ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

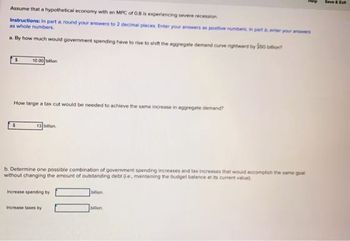

Transcribed Image Text:Assume that a hypothetical economy with an MPC of 0.8 is experiencing severe recession

Instructions: In part around your answers to 2 decimal places. Enter your answers as positive numbers in part enter your answers

as whole numbers.

a. By how much would government spending have to rise to shift the aggregate demand curve rightwerd by 50

S

10.00 bilion

How large a tax cut would be needed to achieve the same increase in aggregate demand?

$

13 billion

b. Determine one possible combination of government spending increases and tax increases that would accomplish the same goal

without changing the amount of outstanding debt e, maintaining the budget balance at its current value)

billion

Increase spending by

Increase taxes by

bilion

Save & Ext

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Which of the following is not a predicted outcome of implementing automatic fiscal policy? О а. Reduces the size of the multiplier O b. Helps prevent inflation due to inflationary gaps O C. Moderates the business cycle O d. Decreases the deficit O e. Reduces the effects of economic shocksarrow_forwardFigure 8-23. The figure represents the relationship between the size of a tax and the tax revenue raised by that tax. 6 on4m21 3 Tax Revenue B Tax Size Refer to Figure 8-23. If the economy is at point A on the curve, then a small increase in the tax rate will O increase the deadweight loss of the tax and increase tax revenue. O increase the deadweight loss of the tax and decrease tax revenue. decrease the deadweight loss of the tax and increase tax revenue. O decrease the deadweight loss of the tax and decrease tax revenue.arrow_forwardpls answer urgent all question Q1,a,b,c . Q1-Suppose the government reduces taxes by $20 billion, that there is no crowding out, and that the marginal propensity to consume is ¾. a. What is the initial effect of the tax reduction on aggregate demand? b. What additional effects follow this initial effect? What is the total effect of the tax cut on aggregate demand? c.How does the total effect of this $40billion tax cut compare to the total effect of a $40 billion in governmentpurchases? Why?arrow_forward

- In the dynamic model of AD-AS in the figure to the right, if the economy is at point A in year 1 and is expected to go to point B in year 2, Congress and the president would most likely pursue OA expansionary fiscal policy. OB. expansionary automatic stabilizers. OC. contractionary fiscal policy. OD. contractionary monetary policy. OE. expansionary monetary policy. Click to select your answer MacBook Air Price Level 104 100 101 LRAS, LRAS₂ A B 11113AD Real GOP SRAS, SRAS₂ AD₂arrow_forward4arrow_forwardCan you answer this questionarrow_forward

- Figure 16-7 Price level P3 a P₂ P₁ 0 LRAS A increase taxes LRAS 8 с Y₂ Ya contractionary fiscal policy O increase government spending O decrease interest rates SRAS₁ AD₁ SRAS AD₂ Refer to Figure 16-7. Given that the economy has moved from A to B in the graph above, which of the following would be the appropriate fiscal policy to achieve potential GDP? Real GDP (trillions of dollars)arrow_forwardHow much government spending needs to be increased to maintain full employment in the economy If the economy was facing recessionary gap of $900 billions? Assume MPC is .9. How much tax cut should government give if they wanted to eliminate this recessionary gap through tax cut?arrow_forwardHelp The aggregate demand curve can be derived from the aggregate expenditures model as indicated by the fact that Multiple Choice an increase in the price level shifts the aggregate expenditures schedule upward and increases real GDP a decrease in the price level shifts the aggregote expenditures schedule downward and decreases real GDP a decreose in the price level shifts the aggregate expenditures scheduie upiward and decreases real GDP an increase in the price level shifts the eggregate expenditures schedule downverd and decreases real GDParrow_forward

- Only typed answer The federal government decides to stimulate the economy and increases government expenditure on new infrastructure projects by $100 billion. The marginal propensity to consume is MPC = 0.3 and the marginal propensity to import is MPI = 0.08. Assuming no crowding out effect, what is the increase in output caused by the stimulus package of$100 billion in a closed economy?arrow_forwardDon't answer by pen paper and don't use chatgpt otherwise we will give dounvotearrow_forwardSuppose the government, in an effort to avoid an increase in the deficit, votes for a budget neutral tax cut policy. Assume the marginal propensity to consume (MPC) is equal to 0.75 and taxes are cut by $15 billion. Round answers to the nearest billion, and specify decreases as a negative number. By how much will government spending change? change in government spending: $ What is the resulting change in the equilibrium level of real GDP? change in equilibrium level of real GDP: $ billion billionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education