Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Hello teacher please help me this question

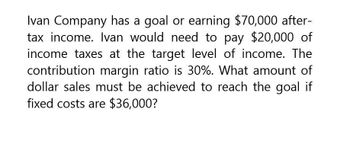

Transcribed Image Text:Ivan Company has a goal or earning $70,000 after-

tax income. Ivan would need to pay $20,000 of

income taxes at the target level of income. The

contribution margin ratio is 30%. What amount of

dollar sales must be achieved to reach the goal if

fixed costs are $36,000?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Delta Co. sells a product for $150 per unit. The variable cost per unit is $90 and fixed costs are $15,250. Delta Co.s tax rate is 36% and the company wants to earn $44,000 after taxes. What would be Deltas desired pre-tax income? What would be break-even point in units to reach the income goal of $44,000 after taxes? What would be break-even point in sales dollars to reach the income goal of $44000 after taxes? Create a contribution margin income statement to show that the break-even point calculated in B, generates the desired after-tax income.arrow_forwardPeak performance Inc. Has the following data for its product: please answer the accounting questionarrow_forwardA company has total fixed costs of $200,000. Its product sells for $25 per unit and variable costs amount to $15 per unit. The company wishes to earn an after-tax income of $35,000. Assume that the company has a 30% tax rate. a. How many units must be sold to achieve this after-tax income level? b. What level of pre-tax income must the firm earn to achieve the desired result described above? Can you show your workings pleasearrow_forward

- A company requires $1400000 is sales to meet its net income target. Its contribution margin is 50% and fixed costs are $300000. What is the company's target net income?arrow_forwardHelp, I know the answer is between b and d but I am not sure which one?, please solve it by yourself A company requires $600,000 in sales to meet its target net income after tax. Itscontribution margin is 40%, and fixed costs are $80,000. How much is the target netincome, given that its after-tax rate is 70%?a. $160,000b. $112,000c. $400,000d. $48,000arrow_forwardA company, subject to a 25% tax rate, desires to earn P600,000 of after-tax income. How much should the firm add to fixed costs when figuring the sales revenues necessary to produce this income level?arrow_forward

- A firm has fixed costs of P200,000 and variable costs per unit of P6. It plans on selling 40,000 units in the coming year. If the firm pays income taxes on its income at a rate of 40 percent, what sales price must the firm use to obtain an after-tax profit of P24,000 on the 40,000 units?arrow_forwardGiven the cost per king-size sheet set above and assuming the manufacturer has total fixed costs of $500,000 and estimates first year sales will be 50,000 sets, determine the price to consumers if the com- pany desires a 40 percent margin on sales.arrow_forwardIf selling price per unit is $30, variable costs per unit are $20, total fixed costs are $10,000, the tax rate is 30%, and the company sells 5,000 units, calculate the net income.arrow_forward

- A company is making plans for next year, using cost-volume-profit analysis as its planning tool. Next year's sales data about its product are as follows Selling price P60 Variable manufacturing costs per unit 22.50 Variable selling and administrative costs 4.5 Fixed operating costs (60% is manufacturing costs) P159,500 Income tax rate 30% How much should sales be next year if the company wants to earn profit after tax of P23,100, the same amount that it earned last year?arrow_forwardAssuming that the company has a current sales of $120,000 with a 25% margin of safety. Its before-tax return on sales is 6%, and its tax rate is 40%. What is the company's total fixed costs?arrow_forwardJasmine Inc. makes a single product that it sells for $25 each. Variable costs are $13 per unit and annual fixed costs total $30,000 per year. The company would like to realize operating income next year of $60,000. What level of sales in dollars must the company achieve to reach its target profit?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College