FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

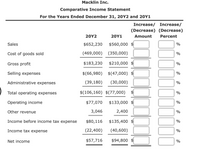

For 20Y2, Macklin Inc. reported a significant decrease in net income. At the end of the year, John Mayer, the president, is presented with the following condensed comparative income statement:

| Macklin Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 |

|||

| 20Y2 | 20Y1 | ||

| Sales | $652,230 | $560,000 | |

| Cost of goods sold | (469,000) | (350,000) | |

| Gross profit | $183,230 | $210,000 | |

| Selling expenses | $(66,980) | $(47,000) | |

| Administrative expenses | (39,180) | (30,000) | |

| Total operating expenses | $(106,160) | $(77,000) | |

| Operating income | $77,070 | $133,000 | |

| Other revenue | 3,046 | 2,400 | |

| Income before income tax expense | $80,116 | $135,400 | |

| Income tax expense | (22,400) | (40,600) | |

| Net income | $57,716 | $94,800 |

Required:

1. Prepare a comparative income statement with horizontal analysis for the two-year period, using 20Y1 as the base year. Use the minus sign to indicate a decrease in the "Increase/(Decrease)" columns. If required, round percentages to one decimal place.

Transcribed Image Text:2. Net income has

from 20Y1 to 20Y2. Sales have

however, the cost of goods sold has

at a faster rate than sales, causing the

gross profit to

Transcribed Image Text:Macklin Inc.

Comparative Income Statement

For the Years Ended December 31, 20Y2 and 20Y1

Increase/ Increase/

(Decrease) (Decrease)

20Υ2

20Y1

Amount

Percent

Sales

$652,230

$560,000 $

%

Cost of goods sold

(469,000) (350,000)

%

Gross profit

$183,230

$210,000

%

Selling expenses

$(66,980) $(47,000) $

%

Administrative expenses

(39,180)

(30,000)

%

Total operating expenses

$(106,160) $(77,000)

$4

%

Operating income

$77,070

$133,000 $

%

Other revenue

3,046

2,400

%

Income before income tax expense

$80,116

$135,400 $

%

Income tax expense

(22,400)

(40,600)

%

Net income

$57,716

$94,800 $

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information is available for Tamarisk Corp. for the year ended December 31, 2022. Other revenues and gains $23,800 Other expenses and losses 4,000 Cost of goods sold 292,000 Sales discounts 4,600 Sales revenue 760,000 Operating expenses 221,000 Sales returns and allowances 10,800 Prepare a multiple-step income statement for Tamarisk Corp. The company has a tax rate of 25%.arrow_forwardRevenue and expense data for Innovation Quarter Inc. for two recent years are as follows: Current Year Previous YearSales $4,000,000 $3,600,000Cost of goods sold 2,280,000 1,872,000Selling expenses 600,000 648,000Administrative expenses 520,000 360,000Income tax expense 240,000 216,000a. Prepare an income statement in comparative form, stating each item for both years as a percent of sales. Round to the nearest whole percentage.b. Comment on the significant changes disclosed by the comparative income statement.arrow_forwardIncome statement data for Winthrop Company for two recent years ended December 31, are as follows: Current Year Previous Year Sales $541,800 $430,000 Cost of goods sold 458,800 370,000 Gross profit $83,000 $60,000 Selling expenses $24,360 $21,000 Administrative expenses 21,080 17,000 Total operating expenses $45,440 $38,000 Income before income tax $37,560 $22,000 Income tax expenses 15,000 8,800 Net income $22,560 $13,200 a. Prepare a comparative income statement with horizontal analysis, indicating the increase (decrease) for the current year when compared with the previous year. If required, round to one decimal place. Winthrop Company Comparative Income Statement For the Years Ended December 31 Current Previous Increase Increase year year (Decrease) (Decrease) Amount Amount Amount Percent Sales $541,800 $430,000 % Cost of goods sold 458,800 370,000 Gross profit $83,000 $60,000 % Selling expenses $24,360 $21,000 % Administrative expenses 21,080 17,000 % Total operating expenses…arrow_forward

