FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

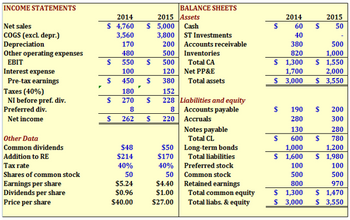

5. Bruno Inc.'s Financial Statement for years 2014-2015. Compute for the Bruno Inc. Year 2015 Debt to Asset Ratio. (Answer Format: 12.23%, if computed answer is 12.343% answer should be 12.34%, if computed answer is 12.347% answer should be 12.35%)*

Transcribed Image Text:INCOME STATEMENTS

Net sales

COGS (excl. depr.)

Depreciation

Other operating expenses

EBIT

Interest expense

Pre-tax earnings

Taxes (40%)

NI before pref. div.

Preferred div.

Net income

Other Data

Common dividends

Addition to RE

Tax rate

Shares of common stock

Earnings per share

Dividends per share

Price per share

2014

$ 4,760

3,560

170

480

$

550

100

$

450

180

$

270

8

$ 262

$48

$214

40%

50

$5.24

$0.96

$40.00

BALANCE SHEETS

2015 Assets

5,000

Cash

3,800

ST Investments

200 Accounts receivable

500

Inventories

$

500

Total CA

120

Net PP&E

$ 380

Total assets

152

$

228 Liabilities and equity

8

Accounts payable

$

220

Accruals

Notes payable

Total CL

Long-term bonds

$50

$170

Total liabilities

40%

Preferred stock

50

Common stock

$4.40

Retained earnings

$1.00

Total common equity

Total liabs. & equity

$27.00

$

2014

$

60

40

380

820

$ 1,300

1,700

$ 3,000

$

$

1,000

$ 1,600

100

500

800

$ 1,300

$ 3,000

2015

50

500

1,000

$ 1,550

2,000

$ 3,550

200

300

280

780

1,200

$ 1,980

100

500

970

$ 1,470

$ 3,550

$

190 $

280

130

600 $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please help me thankuarrow_forwardPlease do not give solution in image format and show all calculation thankuarrow_forwardAdditional information: 2018 current ratio: 1.4:1 debt to total assets: 61.1% Question: find working capital for 2018 Additional information: 2017 current ratio 1.5:1 working capital: 214,500 Question find debt to total assets for 2017arrow_forward

- Challenge Industries has total assets of $122,200. If their total liabilities are $103,200, find the debt-to-equity ratio. (Round to the nearest hundredth and enter the complete ratio. Do not enter spaces. Example: enter '0.93:1')arrow_forwardWant answer with calculationarrow_forwardThe comparative accounts payable and long-term debt balances for a company follow. Current Year Previous YearAccounts payable $114,240 $102,000Long-term debt 127,200 120,000 Based on this information, what is the amount and percentage of increase or decrease that wouldbe shown on a balance sheet with horizontal analysis?arrow_forward

- Using the financial statements in the image, calculate the following ratios for both the FY 2017 and FY 2018: Current Ratio Quick Ratio Total Asset Turnover Average Collection Total Debt to Total Assets Times Interest Earned Net Profit Margin Return on Assets Return on Equity Modified Du Point Equation for FY 2018 PE Ratio Market to Book Ratioarrow_forwardI need help to determine the following; 4. For P & B Manufacturing to assess its debt management I need help to calculate the debt-to-equity ratio at the end of the year AND the equity multiplier. Include calculations and round answers to 2 decimal places.arrow_forward2.The Moon Company had net income in 2022 of AED 40 million. Here are some of the financial ratios from the annual report. Return on Assets = 5% Debt Assets Ratio = 55% Profit Margin = 4.5% Inventory in days = 20 days Using these ratios, calculate the following for the Remal Company: a) Salesb) Total assetsc) Total asset turnover d) Total debte) Stockholders' equity f) Return on equityg) Inventoryarrow_forward

- Calculate the Debt to Equity ratio for Urban Outfitters for both 2018 and 2019. Be sure to round your answer to 2 decimal place.arrow_forwardAttached is Apple Inc.'s financial information. Please answer questions 1-3. 1. Apple's acid-test ratio in 2021 is a. 1.49 b. 1.22 c. 1.56 d. 0.91 2. Apple's days' sales in receivables in 2021 is a. 61.26 b. 50.69 c. 38.27 d. 46.18 3. Apple's long term debt to equity ratio in 2021 is a. 2.54 b. 1.64 c. 0.87 d. 1.89arrow_forwardMake comments on this tablearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education