Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

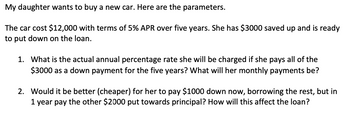

Transcribed Image Text:My daughter wants to buy a new car. Here are the parameters.

The car cost $12,000 with terms of 5% APR over five years. She has $3000 saved up and is ready

to put down on the loan.

1. What is the actual annual percentage rate she will be charged if she pays all of the

$3000 as a down payment for the five years? What will her monthly payments be?

2. Would it be better (cheaper) for her to pay $1000 down now, borrowing the rest, but in

1 year pay the other $2000 put towards principal? How will this affect the loan?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Nikularrow_forwardVickie decides to sell her current home and move to a larger home. She estimates that she can sell her current home for $2,000,000 and can buy a larger home for 6,000,000. She plans to use the entire $2,000,000 sale proceeds as a down payment on the new home and will finance the remainder for 10 years at 6% nominal annual interest compounded monthly. What is her estimated monthly mortgage payment? Christine wants to be able to purchase a dream car for about $50,000 on January 1, 2028, just after she graduates from graduate school. She has a full-time job and started making deposits of $730 each month into an account that pays 6% compounded monthly beginning with the first deposit on February 1, 2023. The last deposit is to be made on January 1, 2028. Determine how much money she would have saved to buy the car. Will she be able to buy her dream car?arrow_forwardEvan and Emmanuel want to buy a $250,000 home. They plan to pay 15% as a down payment, and take out a 30 year loan at 4.9% interest for the balance. a) How much is the loan going to be? b) What will the monthly payment be for Evan and Emmanuel? c) How much of the first payment is interest? d) What is the total of the payments? e) How much interest was paid?arrow_forward

- Michaela buys a new car for $31,600. The simple interest rate is 5.6% and the amount of loan (plus simple interest) is repayable in 6 years. What is the total amount that must be repaid? Round your answer to the nearest dollar and do not round until the final answer. Provide your answer below:arrow_forwardBhaarrow_forwardRick wishes to purchase a new car and can afford monthly payments of up to $275 per month. Finance is available and the terms are that the loan lasts for 6 years, and the annual interest rate is 8%. What is the maximum price for a car that Ryan's budget can afford?Round your answer to the nearest hundred dollars.arrow_forward

- Tammie wants to buy a scooter that costs $3,500. Her mom will loan her the money at 5% annual interest as long as she makes monthly payments over the next 3 years. How much will Tammie's monthly payment be?arrow_forwardYou decide to do some remodeling in the kitchen. Your parents agree to lend you the money, but you insist on paying them interest. The agreement is that they will lend you $8000.00 at a simple interest rate of 2% per year. Once the interest amounts to $480, you agree to pay them back the $8000 plus the $480 interest. After how many months will you have to pay them back? Please answer step by steparrow_forwardWilma wants to buy a car that costs $52,000. She has arranged to borrow the total purchase price of the car from her bank at 6 percent interest rate. The loan requires monthly payments for a period of five years. If the first payment is due in one month after purchasing the car, what will be the amount of Wilma’s monthly payment on the loan?arrow_forward

- Dan is planning to buy a new home that costs $130000 Find the following if Dan make a 5% downpayment. How much will Dan's down payment be? (Round to the nearest cent) How much will Dan owe after he makes the down payment? (Round to the nearest cent)arrow_forward6) Susan is looking to purchase her first home five years from today. The house costs $1,550,000. She will have to make a down payment of 10% of this amount and plans to take a loan from the bank for the difference. Bank charges are approximately 15% of the loan amount. She plans to start saving from today to cover both the down payment and the bank charges. a. How much will she need to save to cover both the down payment and bank charges? b. If she currently has $195,000 in her account and will make no further deposits over the next five years, what rate of interest must she earn on this account in order to achieve the savings target calculated in part (a) above?arrow_forwardYour daughter wants to the University of Cincinnati. She is already planning to start in 10 years (which is when her first tuition payment is due). Her tuition will be $19,886 per year for four years. The relevant discount rate is 8.01 percent per year. You plan to save for her education by setting aside the same amount of money per year for 9 years. What is the amount you need to save per year if you start saving at the end of this year? O $32,914.10 O $5,271.07 $3,657.12 $30,473.20 O $7,316.70arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education