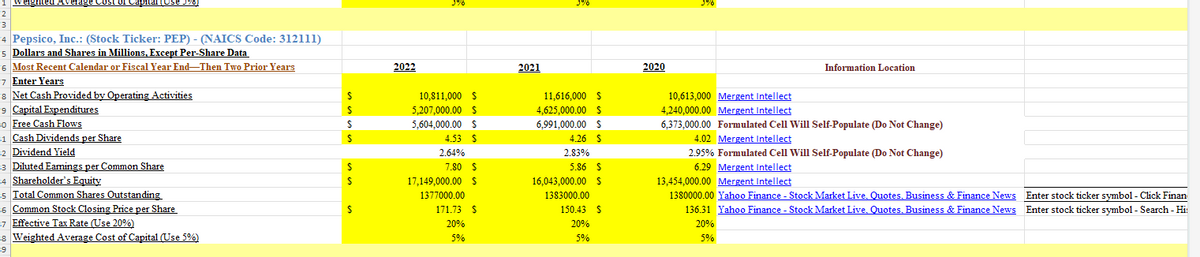

Weighted Average Cost of Capital (Use 5%) 2 3 4 Pepsico, Inc.: (Stock Ticker: PEP) - (NAICS Code: 312111) 5 Dollars and Shares in Millions, Except Per-Share Data 6 Most Recent Calendar or Fiscal Year End-Then Two Prior Years 7 Enter Years Net Cash Provided by Operating Activities 9 Capital Expenditures o Free Cash Flows 1 Cash Dividends per Share 2 Dividend Yield 33 Diluted Earnings per Common Share 4 Shareholder's Equity 35 Total Common Shares Outstanding 6 Common Stock Closing Price per Share 7 Effective Tax Rate (Use 20%) 8 Weighted Average Cost of Capital (Use 5%) 69 2022 2021 S S 10,811,000 $ 5,207,000.00 $ 11,616,000 $ 4,625,000.00 $ S S 5,604,000.00 $ 4.53 $ 6,991,000.00 $ 4.26 $ 2.64% 2.83% S 7.80 $ 5.86 $ S 17,149,000.00 $ 1377000.00 16,043,000.00 $ 1383000.00 S 171.73 $ 150.43 $ 20% 20% 5% 5% 2020 5% Information Location 10,613,000 Mergent Intellect 4,240,000.00 Mergent Intellect 6,373,000.00 Formulated Cell Will Self-Populate (Do Not Change) 4.02 Mergent Intellect 2.95% Formulated Cell Will Self-Populate (Do Not Change) 6.29 Mergent Intellect 13,454,000.00 Mergent Intellect 1380000.00 Yahoo Finance - Stock Market Live. Quotes, Business & Finance News 136.31 Yahoo Finance - Stock Market Live, Quotes, Business & Finance News 20% 5% Enter stock ticker symbol - Click Finan Enter stock ticker symbol - Search - Hi: B C E F G K M N 0 Instructions and Explanations P R T V X Y Z Milestone Four: Interest Rate Implication (Fill in yellow cells) 1. Original Scenario From Milestone 1-Time Value of Money Using 8% Current Market Interest Rate at 8% Interest Rate Years Amounts* P₁* Total Pv* *In millions 8.00% Most Recent Year-End $ $ $ S $ $ $ 2. Change in Interest Rate and Its Implications Lower Current Market Interest Rate to 4% Interest Rate Years Amounts* Py* Total Pv* *In millions 4.00% $ S $ $ $ $ $ 3. Change in Interest Rate and Its Implications 3. Increase Current market Interest Rate to 12% Interest Rate 12.00% Years Amounts* Pv* S $ $ $ $ $ Total Pv* $ *In millions We will use your selected company's free cash flows for Milestone Four analysis. (Note that the initial interest rate and rate changes for this Milestone are different than those used in Milestone One.) Three scenarios will be analyzed: 1. Current Market Interest Rate at 8% 2. Lower Current Market Interest Rate to 4% 3. Increase Current market Interest Rate to 12% Once you have completed these calculations, proceed to write your written analysis. 2. Stock and Bond Valuation 3. Capital Budgeting 4. Interest Rate Implications +