- Horizontal Analysis of the Income Statement Income statement data for Winthrop Company for two recent years ended December 31, are as follows: Current Year Previous Year Sales $418,200 $340,000 Cost of goods sold 350,900 290,000 Gross profit $67,300 $50,000 Selling expenses $19,210 $17,000 Administrative expenses 16,940 14,000 Total operating expenses $36,150 $31,000 Income before income tax $31,150 $19,000 Income tax expenses 12,500 7,600 Net income $18,650 $11,400 a. Prepare a comparative income statement with horizontal analysis, indicating the increase (decrease) for the current year when compared with the previous year. If required, round to one decimal place. Winthrop Company Comparative Income Statement For the Years Ended December 31 CurrentyearAmount PreviousyearAmount Increase(Decrease)Amount Increase(Decrease)Percent Sales $418,200 $340,000 $fill in the blank…arrow_forwardHorizontal analysis of the income statement income statement data for Winthrop company for two recent years ended December 31st are as follows. Sales Cost of goods Gross profit Selling expenses Administrative expenses Total operating expense Income before income tax expense Income tax expense Net income Current year 2,240,000 sales (1,925,000) no cost of goods $315,000 gross profit $ (152,500) selling expenses 118,000 administrative expenses $(270,500) total operating expense $44,500 income before tax expense (17,800) income tax expense $26,700 net income Previous year $2,000,000 sales (1,750,000) cost of goods $250,000 gross profit ($125,000) selling expenses (100,000) administrative expenses ($225,000) total operating expense $25,000 income before income tax expense ( 10,000) income tax expense $15,000 A. Prepare a comparative income statement with horizontal analysis Tama indicated the increase and decrease for the current year when compared with the…arrow_forwardBellingham Industries, a manufacturer of the furniture industry, had the following financial performance for the last two years as shown on their income statements below: Billingham Industries, Inc. Comparative Income Statement For the Years Ended December 31, 2021 and 2020 2021 2020 Amount Amount Sales $1,280,000 $1,180,000 Cost of goods sold 644,800 613,600 Gross profit 635,200 566,400 Selling expenses 230,500 188,800 Administrative expenses 182,500 177,000 Total operating expenses 413,000 365,800 Income from operations 222,200 200,600 Other income 77,000 70,800 Income before income tax 299,200 271,400 Income tax expense 121,600 106,200 Net income $177,600 $165,200 1. Prepare a horizontal analysis using the form provided to…arrow_forward

- sarrow_forwardHorizontal Analysis of the Income Statement Income statement data for Winthrop Company for two recent years ended December 31 are as follows: Current Year Previous Year Sales $536,800 $440,000 Cost of merchandise sold 444,000 370,000 Gross profit $92,800 $70,000 Selling expenses $25,760 $23,000 Administrative expenses 22,800 19,000 Total operating expenses $48,560 $42,000 Income before income tax expense $44,240 $28,000 Income tax expenses 17,700 11,200 Net income $26,540 S16,800 a. Prepare a comparative income statement with horizontal analysis, indicating the increase (decrease) for the current year when compared with the previous year. If required, round to one decimal place. Winthrop Company Comparative Income Statement For the Years Ended December 31 Current Increase Increase (Decrease) Previous year year (Decrease)arrow_forwardIncome statement data for Winthrop Company for two recent years ended December 31 are as follows: 1 Current Year Previous Year 2 Sales $1,596,000.00 $1,400,000.00 3 Cost of goods sold 1,316,700.00 1,197,000.00 4 Gross profit $279,300.00 $203,000.00 5 Selling expenses $76,950.00 $67,500.00 6 Administrative expenses 55,000.00 50,000.00 7 Total operating expenses $131,950.00 $117,500.00 8 Income before income tax $147,350.00 $85,500.00 9 Income tax expense 11,060.00 7,000.00 10 Net income $136,290.00 $78,500.00 A. Prepare a comparative income statement with horizontal analysis, indicating the increase (decrease) for the current year when compared with the previous year. Round percentages to one decimal place. B. What conclusions can be drawn from the horizontal analysis? Round the answers to one decimal place.arrow_forward

- Bellingham Industries, a manufacturer of the furniture industry, had the following financial performance for the last two years as shown on their income statements below: Billingham Industries, Inc. Comparative Income Statement For the Years Ended December 31, 2021 and 2020 2021 2020 Amount Amount Sales $1,280,000 $1,180,000 Cost of goods sold 644,800 613,600 Gross profit 635,200 566,400 Selling expenses 230,500 188,800 Administrative expenses 182,500 177,000 Total operating expenses 413,000 365,800 Income from operations 222,200 200,600 Other income 77,000 70,800 Income before income tax 299,200 271,400 Income tax expense 121,600 106,200 Net income $177,600 $165,200 1. Prepare a horizontal analysis using the form provided to…arrow_forwardComparative Income Statements Consider the following income statement data from the Ross Company: Current Year Previous Year $525,000 $451,000 336,000 280,000 105,000 100,000 60,000 55,000 7,800 6,400 Sales revenue Cost of goods sold Selling expenses Administrative expenses Income tax expense Prepare a comparative income statement, showing increases and decreases in dollars and in percentages. Note: Round "Percent Change" answers to one decimal place (ex: 0.2345 = 23.5%). ROSS COMPANY Comparative Income Statements Sales Revenue Cost of Goods Sold Selling Expenses Administrative Expenses Total Income before Income Taxes Increase Current Year Previous Year (Decrease) $ $ $ $ $ $ Percent Change % % % % % % % % %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education