FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

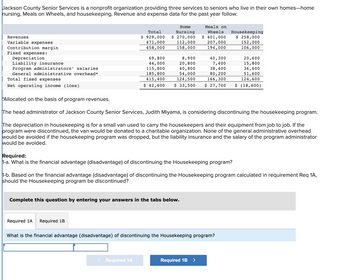

Transcribed Image Text:Jackson County Senior Services is a nonprofit organization providing three services to seniors who live in their own homes-home

nursing, Meals on Wheels, and housekeeping. Revenue and expense data for the past year follow:

Revenues

Variable expenses

Contribution margin

Fixed expenses:

Depreciation

Liability insurance

Program administrators' salaries

General administrative overhead*

Total fixed expenses

Net operating income (loss)

Home

Total

Nursing

$ 929,000 $ 270,000

471,000 112,000

458,000

158,000

69,800

44,000

8,900

20,800

115,800

40,800

185,800

54,000

415,400

124,500

$ 42,600 $ 33,500

Required 1A Required 1B

*Allocated on basis of program revenues.

The head administrator of Jackson County Senior Services, Judith Miyama, is considering discontinuing the housekeeping program.

The depreciation in housekeeping is for a small van used to carry the housekeepers and their equipment from job to job. If the

program were discontinued, the van would be donated to a charitable organization. None of the general administrative overhead

would be avoided if the housekeeping program was dropped, but the liability insurance and the salary of the program administrator

would be avoided.

Required:

1-a. What is the financial advantage (disadvantage) of discontinuing the Housekeeping program?

Complete this question by entering your answers in the tabs below.

< Required 1A

1-b. Based on the financial advantage (disadvantage) of discontinuing the Housekeeping program calculated in requirement Req 1A,

should the Housekeeping program be discontinued?

Meals on

Wheels Housekeeping

$ 401,000 $ 258,000

207,000

152,000

194,000

106,000

40,300

20,600

7,400

15,800

38,400

36,600

80,200

51,600

166,300

124,600

$ 27,700 $ (18,600)

What is the financial advantage (disadvantage) of discontinuing the Housekeeping program?

Required 1B

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Jackson County Senior Services is a nonprofit organization devoted to providing essential services to seniors who live in their own homes within the Jackson County area. Three services are provided for seniors-home nursing, Meals On Wheels, and housekeeping. Data on revenue and expenses for the past year follow: Revenues Variable expenses Contribution margin Fixed expenses: Depreciation Liability insurance Program administrators' salaries General administrative overhead* Total fixed expenses Net operating income (loss) Req 1A Total $ 930,000 481,000 449,000 Req 1B 69,800 42,700 Req 2A 113,800 186,000 412,300 $ 36,700 Req 2B Home Nursing $ 266,000 120,000 146,000 Complete this question by entering your answers in the tabs below. 8,500 20,300 40,100 53,200 122, 100 $ 23,900 Req 1A *Allocated on the basis of program revenues. The head administrator of Jackson County Senior Services, Judith Miyama, considers last year's net operating income of $36,700 to be unsatisfactory; therefore, she…arrow_forwardProjected revenue for year 20X1 is as follows: $823,155 in January, $685,546 in February, $454,050 in March, and $811,904 in April. Historical net revenues categorized by payer: Payer Revenue Percent Medicare 8,931,228 Medicaid 11,906,868 Blue Cross 10,159,306 Private 5,082,192 Total ? Collection patterns by payer: Payer Within 1 Month Within 2 Months Within 3 Months Within 4 Months Total Medicare 18% 26% 28% ? 100% Medicaid 6% 20% 49% ? 100% Blue Cross 11% 43% 26% ? 100% Private 59% 28% 6% ? 100% How much revenue do we expect to collect in total in March? (Do not round intermediate calculations. Round your final answer to 2 decimal places. Omit the "$" sign and commas in your response. For example, $12.3456 should be entered as 12.35.)arrow_forwardMargaret started her own business in the current year and will report a profit for her first year. Her results of operations are as follows: Gross income Travel Contribution to Presidential Election Campaign Transportation 5,300 miles equally across the year, using standard mileage method Entertainment in total Nine gifts at $50 each Rent and utilities for apartment in total (25 percent is used for a home office) Gross income Expenses: Travel Political contribution Transportation Entertainment Complete the table below to determine the net income Margaret should show on her Schedule C. If an amount is zero, enter "0". If required, round the amounts to the nearest dollar. Gifts Rent and utilities Total expenses Taxable business income 45,000 1,000 0 0 225 $45,000 1,000 100 2,625 X X ? X 4,200 450 10,500arrow_forward

