Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

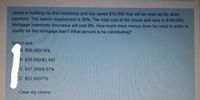

Transcribed Image Text:Jamal is building his first residence and has saved $15,000 that will be used as his down

payment. The bank's requirement is 30%. The total cost of the house and land is $150,000

Mortgage Indemnity Insurance will cost 8%. How much more money does he need in order to

qualify for the mortgage loan? What percent is he contributing?

Select one

A. $30,000/15%

B. $30,000/S2,400

$37 500/8.57%

D. $52,500/7%

Clear my choice

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- An engineer is considering buying a life insurance policy for his family. He currently owes $65,000 and he would like his family to have an annual available income of $50,000 indefinitely. If the engineer assumes that any money from the insurance policy can be invested in an account paying a guaranteed 5% annual interest, how much life insurance should he buy? $1,000,000 $1,065,000 ● $2,000,000 $2,130,000arrow_forwardPat bought a home for $165,000 and made a $25,000 down payment. She got a fixed rate mortgage at 5% for 30 years. What will her payments be? What is the total interest over the life of the loan?arrow_forwardI need the answer of the question attached. Please provide all possible answers. Thank you!arrow_forward

- Conor is comparing two potential housing options. Conor plans to stay in the home for 4 years, after which he plans to move again. Conor earns 12% annually on his other investments. He determines the following information about each option: OPTION 1: Purchase a home • Purchase a $270,000 home with a 30-year fixed mortgage • Loan amount = $270,000 (100% financing) • Annual mortgage interest rate = 6.00% Monthly mortgage payments = $1,618.79 • Additional monthly costs (insurance, taxes, maintenance) = $350.00 • Real estate growth rate = 5% annually .arrow_forwardLiam had an extension built onto his home. He financed it for 48 months with a loan at 4.3% APR. His monthly payments were $780. How much was the loan amount for this extension? A. $48,077 B. $54,945 C. $41,209 D. $34,341arrow_forwardPLEASE ANSWER. I WILL UPVOTE I PROMISEarrow_forward

- Tobin is buying a new apartment. He can afford a mortgage payment of $1990 a month, and a down payment of $11000. He obtained a 16-year loan at 6.05% compounded monthly. Use Excel to determine what the most expensive apartment he can buy under these terms. How much will Tobin pay in interest over the 16-year years? Apartment price = $ Interest paid = $arrow_forwardSuppose that you need $30,000 for your last year of college. You could go to a private lending institution and apply for a signature student loan; rates range from 7% to 14%. However, your Aunt Sally is willing to loan you the money from her retirement savings, with no repayment until after graduation. All she asks is that in the meantime you pay her each month the amount of interest that she would otherwise get on her savings (since she needs that to live on), which is 4%.What is your monthly payment to her, and how much interest will you pay her over the year (9 months)?(Fill in the blanks below and give your answers as whole numbers.)The amount of interest per month you would pay Aunt Sally is $__(1)__ .The total interest you will pay her over the year (9 months)is $__(2)__ .arrow_forwardGerritt wants to buy a car that costs $27,000. The interest rate on his loan is 5.35 percent compounded monthly and the loan is for 5 years. What are his monthly payments? Multiple Choice (select the correct answer) $511.58 $539.56 $496.74 $513.86 $524.73arrow_forward

- Mary has found a beautiful home on Richmond Rd. that she loves.The price of the home is $285,000. If Mary and George qualify for a30-year loan at a fixed interest rate of 3.99%, can they afford thehome? (Hint: Don't forget about the down payment!)arrow_forwardTom and Kyra Courtney are considering buying a house and are researching the potential costs. Their adjusted gross income is $144,000. The monthly mortgage payment for the house they want would be $1,450. The annual property taxes would be $9,400, and the homeowner’s insurance premium would cost them $876 per year. What is the front end ratio and will they be able to qualify?arrow_forwardI need help with this questionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education