Weighted Average Cost of Capital (Use 5%) 2 3 4 Pepsico, Inc.: (Stock Ticker: PEP) - (NAICS Code: 312111) 5 Dollars and Shares in Millions, Except Per-Share Data 6 Most Recent Calendar or Fiscal Year End-Then Two Prior Years 7 Enter Years Net Cash Provided by Operating Activities 9 Capital Expenditures o Free Cash Flows 1 Cash Dividends per Share 2 Dividend Yield 33 Diluted Earnings per Common Share 4 Shareholder's Equity 35 Total Common Shares Outstanding 6 Common Stock Closing Price per Share 7 Effective Tax Rate (Use 20%) 8 Weighted Average Cost of Capital (Use 5%) 69 2022 2021 S S 10,811,000 $ 5,207,000.00 $ 11,616,000 $ 4,625,000.00 $ S S 5,604,000.00 $ 4.53 $ 6,991,000.00 $ 4.26 $ 2.64% 2.83% S 7.80 $ 5.86 $ S 17,149,000.00 $ 1377000.00 16,043,000.00 $ 1383000.00 S 171.73 $ 150.43 $ 20% 20% 5% 5% 2020 5% Information Location 10,613,000 Mergent Intellect 4,240,000.00 Mergent Intellect 6,373,000.00 Formulated Cell Will Self-Populate (Do Not Change) 4.02 Mergent Intellect 2.95% Formulated Cell Will Self-Populate (Do Not Change) 6.29 Mergent Intellect 13,454,000.00 Mergent Intellect 1380000.00 Yahoo Finance - Stock Market Live. Quotes, Business & Finance News 136.31 Yahoo Finance - Stock Market Live, Quotes, Business & Finance News 20% 5% Enter stock ticker symbol - Click Finan Enter stock ticker symbol - Search - Hi: B C E F G K M N 0 Instructions and Explanations P R T V X Y Z Milestone Four: Interest Rate Implication (Fill in yellow cells) 1. Original Scenario From Milestone 1-Time Value of Money Using 8% Current Market Interest Rate at 8% Interest Rate Years Amounts* P₁* Total Pv* *In millions 8.00% Most Recent Year-End $ $ $ S $ $ $ 2. Change in Interest Rate and Its Implications Lower Current Market Interest Rate to 4% Interest Rate Years Amounts* Py* Total Pv* *In millions 4.00% $ S $ $ $ $ $ 3. Change in Interest Rate and Its Implications 3. Increase Current market Interest Rate to 12% Interest Rate 12.00% Years Amounts* Pv* S $ $ $ $ $ Total Pv* $ *In millions We will use your selected company's free cash flows for Milestone Four analysis. (Note that the initial interest rate and rate changes for this Milestone are different than those used in Milestone One.) Three scenarios will be analyzed: 1. Current Market Interest Rate at 8% 2. Lower Current Market Interest Rate to 4% 3. Increase Current market Interest Rate to 12% Once you have completed these calculations, proceed to write your written analysis. 2. Stock and Bond Valuation 3. Capital Budgeting 4. Interest Rate Implications +

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Provide an explanation of the impact of external factors on the financial position of your selected company. Use the Interest Rates Spreadsheet to demonstrate the implications of interest rate changes on at least one.

Specifically, the following critical elements must be addressed:

Macroeconomic Items: The CEO of your selected company is convinced that financial analysis should hinge only on what is happening internally within the company. Convince the CEO otherwise based on the following:- Analyze the implications of interest rate changes on any of your calculations. Support your claims.

- Determine how an issue in the overall stock market—negative or positive—might impact the company’s stock valuation numbers, other financial variables, or its overall

portfolio management . Support your response with evidence through research, references, and citations. - Analyze the impact of any external factor of PepsiCo. discussed throughout the course on the company’s financial position. Technological factors, competitive factors, and global factors are examples of external factors. Justify your reasoning through research, references, and citations.

- Compete the excel worksheet.

Transcribed Image Text:Weighted Average Cost of Capital (Use 5%)

2

3

4 Pepsico, Inc.: (Stock Ticker: PEP) - (NAICS Code: 312111)

5 Dollars and Shares in Millions, Except Per-Share Data

6 Most Recent Calendar or Fiscal Year End-Then Two Prior Years

7 Enter Years

Net Cash Provided by Operating Activities

9 Capital Expenditures

o Free Cash Flows

1 Cash Dividends per Share

2 Dividend Yield

33 Diluted Earnings per Common Share

4 Shareholder's Equity

35 Total Common Shares Outstanding

6 Common Stock Closing Price per Share

7 Effective Tax Rate (Use 20%)

8 Weighted Average Cost of Capital (Use 5%)

69

2022

2021

S

S

10,811,000 $

5,207,000.00 $

11,616,000 $

4,625,000.00 $

S

S

5,604,000.00 $

4.53 $

6,991,000.00 $

4.26 $

2.64%

2.83%

S

7.80 $

5.86 $

S

17,149,000.00 $

1377000.00

16,043,000.00 $

1383000.00

S

171.73 $

150.43 $

20%

20%

5%

5%

2020

5%

Information Location

10,613,000 Mergent Intellect

4,240,000.00 Mergent Intellect

6,373,000.00 Formulated Cell Will Self-Populate (Do Not Change)

