ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

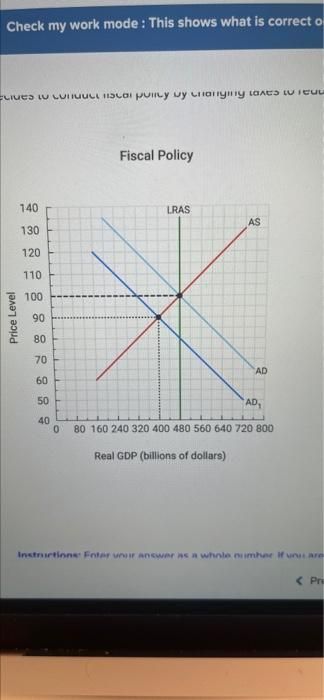

Transcribed Image Text:Check my work mode: This shows what is correct o

Ecives to conut ca puncy by changing lants to

Fiscal Policy

140

LRAS

AS

130

120

110

100

Price Level

90

80

70

60

50

AD,

40

0 80 160 240 320 400 480 560 640 720 800

Real GDP (billions of dollars)

Instructions: Enter your answer as a whole number if unu are

< Pri

AD

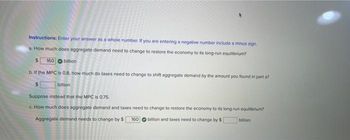

Transcribed Image Text:Instructions: Enter your answer as a whole number. If you are entering a negative number include a minus sign

a. How much does aggregate demand need to change to restore the economy to its long-run equilibrium?

160 billion

b. If the MPC is 0.8, how much do taxes need to change to shift aggregate demand by the amount you found in part a?

billion

Suppose instead that the MPC is 0.75.

c. How much does aggregate demand and taxes need to change to restore the economy to its long-run equilibrium?

Aggregate demand needs to change by $

billion and taxes need to change by $

160

bilion.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Using the Aggregate Supply -Aggregate Demand model describe both the short run and the long run effects of a reduction in corporation tax for an economy currently producing at their potential GDP level.arrow_forwardFrom the perspective of someone using aggregate-demand and aggregate supplyanalysis, what is the impact of a tax cut when the economy is operating above fullemployment. Is this a wise policy? Why or why not?arrow_forwardWhich of the following scenarios would result in a decrease in Aggregate Demand? R A decline in investors confidence causes investment to fall. O Technology improvements lead to productivity gains O A rise in imports from Europe f5 O The congress passes a new income tax cut. 100 % 5 16 T e 6 6 3 Y ly 7 7 U 8 f10 num lk. 8 9 5 9 f12 Farrow_forward

- Which of the following can tax cuts influence? a. aggregate demand and aggregate supply b. aggregate demand but not aggregate supply c. aggregate supply but not aggregate demand d. neither aggregate demand nor aggregate supplyarrow_forwardAssume the tax multiplier is estimated to be 1.3 and the aggregate supply curve has its usual upward slope. Suppose the government lowers taxes by $75 million. Aggregate demand will by $ million. (Enter your response rounded to one decimal place.)arrow_forwardNeed help with this. THanks -When Government Spending increases by $10 B Aggregate Demand increases by MORE than $10 B. Which part of Aggregate Demand (C, I, G, or X?) increases so as to make this ripple effect, or multiplied impact, happen?arrow_forward

- supply equation is Y - Ypot + 80 (P-Pe), where Ypot is the potential level of output. In 2016, the population was 400 million, and the structure of the economy was described by the following equations for household consumption behavior and taxes received: C = 100+ 0.8DI, and T = 0. where all monetary values are in billions of dollars. Government spending was fixed at $1700 billion, and firm's investment behavior was fixed at $800 billion. Trading is allowed in this economy and in 2016, trading occurred such that the trade account was balanced. That is, net exports (X-IM) was equal to zero. (Question 15 of 20) Now consider that in in the following year (2017), the government decided to implement a policy aimed at moving the economy to full employment. In its decision to move the economy to full employment, they used government spending as the policy tool. The structure and fixed spending behaviors remain the same as they were in 2016, except for government spending. In addition, changes…arrow_forwardInstructions: Enter your answers as a whole number. B. How much does aggregate demand need to change to restore the economy to its long-run equilibrium? $ billion b. If the MPC is 0.75, how much does government purchases need to change to shift aggregate demand by the amount you found in parta? $ billion Suppose instead that the MPC is 0.6. C. How much does aggregate demand and government purchases need to change to restore the economy to its long-run equilibrium? Aggregate demand needs to change by $ billion and government purchases need to change by $1 Price Level 160 140 120 100 80 60 40 20 0 LRAS (240,90) AD₁ billion. Real GDP (billions of dollars) AS AD 80 160 240 320 400 480 560 640 720 800arrow_forwardWhen Government Spending increases by $10 Billion Aggregate Demand increases by MORE than $10 Billion. Which part of Aggregate Demand increases so as to make this ripple effect, or multiplied impact, happen?arrow_forward

- A) Discuss, with examples, factors or events that might shift the short run aggregate supply curve. B) Imagine an economy is in long run equilibrium. Now suppose that firms experience an increase in their cost of production (say, due to a natural disaster). i. Explain, with graphs, the macroeconomic impact of such an increase in production costs. ii. Describe how policymakers could use fiscal policy to counteract the effects of increased cost of production.arrow_forwardWhich fiscal policy will increase aggregate supply? increasing tax rates on businesses O increasing tax rates on consumers instituting more regulations on businesses allocating more money for federal student loansarrow_forwardUS President Collin Hawkins is concerned about the economy. He orders the Treasury to issue direct stimulus payments to citizens in an effort to prevent a recession. On average citizens save 20% of their income. The total of this stimulus amount is $1.3 trillion USD. What is the multiplier? What is the total economic impact of this injection? $ "instead of using 'O's, simply note the number using "m", "b", or "t" for 'million, "billion, or 'trillion. For example if your answer is "$56,100,000,000", you should instead type "$56.1b"arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education