FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

How does Accounts Payable impact Avett Inc.'s 2020 Statement of

Question 4 options:

|

|

The periodic change in Accounts Payable is not included on the Statement of Cash Flows |

|

|

The periodic change in Accounts Payable is added in Cash Flows from Financing |

|

|

The periodic change in Accounts Payable is subtracted in Cash Flows from Investing |

|

|

The periodic change in Accounts Payable is subtracted in Cash Flows from Operations |

|

|

The periodic change in Accounts Payable is added in Cash Flows from Operations |

|

|

The periodic change in Accounts Payable is added in Cash Flows from Investing |

|

|

The periodic change in Accounts Payable is subtracted in Cash Flows from Financing |

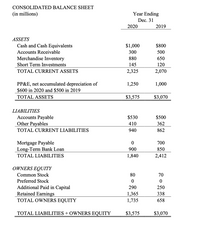

Transcribed Image Text:CONSOLIDATED BALANCE SHEET

(in millions)

Year Ending

Dec. 31

2020

2019

ASSETS

Cash and Cash Equivalents

$1,000

$800

Accounts Receivable

300

500

Merchandise Inventory

880

650

Short Term Investments

145

120

TOTAL CURRENT ASSETS

2,325

2,070

PP&E, net accumulated depreciation of

$600 in 2020 and $500 in 2019

1,250

1,000

TOTAL ASSETS

$3,575

$3,070

LIABILITIES

Accounts Payable

Other Payables

$530

$500

410

362

TOTAL CURRENT LIABILITIES

940

862

Mortgage Payable

Long-Term Bank Loan

700

900

850

TOTAL LIABILITIES

1,840

2,412

OWNERS EQUITY

Common Stock

80

70

Preferred Stock

Additional Paid in Capital

Retained Earnings

TOTAL OWNERS EQUITY

290

250

1,365

1,735

338

658

TOTAL LIABILITIES + OWNERS EQUITY

$3,575

$3,070

Transcribed Image Text:CONSOLIDATED INCOME STATEMENT

(in millions)

December 31, 2020

$20,000

(10,000)

(10,000)

(8,000)

2,000

(500)

$1,500

Revenues

Cost of Goods Sold

Profit Margin

SG&A

Pre-Tax Income

Тах Expense

Net Income

Additional Information

> No Property, Plant & Equipment (PPE) was sold during 2020.

> No short-term investments were sold during the year.

> All depreciation expense is included in SG&A

> Because there is no dividends payable account at either the start of end of the year, you may

assume all dividends declared in 2020 were paid in 2020.

Тo Do

> Complete the 2020 Cash Flow Statement on the following page.

Note: You may use the worksheet provided on the last page to help you prepare the Cash Flow Statement.

Hint #1 PPE: Remember to evaluate changes in gross PPE separate from changes in accumulated

depreciation. Recall gross PPE less accumulated depreciation equals net PPE.

Hint #2 Stock Issuance: Remember the total change in cash due to stock issuances/repurchases is the sum

of the change in common stock (stated par value) and additional paid in capital (APIC).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Exercise 7-16: From the following list, identify whether the change in the account balance during the year would be added to or deducted from net income when the indirect method is used to determine cash flows from operating activities: Increase in accounts receivable Decrease in accounts receivable Increase in notes receivable Decrease in notes receivablearrow_forwardChanges in accounting estimates are: Multiple Choice a)Statement of cash flow items. b)Accounted for with a cumulative "catch-up" adjustment. c)Reported as prior period adjustments. d)Accounted for in current and future periods. e)Considered accounting errors.arrow_forwardSh11 Please help me. Solutionarrow_forward

