Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

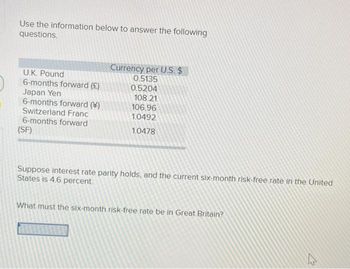

Transcribed Image Text:Use the information below to answer the following

questions.

U.K. Pound

6-months forward (£)

Japan Yen

6-months forward ()

Switzerland Franc

6-months forward

(SF)

Currency per U.S. $

0.5135

0.5204

108.21

106.96

1.0492

1.0478

Suppose interest rate parity holds, and the current six-month risk-free rate in the United

States is 4.6 percent.

What must the six-month risk-free rate be in Great Britain?

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The following table shows PPP exchange rates (the price of 1 U.S. dollar in units of the foreign currency) for several countries, determined based on the Big Mac Index. PPP exchange rate (1USS=) United States (US$) Argentina (Peso) Australia (A$) Brazil (Real) Britain (£) Canada (C$) Chile (Peso) China (Yuan) В.75 1.17 2.33 0.61 1.12 469 3.54 a. According to this data, what are the predicted exchange rates between the following countries? i. Argentina and Australia ii. Brazil and Canada iii. Chile and China iv. China and Canada b. Suppose that a Canadian dollar buys more silver in Australia than it buys in Mexico. What does purchasing-power parity imply should happen?arrow_forwardThe following are the foreign currency positions of an FI, expressed in the foreign currency: Currency Assets Liabilities FX Bought FX Sold Swiss franc (Sf) Sf 132,600 Sf 54,570 Sf 12,750 Sf 17,850 British pound (£) £ 42,500 £ 21,500 £ 15,500 £ 22,000 Japanese yen (¥) ¥ 8,200,000 ¥ 3,500,000 ¥ 1,600,000 ¥ 9,100,000 The exchange rate of dollars for Sf is 1.02, of dollars for British pound is 1.31, and of dollars for yen is .00953.The following are the foreign currency positions converted to dollars: Currency Assets Liabilities FX Bought FX Sold Swiss franc (Sf) $ 130,000 $ 53,500 $ 12,500 $ 17,500 British pound (£) $ 55,675 $ 28,165 $ 20,305 $ 28,820 Japanese yen (¥) $ 78,146 $ 33,355 $ 15,248 $ 86,723 a. What is the FI’s net exposure in Swiss francs stated in Swiss francs (Sf) and in dollars ($)?b. What is the FI’s net exposure in British pounds stated in British pounds (£) and in…arrow_forwardUse the information below to answer the questions that follow. U.S. $ EQUIVALENT CURRENCY PER U.S. $ .6394 .9793 U.K. Pound (£) Canada dollar a. Which would you rather have, $100 or £100? b. Which would you rather have, $100 Canadian or £100? c-1. What is the cross-rate for Canadian dollars in terms of British pounds? (Do not include the Canadian dollar sign, C$. Round your answer to 4 decimal places, e.g., 32.1616.) c-2. What is the cross-rate for British pounds in terms of Canadian dollars? (Do not include the pound sign, £. Round your answer to 4 decimal places, e.g., 32.1616.) c-1. Cross-rate c-2. Cross-rate 1.5640 1.0211 с 1€ /Can$arrow_forward

- On December 20, 2020, Momeier Company (a U.S.-based company) sold parts to a foreign customer at a price of 45,000 rials. Payment is received on January 10, 2021. Currency exchange rates are as follows: Date U.S. Dollar per Rial December 20, 2020 $ 1.14 December 31, 2020 1.11 January 10, 2021 1.07 How does the fluctuation in the U.S. dollar per rial exchange rate affect Momeier’s 2020 income statement? How does the fluctuation in the U.S. dollar per rial exchange rate affect Momeier’s 2021 income statement?arrow_forwardYou are given the following quotes: U.S. dollar/Mexican Peso = 0.2501 U.S. dollar/Australian Dollar = 0.7448 U.S dollar/Chinese Yuan = 0.1352 What is the Chinese Yuan/Australian Dollar cross rate?arrow_forwardUse the following information on the U.S. dollar value of the euro to answer the question. Forward Rate for Spot Rate April 30, 2024 Delivery $1.130 $1,140 October 20, 2023 November 1, 2023 December 31, 2023 April 30, 2024 Select one: 1.148 1.100 1.170 On October 30, 2023, a US company receives a purchase order from a customer in Spain. Under the sale terms, the customer will pay the company €100.000 on April 30; 2024 On October 30, the US company also enters a forward contract to sell €100,000 on April 30, 2024. The company delivers the merchandise to the customer on November 1, On April 30, the company receives €100,000 from the customer and sells it using the forward contract. The company's accounting year ends December 31. What net gain or loss is recognized in 2023, in addition to sales revenue? esc a $500 net loss b. 1800 net gain, c. $800 net loss d. $500 net gain 3.145 1165 1.170 * 8: MacBook Air & FL 40 # 6-41 16 W 19 F M marrow_forward

- VALUE OF EURO (U.S. dollars per euro) 1.9 1.8 1.7 1.6 1.5 1.4 1.3 1.2 1.1 0 50 100 150 200 250 300 350 400 450 500 550 600 QUANTITY OF EUROS (Billions) At an exchange rate of 1.5 per euro, the quantity of euros demanded is of euros demanded is + (?) billion euros, while at an exchange rate of 1.1 per euro, the quantity sloping. billion euros. This confirms that the demand curve for euros isarrow_forwardAn exchange rate is the price of one country's currency expressed in another country's currency. The exchange rates of the euro () and the Japanese yen (X) relative to the U.S. dollar ($) are listed as follows: Spot Rate 0.6589 / $:1 Euro Yen 99.4400 / $1 quotation, the foreign exchange rate represents the number of American dollars that can be When exchange rates are stated as purchased with one unit of foreign currency. Given the exchange rate data above, how many yen (x) can one euro ( 1) purchase? ○ ¥ 166.01 x181.10 ○ ¥ 150.92 O173.56 quotation. The foreign currency price of one unit of the home currency is calledarrow_forwardA product sells for $750 in the United States. The spot exchange rate is $1 to 1.56 Swiss francs. If purchasing power parity (PPP) holds, what is the price of the product in Switzerland? a. 1,228.50 b. 1,392.30 O c. 1,462.50 O d. 1,170.00 O e. 947.70arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education