FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

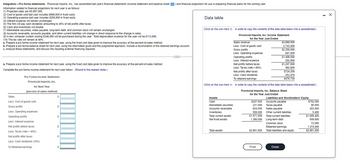

Transcribed Image Text:Integrative-Pro forma statements Provincial Imports, Inc., has assembled last year's financial statements (income statement and balance sheet) and financial projections for use in preparing financial plans for the coming year.

Information related to financial projections for next year is as follows:

(1) Projected sales are $5,997,000.

(2) Cost of goods sold last year includes $996,000 in fixed costs.

(3) Operating expense last year includes $256,000 in fixed costs.

(4) Interest expense will remain unchanged.

(5) The firm will pay cash dividends amounting to 35% of net profits after taxes.

(6) Cash and inventories will double.

(7) Marketable securities, notes payable, long-term debt, and common stock will remain unchanged.

(8) Accounts receivable, accounts payable, and other current liabilities will change in direct response to the change in sales.

(9) A new computer system costing $348,000 will be purchased during the year. Total depreciation expense for the year will be $113,000.

(10) The tax rate will remain at 40%.

a. Prepare a pro forma income statement for next year, using the fixed cost data given to improve the accuracy of the percent-of-sales method.

b. Prepare a pro forma balance sheet for next year, using the information given and the judgmental approach. Include a reconciliation of the retained earnings account.

c. Analyze these statements, and discuss the resulting external financing required.

a. Prepare a pro forma income statement for next year, using the fixed cost data given to improve the accuracy of the percent-of-sales method.

Complete the pro forma income statement for next year below: (Round to the nearest dollar.)

Pro Forma Income Statement

Provincial Imports, Inc.

for Next Year

(percent-of-sales method)

Sales

Less: Cost of goods sold

Gross profits

Less: Operating expenses

Operating profits

Less: Interest expense

Net profits before taxes

Less: Taxes (rate = 40%)

Net profits after taxes

Less: Cash dividends (35%)

To Retained earnings

$

$

$

$

$

$

-C

Data table

(Click on the icon here in order to copy the contents of the data table below into a spreadsheet.)

Provincial Imports, Inc. Income Statement

for the Year Just Ended

Sales revenue

Less: Cost of goods sold

Gross profits

Less: Operating expenses

Operating profits

Less: Interest expense

Net profits before taxes

Less: Taxes (rate=40%)

Net profits after taxes

Less: Cash dividends

To retained earnings

(Click on the icon here in order to copy the contents of the data table below into a spreadsheet.)

Provincial Imports, Inc. Balance Sheet

for the Year Just Ended

Assets

Cash

Marketable securities

Accounts receivable

Inventories

Total current assets

Net fixed assets

Total assets

$4,999,000

2,743,000

$2,256,000

847,000

$1,409,000

202,000

$1,207,000

482,800

$724,200

253,470

$470,730

Liabilities and Stockholders' Equity

$207,000 Accounts payable

231,000

Taxes payable

624,000

Notes payable

509,000

Other current liabilities

$1,571,000

Total current liabilities

Long-term debt

1,390,000

Common stock

Retained earnings

$2,961,000 Total liabilities and equity

Print

Done

$702,000

95,000

203,000

5,400

$1,005,400

509,600

72.000

1,374,000

$2,961,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Manero Company included the following information in its annual report: 2019 2018 Sales $178,400 $162,500 102,500 Cost of goods sold 115,000 Operating expenses 50,000 50,000 Operating income 13,400 10,000 In a trend income statement for 2017, where 2017 is the base year, sales are expressed as: Multiple Choice 150.5% O100.0% 84,4% 92.6% 2017 $155,500 100,000 45,000 10,500arrow_forwardRevenue and expense data for Innovation Quarter Inc. for two recent years are as follows: Current Year Previous YearSales $4,000,000 $3,600,000Cost of goods sold 2,280,000 1,872,000Selling expenses 600,000 648,000Administrative expenses 520,000 360,000Income tax expense 240,000 216,000a. Prepare an income statement in comparative form, stating each item for both years as a percent of sales. Round to the nearest whole percentage.b. Comment on the significant changes disclosed by the comparative income statement.arrow_forwardBook ferences Various financial data for SunPath Manufacturing for 2019 and 2020 follow. Output: Sales Inputs: Labor Raw Materials Energy Capital Employed Other 2019 2020 $300,000 $330,000 40,000 45,000 10,000 250,000 2,000 43,000 51,000 9,000 262,000 6,000 What is the percentage change in SunPath's total productivity measure between 2019 and 2020?arrow_forward

- .arrow_forwardThe following information relates to ELEPHANT INC. for the year ended 2020: Cash purchases - gross P300,000 Trade accounts payable - beginning 500,000 Trade accounts payable - ending 400,000 Trade notes payable decreased by 200,000 Cash payments on payables 1,000,000 Purchase return and discounts (inclusive of P15,000 receipts from suppliers) 20,000 Inventory increased by 100,000 Compute the cost of goods sold under accrual basis of accounting. A. P885,000 B. P950,000 C. P925,000 D. P845,000arrow_forwardBellingham Industries, a manufacturer of the furniture industry, had the following financial performance for the last two years as shown on their income statements below: Billingham Industries, Inc. Comparative Income Statement For the Years Ended December 31, 2021 and 2020 2021 2020 Amount Amount Sales $1,280,000 $1,180,000 Cost of goods sold 644,800 613,600 Gross profit 635,200 566,400 Selling expenses 230,500 188,800 Administrative expenses 182,500 177,000 Total operating expenses 413,000 365,800 Income from operations 222,200 200,600 Other income 77,000 70,800 Income before income tax 299,200 271,400 Income tax expense 121,600 106,200 Net income $177,600 $165,200 1. Prepare a horizontal analysis using the form provided to…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education