FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

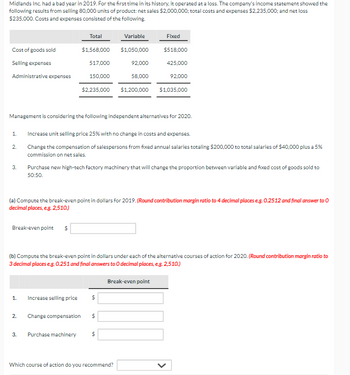

Transcribed Image Text:Midlands Inc. had a bad year in 2019. For the first time in its history, it operated at a loss. The company's income statement showed the

following results from selling 80,000 units of product: net sales $2,000,000; total costs and expenses $2,235,000; and net loss

$235,000. Costs and expenses consisted of the following.

Total

Variable

Fixed

Cost of goods sold

$1,568,000

$1,050,000

$518,000

Selling expenses

517,000

92,000

425,000

Administrative expenses

150,000

58,000

92,000

$2,235,000

$1,200,000 $1,035,000

Management is considering the following independent alternatives for 2020.

1.

Increase unit selling price 25% with no change in costs and expenses.

2.

3.

Change the compensation of salespersons from fixed annual salaries totaling $200,000 to total salaries of $40,000 plus a 5%

commission on net sales.

Purchase new high-tech factory machinery that will change the proportion between variable and fixed cost of goods sold to

50:50.

(a) Compute the break-even point in dollars for 2019. (Round contribution margin ratio to 4 decimal places e.g. 0.2512 and final answer to 0

decimal places, e.g. 2,510.)

Break-even point $

(b) Compute the break-even point in dollars under each of the alternative courses of action for 2020. (Round contribution margin ratio to

3 decimal places e.g. 0.251 and final answers to O decimal places, e.g. 2,510.)

1. Increase selling price

$

2.

Change compensation

$

3.

Purchase machinery

$

Break-even point

Which course of action do you recommend?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Introduction to cost-volume-profit (CVP) analysis:

VIEW Step 2: Requirement a- Calculation of break-even point in dollars for 2019:

VIEW Step 3: Requirement b1- Calculation of break-even point in dollar based on increase selling price:

VIEW Step 4: Requirement b2- Calculation of break-even point in dollar based on change compensation:

VIEW Step 5: Requirement b3- Calculation of break-even point in dollar based on purchase of machinery:

VIEW Step 6: Recommendation of course of action between b1, b2 and b3:

VIEW Solution

VIEW Step by stepSolved in 7 steps with 17 images

Knowledge Booster

Similar questions

- Ore Company produces bookcases. Sales were good in 2019. However, with the slowdown in the economy, the Chief Financial Officer is concerned about the sales for 2020. The income statement for 2020 is as follows: Sales revenue $600,000 Less: Variable costs $360,000 Contribution margin $240,000 Less: Fixed costs $140,000 Net profit $100,000 The company expects to sell 60,000 units in 2020. Compare different types of cost behaviours to do the following: (a) Use cost-volume-profit analysis to determine the breakeven point in units and in dollars. (b) Use cost-volume-profit analysis to determine the margin of safety in units and in dollars. (c) Assuming that cost behaviour pattern remains unchanged, compute the decrease in net income if sales revenue dropped by $200,000 in 2020.arrow_forwardWhat is the margin, turnover and ROI if the existing company performs the same next year AND it adds the proposed investment? Paul company has the following data for its most recent year end: Sales $1,400,000 Variable Expenses $756,000 Contribution Margin $644,000 Fixed Expenses $410,000 NOI $234,000 AIso Paul is considering an investment in new equipment that willcost $250,000. The new equipment is projected to produce saIes of$420,000 and have variabIe costs of 60% of sales and fixed costs of$114,000.arrow_forward3) If demand for 2022 is instead 2,500 units should the company pay to increase their capacity? Why? Please explain your calculations and reference to the chart in Figure 1. Assume units are sold at the normal price. Please mention the concept of incremental profits. Hint: If you expand capacity, you will have to pay additional fixed costs of $25,000. Remember that fixed costs are fixed within the relevant range. If you expand capacity then you are outside this range. If you expand capacity then you can make revenue on 500 additional units at the normal price and would pay variable costs on 500 additional units. Please consider the incremental profit or loss of expanding capacity. The incremental profit is the increase in revenues minus the increase in costs of adding 500 more units. If the incremental profit of expanding capacity is positive then you should do so.arrow_forward

- In 2023 , Sandy's Sandwich Shoppe had a capacity of $10,000,000 of sales , actual sales of $6,000,000 , break -even sales of $4,500,000 , fixed costs of $ 1,800,000 , and variable costs of 60% of actual sales What was Sandy's margin of safety expressed in terms of dollars ? $300,000 $ 2,700,000 None of the listed choices are correct $ 1,800,000 $ 1,500,000arrow_forwardHelp!arrow_forwardCalculate the Margin Of Safety in units and in sales dollars? The President of Benoit is under pressure from shareholders to increase operating income by 50% in 2020. Management expects per unit data and total fixed costs to remain the same in 2020. Compute the number of units that would have to be sold in 2020 to reach the shareholders desired profit level. Is this a realistic goal? Assume that as a result of reorganizing the production process, the management of Benoit Manufacturing was able to reduce direct material cost per unit by $5 due to a change in the supplier of the raw material used in the production process. Variable manufacturing overhead per unit would also decrease by $3. The business is also considering paying additional annual commission of $36,400 to its sales team as part of the sales expansion effort, which should result in an increase in sales revenue. The head of the marketing department has indicated that the effort of the sales team should result in a…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education