Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

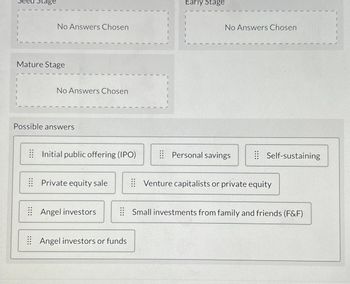

Transcribed Image Text:Seed Stage

Early Stage

No Answers Chosen

No Answers Chosen

Mature Stage

No Answers Chosen

Possible answers

Initial public offering (IPO)

Personal savings

Self-sustaining

⠀⠀Private equity sale

⠀⠀Venture capitalists or private equity

Angel investors

Small investments from family and friends (F&F)

Angel investors or funds

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Investors who have to depend current income from their investments to supplement their living expenses should invest in stocks. multiple choice income and value well-known growth and speculative income and blue-chip income and lesser-known growth blue-chip and lesser-known growtharrow_forwardEarly investors in new companies are known as: Angel Investors Portfolio Managers Sovereign Wealth Funds Pension Fundsarrow_forwardPrivate equity funds invest either in the equity of publicly traded or private firms, wanting to become private, or in early-stage firms. Select one: True Falsearrow_forward

- Ashley is a cautions investor who cares a lot about diversification. Which action she is likely to pursue? Invest entire portfolio into mutual fund Invest entire portfolio into options Invest entire portfolio into REIT Invest entire portfolio into hedge fundarrow_forwardQuestion 2 A private limited company is seeking to raise a large amount of finance to invest in a new project. Which of the following options would you recommend? A. Selling shares directly to the public B. Negotiating an overdraft C. An interest bearing bank loan D. All the abovearrow_forwardQuestion 1 LBO funds exit their investments primarily through the IPO process. O True O Falsearrow_forward

- Corporate finance is concerned with (i) what long-term investments the firm should choose, (in) how the firm should raise funds for selected investments, and (ili) how short-term assets should be managed and financed. option 1: True option 2: Falsearrow_forward(a) Venture capital funds want to invest in innovative startups. Why should VC manager care about agency theory? What is agency theory about? (b) Venture capital funds invest in startups. Why are convertible preferred securities so prevalent in such investments?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education