FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

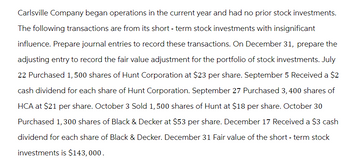

Transcribed Image Text:Carlsville Company began operations in the current year and had no prior stock investments.

The following transactions are from its short-term stock investments with insignificant

influence. Prepare journal entries to record these transactions. On December 31, prepare the

adjusting entry to record the fair value adjustment for the portfolio of stock investments. July

22 Purchased 1, 500 shares of Hunt Corporation at $23 per share. September 5 Received a $2

cash dividend for each share of Hunt Corporation. September 27 Purchased 3, 400 shares of

HCA at $21 per share. October 3 Sold 1,500 shares of Hunt at $18 per share. October 30

Purchased 1,300 shares of Black & Decker at $53 per share. December 17 Received a $3 cash

dividend for each share of Black & Decker. December 31 Fair value of the short-term stock

investments is $143,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On May 3, Zirbal Corporation purchased 4,500 shares of its own stock for $31,500 cash. On November 4, Zirbal reissued 1,350 shares of this treasury stock for $10,800. Prepare the May 3 and November 4 journal entries to record Zirbal's purchase and reissuance of treasury stock. View transaction list Journal entry worksheetarrow_forwardBonneau Company had the following transactions relating to investments in available-for-sale securities during the year. Prepare the required general journal entries for these transactions:July 4 Bonneau purchased 400 shares of Crossley Company stock at $120 per share plus a $400 brokerage fee. These stocks will be classified as Available-for-Sale securities.Sept 15 Bonneau received a $1.50 per share cash dividend on the Crossley Company stock.Dec 31 The fair value of the Crossley Company stock (the only investment that Bonneau owns) is $125 per share. The balance of the Fair value Adjustment—AFS account had a zero balance prior to adjustment.arrow_forwardRequired: Prepare general journal entries for the following transactions involving short-term securities (assume no investments were held prior to the following transactions): (a) Feb 12: Purchased 600 Flipper Corp shares at $50 per share. Commission Fee was $50. (b) Feb 27: Purchased 200 Jason Corp shares at $30 per share, no commission (c) Mar 16: Received a $4 per share dividend on the Flipper Corp shares. (d) Mar 31: Sold 150 shares of Flipper Corp at $60 per share.arrow_forward

- On February 1. Mini Company purchased 1.000 shares (2% ownership) of Win Company common stock for $30 per share. The shares are classified as a short-term investment. On March 20, Mini Company sold 200 shares of Win stock for $5,800. Mini received a dividend of $1 per share on April 25. The fair value of the remaining stock is $26,400 on June 30. The entry to record the appropriate fair value adjustment on June 30 would include a debit to O Urealzed Gain or Lass - Income in the amount of $2,400. 57 167 points O Fair Value Adjustment -Stock in the amount of $2.400. O Unrealized Gain or Loss -Income in the amount of $3,600. O No gain or loss should be recorded because no adlitional shares were sold on June 30. 58 L66 points The Norfolk Pine Co purchased 10.000 shares of Peperomia Ginny, Inc. on July 1 at a cost of $18 per share. On December 1, Norfolk Pine sells 600 shares at a price of $20 per share. Norfolk Pine's entry to record this transaction will include a 0 debit to Common Stock…arrow_forwardI need help with these questions please help me...arrow_forwardSubject: acountingarrow_forward

- On May 27, Kick Off Inc. reacquired 3,000 shares of its common stock at $54 per share. On August 3, Kick Off sold 1,700 of the reacquired shares at $57 per share. November 14, Kick Off sold the remaining shares at $53 per share. Journalize the transactions of May 27, August 3, and November 14. For a compound transaction, if an amount box does not require an entry, leave it blank. May 27 Aug. 3 Nov. 14arrow_forwardi need the answer quicklyarrow_forwardOn November 1 of Year 1, Drucker Co. acquired the following investments in equity securities measured at FV-NI. Kelly Corporation 400 shares of common stock (no-par) at $60 per share Keefe Corporation 240 shares preferred stock ($10 par) at $20 per share On December 31, the company's year-end, the quoted market prices were as follows: Kelly Corporation common stock, $52, and Keefe Corporation preferred stock, $24. Following are the data for the following year (Year 2). Mar. 02: Dividends per share, declared and paid: Kelly Corp., $1, and Keefe Corp., $0.50. Oct. 01: Sold 80 shares of Keefe Corporation preferred stock at $25 per share. Dec. 31: Fair values: Kelly common, $46 per share, Keefe preferred, $26 per share. Year 1 Year 2 d. Prepare the entries required in Year 2 to record dividend revenue, the sale of stock, and the fair value adjustment. Assume that the Fair Value Adjustment account needs to be adjusted for the investment portfolio on December 31, Year 2. Date Mar. 2, Year 2…arrow_forward

- On January 1, Vermont Corporation had 49,400 shares of $11 par value common stock issued and outstanding. All 49,400 shares had been issued in a prior period at $22 per share. On February 1, Vermont purchased 910 shares of treasury stock for $24 per share and later sold the treasury shares for $19 per share on March 1. The journal entry to record the purchase of the treasury shares on February 1 would include a debit to a loss account for $1,820. credit to a gain account for $1,820. credit to Treasury Stock for $21,840. debit to Treasury Stock for $21,840. MacBook Proarrow_forwardHow do I solve this?arrow_forwardAn investor purchased 100 shares of Mallard common stock at $20 per share on March 15 of Year 1. On December 31 of Year 1, the stock was quoted at $19 per share and Mallard declared and paid a dividend of $1.50 per share. On June 5 of Year 2, the investor sold all 100 shares for $22 per share. On December 31 of each year, the Fair Value Adjustment account is adjusted. Assuming the investment is measured at FV-NI, provide the journal entries to be made at each of the following dates. a. March 15, Year 1. b. December 31, Year 1. c. June 5, Year 2. d. December 31, Year 2. Note: If a journal entry isn't required for the transaction, select "N/A—Debit" and "N/A―Credit" as the account names and leave the Dr. and Cr. answers blank (zero). Date Account Name (a) Mar. 15, Year 1 Investment in Stock Cash (b1) Dec. 31, Year 1 (b2) Dec. 31, Year 1 (c) June 5, Year 2 To record investment purchase. Cash Dividend Revenue To record dividends. Unrealized Gain or Loss-Income Fair Value Adjustment-Equity…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education