4.02 Mergent Intellect

2.95% Formulated Cell Will Self-Populate (Do Not Change)

6.29 Mergent Intellect

13,454,000.00 Mergent Intellect

1380000.00 Yahoo Finance - Stock Market Live. Quotes, Business & Finance News

136.31 Yahoo Finance - Stock Market Live, Quotes, Business & Finance News

20%

5%

Enter stock ticker symbol - Click Finan

Enter stock ticker symbol - Search - Hi:

Transcribed Image Text:B

C

E

F

G

K

M

N

0

Instructions and Explanations

P

R

T

V

X

Y

Z

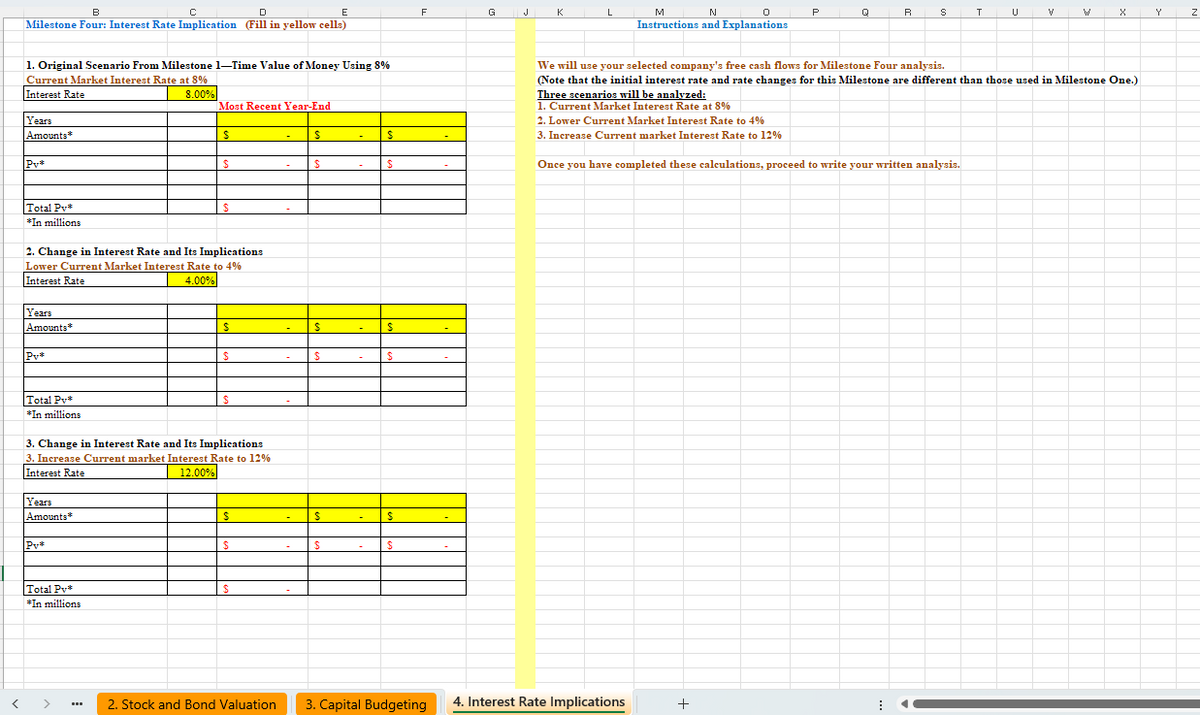

Milestone Four: Interest Rate Implication (Fill in yellow cells)

1. Original Scenario From Milestone 1-Time Value of Money Using 8%

Current Market Interest Rate at 8%

Interest Rate

Years

Amounts*

P₁*

Total Pv*

*In millions

8.00%

Most Recent Year-End

$

$

$

S

$

$

$

2. Change in Interest Rate and Its Implications

Lower Current Market Interest Rate to 4%

Interest Rate

Years

Amounts*

Py*

Total Pv*

*In millions

4.00%

$

S

$

$

$

$

$

3. Change in Interest Rate and Its Implications

3. Increase Current market Interest Rate to 12%

Interest Rate

12.00%

Years

Amounts*

Pv*

S

$

$

$

$

$

Total Pv*

$

*In millions

We will use your selected company's free cash flows for Milestone Four analysis.

(Note that the initial interest rate and rate changes for this Milestone are different than those used in Milestone One.)

Three scenarios will be analyzed:

1. Current Market Interest Rate at 8%

2. Lower Current Market Interest Rate to 4%

3. Increase Current market Interest Rate to 12%

Once you have completed these calculations, proceed to write your written analysis.

2. Stock and Bond Valuation 3. Capital Budgeting

4. Interest Rate Implications

+

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education