FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

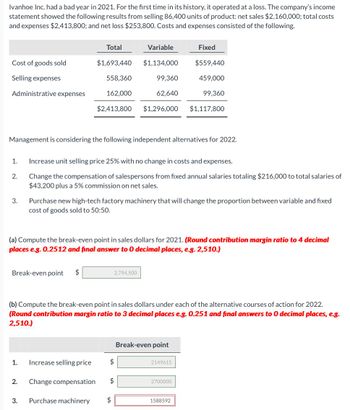

Transcribed Image Text:Ivanhoe Inc. had a bad year in 2021. For the first time in its history, it operated at a loss. The company's income

statement showed the following results from selling 86,400 units of product: net sales $2,160,000; total costs

and expenses $2,413,800; and net loss $253,800. Costs and expenses consisted of the following.

Cost of goods sold

Selling expenses

Administrative expenses

1.

2.

3.

Break-even point $

1.

Total

$1,693,440

558,360

162,000

Management is considering the following independent alternatives for 2022.

Increase selling price

2. Change compensation

$2,413,800 $1,296,000

3. Purchase machinery

Variable

Increase unit selling price 25% with no change in costs and expenses.

Change the compensation of salespersons from fixed annual salaries totaling $216,000 to total salaries of

$43,200 plus a 5% commission on net sales.

$1,134,000

99,360

62,640

Purchase new high-tech factory machinery that will change the proportion between variable and fixed

cost of goods sold to 50:50.

(a) Compute the break-even point in sales dollars for 2021. (Round contribution margin ratio to 4 decimal

places e.g. 0.2512 and final answer to 0 decimal places, e.g. 2,510.)

2,794,500

$

(b) Compute the break-even point in sales dollars under each of the alternative courses of action for 2022.

(Round contribution margin ratio to 3 decimal places e.g. 0.251 and final answers to 0 decimal places, e.g.

2,510.)

$

$

Fixed

$559,440

459,000

Break-even point

99,360

2149615

$1,117,800

2700000

1588592

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Flamengo Co is a sporting goods manufacturing. Last year, report the following Income Statement: Sales $620,000 Cost of goods sold 316,000 Gross margin $304,000 Selling and administrative expense 246,000 Operating income $ 58,000 Less: Income taxes (at 40%) 34,000 Net income $ 24,000 At the beginning of the year, the value of operating assets was $263,000. At the end of the year, the value of operating assets was $363,000. Flamengo Co. requires a minimum rate of return of 15%. Total capital employed equals $350,000 and the actual cost of capital is 6%, Calculate the Return on Investment. (Carry computations out to two decimal places.)arrow_forwardAccording to the producer price index database maintained by the Bureau of Labor Statistics, the average cost of computer equipment fell 3.8 percent between January and December 2018. Let's see whether these changes are reflected in the income statement of Gonzalez Industries for the year ended December 31, 2018. Sales Revenue Cost of Goods Sold Gross Profit Selling, General, and Administrative Expenses Interest Expense Income before Income Tax Expense Income Tax Expense Net Income Required 1 Required: 1. Compute the gross profit percentage for each year. Assuming the change from 2017 to 2018 is the beginning of a sustained trend, is Gonzalez likely to earn more or less gross profit from each dollar of sales in 2019? 2. Compute the net profit margin for each year. Did Gonzalez do a better or worse job of controlling operating expenses in 2018 relative to 2017? Required 2 2018 $ 105,000 62,500 42,500 36,500 3. Gonzalez reported average net fixed assets of $54,700 in 2018 and $45,600 in…arrow_forwardRevenue and expense data for the current calendar year for Tannenhill Company and for the electronics industry are as follows. Tannenhill’s data are expressed in dollars. The electronics industry averages are expressed in percentages. TannenhillCompany ElectronicsIndustryAverage Sales $800,000 100 % Cost of goods sold 512,000 70 Gross profit $288,000 30 % Selling expenses $176,000 17 % Administrative expenses 64,000 7 Total operating expenses $240,000 24 % Operating income $48,000 6 % Other revenue 16,000 2 $64,000 8 % Other expense 8,000 1 Income before income tax $56,000 7 % Income tax expense 24,000 5 Net income $32,000 2 % a. Prepare a common-sized income statement comparing the results of operations for Tannenhill Company with the industry average. If required, round percentages to one decimal place. Enter all amounts as positive numbers.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education