FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

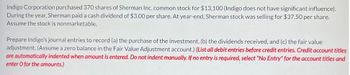

Transcribed Image Text:Indigo Corporation purchased 370 shares of Sherman Inc. common stock for $13,100 (Indigo does not have significant influence).

During the year, Sherman paid a cash dividend of $3.00 per share. At year-end, Sherman stock was selling for $37.50 per share.

Assume the stock is nonmarketable.

Prepare Indigo's journal entries to record (a) the purchase of the investment, (b) the dividends received, and (c) the fair value

adjustment. (Assume a zero balance in the Fair Value Adjustment account.) (List all debit entries before credit entries. Credit account titles

are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and

enter o for the amounts.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- On January 1, Sohar Corporation purchased a 25% equity in Salalah Corporation for $120,000. At December 31, Salalah declared and paid a $50,000 cash dividend and reported net income of $250,000. Instructions (a) Journalize the transactions. (b) Determine the amount to be reported as an investment in Salalah stock at December 31.arrow_forwardJackson Company engaged in the following investment transactions during the current year. February 17 Purchased 430 shares of Medical Company common stock for $15 per share plus a brokerage commission of $150. Jackson does not have significant influence over Medical.April 1 Bought 23,000 of the 100,000 outstanding shares of Olde Company for $230,000. Goodwill of $73,000 was included in the price.June 25 Received a $1.30 per share dividend on Medical Company stock.June 30 Olde Company reported second-quarter profits of $13,000.October 1 Purchased 1,300 bonds of Alpha Company for $14 per bond plus a brokerage fee of $330. These bonds are classified as securities available-for-sale.December 31 Medical Company shares are selling for $20 and Alpha bonds are selling for $11.Prepare the appropriate journal entries to record the transactions for the year, including year-end adjustments. Note: If no entry is required for a transaction/event, write "No journal entry required"arrow_forwardOn May 3, Zirbal Corporation purchased 4,500 shares of its own stock for $31,500 cash. On November 4, Zirbal reissued 1,350 shares of this treasury stock for $10,800. Prepare the May 3 and November 4 journal entries to record Zirbal's purchase and reissuance of treasury stock. View transaction list Journal entry worksheetarrow_forward

- Carlsville Company began operations in the current year and had no prior stock investments. The following transactions are from its short-term stock investments with insignificant influence. Prepare journal entries to record these transactions. On December 31, prepare the adjusting entry to record the fair value adjustment for the portfolio of stock investments. July 22 Purchased 1, 500 shares of Hunt Corporation at $23 per share. September 5 Received a $2 cash dividend for each share of Hunt Corporation. September 27 Purchased 3, 400 shares of HCA at $21 per share. October 3 Sold 1,500 shares of Hunt at $18 per share. October 30 Purchased 1,300 shares of Black & Decker at $53 per share. December 17 Received a $3 cash dividend for each share of Black & Decker. December 31 Fair value of the short-term stock investments is $143,000.arrow_forwardBonneau Company had the following transactions relating to investments in available-for-sale securities during the year. Prepare the required general journal entries for these transactions:July 4 Bonneau purchased 400 shares of Crossley Company stock at $120 per share plus a $400 brokerage fee. These stocks will be classified as Available-for-Sale securities.Sept 15 Bonneau received a $1.50 per share cash dividend on the Crossley Company stock.Dec 31 The fair value of the Crossley Company stock (the only investment that Bonneau owns) is $125 per share. The balance of the Fair value Adjustment—AFS account had a zero balance prior to adjustment.arrow_forwardOn February 1. Mini Company purchased 1.000 shares (2% ownership) of Win Company common stock for $30 per share. The shares are classified as a short-term investment. On March 20, Mini Company sold 200 shares of Win stock for $5,800. Mini received a dividend of $1 per share on April 25. The fair value of the remaining stock is $26,400 on June 30. The entry to record the appropriate fair value adjustment on June 30 would include a debit to O Urealzed Gain or Lass - Income in the amount of $2,400. 57 167 points O Fair Value Adjustment -Stock in the amount of $2.400. O Unrealized Gain or Loss -Income in the amount of $3,600. O No gain or loss should be recorded because no adlitional shares were sold on June 30. 58 L66 points The Norfolk Pine Co purchased 10.000 shares of Peperomia Ginny, Inc. on July 1 at a cost of $18 per share. On December 1, Norfolk Pine sells 600 shares at a price of $20 per share. Norfolk Pine's entry to record this transaction will include a 0 debit to Common Stock…arrow_forward

- Subject: acountingarrow_forwardConcord Corporation purchased 360 shares of Sherman Inc. common stock for $11,900 (Concord does not have significant influence). During the year, Sherman paid a cash dividend of $3.25 per share. At year-end, Sherman stock was selling for $37.50 per share. Prepare Concord' journal entries to record (a) the purchase of the investment, (b) the dividends received, and (c) the fair value adjustment. (Assume a zero balance in the Fair Value Adjustment account.) (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. Account Titles and Explanation Debit Credit (a) (b) (c)arrow_forward(44). Subject:- Accounting On March 1, Emma Corp purchased 1,900 (or 11%) of the common shares of Christine Corp for $40 per share. Brokerage fees of $1,100 were incurred on the purchase. On December 1, Christine Corp declared and paid $30,000 of dividends. On December 31, shares of Christine Corp were trading at $62 per share. The investment was recorded using FVTOCI. What amount would be recorded to the "Investment in Christine Corp" account on March 1?arrow_forward

- On November 1 of Year 1, Drucker Co. acquired the following investments in equity securities measured at FV-NI. Kelly Corporation 400 shares of common stock (no-par) at $60 per share Keefe Corporation 240 shares preferred stock ($10 par) at $20 per share On December 31, the company's year-end, the quoted market prices were as follows: Kelly Corporation common stock, $52, and Keefe Corporation preferred stock, $24. Following are the data for the following year (Year 2). Mar. 02: Dividends per share, declared and paid: Kelly Corp., $1, and Keefe Corp., $0.50. Oct. 01: Sold 80 shares of Keefe Corporation preferred stock at $25 per share. Dec. 31: Fair values: Kelly common, $46 per share, Keefe preferred, $26 per share. Year 1 Year 2 d. Prepare the entries required in Year 2 to record dividend revenue, the sale of stock, and the fair value adjustment. Assume that the Fair Value Adjustment account needs to be adjusted for the investment portfolio on December 31, Year 2. Date Mar. 2, Year 2…arrow_forwardHow do I solve this?arrow_forwardMarigold Corporation purchased 630 common shares of Ditch Inc. for $12,900 on February 21. Marigold paid a 1% commission on the share purchase and, because the shares were not publicly traded, decided to account for them following the cost model. On June 30, Ditch declared and paid a cash dividend of $1.90 per share. (a) Prepare Marigold Corporation's journal entry to record the purchase of the investment. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Date Account Titles and Explanation Feb. 21 Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education