FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Note : i previously send this question and it has answer for a), b) and c).

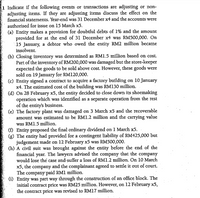

Transcribed Image Text:1 Indicate if the following events or transactions are adjusting or non-

adjusting items. If they are adjusting items discuss the effect on the

financial statements. Year-end was 31 December x4 and the accounts were

authorised for issue on 15 March x5.

(a) Entity makes a provision for doubtful debts of 1% and the amount

provided for at the end of 31 December x4 was RM500,000. On

15 January, a debtor who owed the entity RM2 million became

insolvent.

(b) Closing inventory was determined as RM1.5 million based on cost.

Part of the inventory of RM200,000 was damaged but the store-keeper

expected the goods to be sold above cost. However, these goods were

sold on 19 January for RM120,000.

(c) Entity signed a contract to acquire a factory building on 10 January

x4. The estimated cost of the building was RM130 million.

(d) On 28 February x5, the entity decided to close down its shoemaking

operation which was identified as a separate operation from the rest

of the entity's business.

(e) The factory plant was damaged on 3 March x5 and the recoverable

amount was estimated to be RM1.2 million and the carrying value

was RM1.5 million.

() Entity proposed the final ordinary dividend on 1 March x5.

(g) The entity had provided for a contingent liability of RM425,000 but

judgement made on 12 February x5 was RM500,000.

(h) A civil suit was brought against the entity before the end of the

financial year. The lawyers advised the company that the company

would lose the case and-suffer a loss of RM1.2 million. On 10 March

x5, the company and the complainant agreed to settle it out of court.

The company paid RM1 million.

(i) Entity was part way through the construction of an office block. The

initial contract price was RM25 million. However, on 12 February x5,

the contract price was revised to RM17 million.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- can you explain why the answer for the third part is option number 2 from the selection of answersarrow_forwardPLEASE, WRITE THE SOLUTIONS ON PAPER, EXPLAINING THE ENTIRE PROCESS, THE ONLY AND CORRECT ANSWERS ARE FOR (i) V(t) = exp (-2e^0.02t + 2 ) for 0 15 (i) Derive, and simplify as far as possible, expressions in terms of t for V(t), where V(t) is the present value of a unit sum of cash flow made at time t. You should derive separate expressions for the three sub-intervals. (ii) Hence, making use of the result in part (i), calculate the value at time t = 3 of a payment of £2,500 made at time t = 15. (iii) Calculate, to the nearest 0.01%, the constant nominal annual rate of interest convertible half-yearly implied by the transaction in part (ii). (iv) Making use of the result in part (i), calculate the present value of a payment stream p(t) paid continuously from time t = 15 to t = 20 at a rate of payment at time t given by: p(t) = 300e 0.02tarrow_forwardCan i have the steps in formula form pleasearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education