- please help me to solve this questionarrow_forwardMultiple statements. The following are account balances (in thousands) for Lima Health Plan. Prepare (a) a balance sheet and (b) an income statement for the year ended December 31, 20 X0. Givens (in '000s) Income tax benefit of operating loss $ 12,000 Net property and equipment Physician services expense $244,000 Premium revenue $225,000 Marketing expense $21,000 Compensation expense, $15,000 Interest income and other revenue, $9,000 Outside referral expense, $7,000 Medicare revenue, $160,000 Occupancy and depreciation expense $1,000 Medical claims payable, $57,000 Accounts receivable, $1,500 Emergency room expense, $24,000 Inpatient services expense $191, 000 Interest expense $1,000 Medicaid revenue $55,000 Stockholders' equity $71, 700 Cash and cash equivalents $127,000 Long-term debt $2,800 Other administrative expense $1,400arrow_forward2aarrow_forward

- Projected revenue for year 20X1 is as follows: $845,622 in January, $517,629 in February, $528,674 in March, and $847,032 in April. Historical net revenues categorized by payer: Payer Medicare Medicaid Blue Cross Private Payer Revenue Percent Medicare 8,331,224 Medicaid 12,723,238 Blue Cross 10,763,087 Collection patterns by payer: Private Total Within 1 Month 21% 9% 5% 54% 5,527,687 Within 2 Months 33% 17% 40% 30% ? Within 3 Months 35% 48% 36% 5% Within 4 Months Total ? 100% ? 100% ? 100% ? 100% How much revenue do we expect to collect in total in March? (Doarrow_forwardJackson County Senior Services is a nonprofit organization devoted to providing essential services to seniors who live in their own homes within the Jackson County area. Three services are provided for seniors-home nursing, Meals On Wheels, and housekeeping. Data on revenue and expenses for the past year follow: Revenues Variable expenses Contribution margin Fixed expenses: Depreciation Liability insurance. Program administrators' salaries General administrative overhead* Total fixed expenses Net operating income (loss) Total $ 924,000 469,000 455,000 70,500 43,500 114,100 184,800 412,900 $ 42,100 Home Nursing $ 264,000 119,000 145,000 8,900 20,300 40,200 52,800 122, 200 $ 22,800 Meals On Wheels $ 409,000 194,000 215,000 40,800 7,300 38,800 81,800 168, 700 House- keeping $ 251,000 156,000 95,000 20,800 15,900 35,100 50,200 122,000 $ 46,300 $ (27,000) *Allocated on the basis of program revenues. The head administrator of Jackson County Senior Services, Judith Miyama, considers last…arrow_forwardThe following data are available pertaining to Household Appliance Company's retiree health care plan for 2021: Number of employees covered 2 Years employed as of January 1, 2021 3 [each] Attribution period 20 years Expected postretirement benefit obligation, Jan. 1 $ 60,000 Expected postretirement benefit obligation, Dec. 31 $ 63,000 Interest rate 5 % Funding none Required:1. What is the accumulated postretirement benefit obligation at the beginning of 2021?2. What is interest cost to be included in 2021 postretirement benefit expense?3. What is service cost to be included in 2021 postretirement benefit expense?4. Prepare the journal entry to record the postretirement benefit expense for 2021.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education