternatively, if you calculate the discount factor(s) using a formula, round to six (6) decimal places before using the factor in the problem. Required a. How much will Billy Dan and Betty Lou have to invest each year to purchase their dream home at the end of 7 years? Assume an interest rate of 9 percent. b. Billy Dan's parents want to give the couple a substantial wedding gift for the purchase of their future home. How much must Billy Dan's parents give them now if they are to reach the desired amount of $255,000 in 9 years? Assume an interest rate of 9 percent. Complete this question by entering your answers in the tabs below. Required A…arrow_forward

- Sylvia wants to buy a car and feels that she can afford payments of $200 per month (month-end payments) for five years. Using an interest rate of j12-4.8%, what is the most expensive car that she can buy? Your Answer:arrow_forwardRachel purchased a car for $17,500 three years ago using a 4-year loan with an interest rate of 10.8 percent. She has decided that she would sell the car now, if she could get a price that would pay off the balance of her loan. What is the minimum price Rachel would need to receive for her car? Calculate her monthly payments, then use those payments and the remaining time left to compute the present value (called balance) of the remaining loan.arrow_forwardJamie is going to buy some furniture with a single payment loan that is discounted. The loan will be for $5,000 for two years at 10% interest. Calculate the APR on this loan. (Show all work.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education