- When preparing a statement of cash flows, a decrease in accounts receivable during a period would cause which one of the following adjustments in determining cash flow from operating activities? Direct Method Indirect Method IncreaseDecrease DecreaseIncrease IncreaseIncrease DecreaseDecreasearrow_forwardThe is intended to reconcile changes in the balance sheet cash accounts. accounting statement of income accounting statement of changes in equity O capital budgeting cash flow calculation O accounting statement of cash flows Save for Later Attempts: 0 of 3 used Submit Answerarrow_forwardClassifying Items in the Statement of Cash Flows The following items are commonly reported in a statement of cash flows (indirect method presentation). For each item 1 through 20, determine (a) in which section the item is presented (operating, investing, or financing) and (b) whether the associated dollar amount is added or subtracted in the statement. (a) (b) 1. Payments of short-term debt. Answer Answer 2. Repurchases of common stock. Answer Answer 3. Purchases of property and equipment. Answer Answer 4. Sale of investments classified as long-term. Answer Answer 5. Proceeds from the issuance of common stock. Answer Answer 6. Increase in prepaid expenses and other current assets. Answer Answer 7. Acquisition for cash of a competitor. Answer Answer 8. Increase in current income tax payable. Answer Answer 9. Decrease in accounts payable. Answer Answer 10. Dividends paid to stockholders. Answer Answer 11.…arrow_forward

- Which of the following statements is incorrect regarding the investing activities section of the statement of cash flows? Multiple Choice Investing activities deal with long-term liabilities (debt) and equity accounts. Increases in long-term asset balances suggest cash outflows to purchase assets. Decreases in long-term asset balances suggest cash inflows from selling assets. Investing activities involve cash purchases and cash disposals of long-term assets. Xarrow_forwardPlease explain why the option is correct and remaining incorrect in detail answer in text explain each and every option need correct answerarrow_forwardCash Flows from (Used for) Operating Activities The net income reported on the income statement for the current year was $73,600. Depreciation recorded on store equipment for the year amounted to $27,400. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: Cash Accounts receivable (net) Merchandise inventory Prepaid expenses Accounts payable (merchandise creditors) Wages payable End of Year $23,500 56,000 35,500 4,750 21,800 4,900 Beginning of Year $18,700 48,000 40,000 7,000 16,800 5,800 a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, casharrow_forward

- B. TRUE OR FALSE. 1) T F 2) T F 3) T F 4) T F 5) 6) T F T F 7) T F Indicate whether each statement is true or false. Cash equivalents include short-term, highly liquid investments that mature in 6 months, such as T-Bills and T-Notes. The FASB prefers that the direct method of the statement of cash flows be used; but if used, a reconciliation of net income to cash provided by operations must also be included. If 5% of revenues are derived from a single customer, the company must disclose the total amount of revenues from each such customer. Although potentially helpful to financial statement readers, information about significant foreign sales of a multinational corporation does not have to be disclosed in the notes to the financial statements. Auditors rarely give unmodified (unqualified) audit opinions because the SEC will bar corporations receiving such opinions from selling their stock publicly. The direct method of cash flow statement is the most popular method used by corporations…arrow_forwardThe income statement and the cash flows from operating activities section of the statement of cash flows are provided below for Syntric Company. The merchandise inventory account balance neither increased nor decreased during the reporting period. Syntric had no liability for insurance, deferred income taxes, or interest at any time during the period. Sales Cost of goods sold Gross margin Salaries expense Insurance expense Depreciation expense Depletion expense Interest expense Gains and losses: Gain on sale of equipment Loss on sale of land Income before tax Income tax expense SYNTRIC COMPANY Income Statement For the Year Ended December 31, 2024 ($ in thousands) Net income Cash Flows from Operating Activities: Cash received from customers Cash paid to suppliers Cash paid to employees Cash paid for interest Cash paid for insurance Cash paid for income tax Net cash flows from operating activities $35.0 16.9 9.0 3.4 10.4 $ 271.7 (168.8) 102.9 (74.7) 19.0 (6.4) 40.8 (20.4) $ 20.4 $225.0…arrow_forwardWhich of the following statements describes the statement of cash flows? Group of answer choices It reports a company's cash inflows and outflows for a period. It reports the total assets. It reports the changes in stockholders' equity. It reports the changes in retained earnings.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education