FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

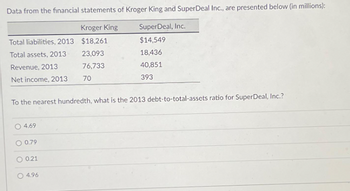

Transcribed Image Text:Data from the financial statements of Kroger King and SuperDeal Inc., are presented below (in millions):

SuperDeal, Inc.

$14,549

18,436

40,851

393

Total liabilities, 2013

Total assets, 2013

Revenue, 2013

Net income, 2013

To the nearest hundredth, what is the 2013 debt-to-total-assets ratio for SuperDeal, Inc.?

4.69

0.79

0.21

Kroger King

$18,261

23,093

76,733

70

O 4.96

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Based on the following information as of December 31,2020, compute the company’s debt-equity ratio. Assume current liabilities are all interest-bearing. Round to nearest two decimal places. Current assets: 15 Non-current assets: 12 Current Liabilities: 22 Non-current Liabilities: 4 Debt to Equity Ratio = ?arrow_forwardAnderson Inc has total assets of $18,797, current assets of $3,777, current liabilities of $4,999 and total equity of $7,036. Given this information what is the long term debt of the company?arrow_forwardThese are the three long term solvency ratios for Facebook Inc. Based on these numbers, how well is the company doing? How are their levels of debt financing?arrow_forward

- Consider the following balance sheet for Go The Distance Trading Cards. Sales were $1,200,000 in the past year. Go The Distance Trading Cards Balance Sheet, 2013: Assets $ Current Assets $74,630.00 Net fixed Assets (Net PPE) $224,900.00 Total Assets $299,530.00 Liabilities and Shareholder Equity Current Liabilities $43,510.00 Long-term liabilities (Long term debt) $93,200.00 Total Liabilities $136,710.00 Shareholder equity $162,820.00 Total Liabilities and Shareholder Equity $299,530.00 What is the debt-to-asset ratio for this firm?arrow_forwardWD Corporation reports the following year-end balance sheet data. The company's debt-to-equity ratio equals: Cash $ 42,000 Current liabilities $ 77,000 Accounts receivable 57,000 Long-term liabilities 28,000 Inventory 62,000 Common stock 102,000 Equipment 147,000 Retained earnings 101,000 Total assets $ 308,000 Total liabilities and equity $ 308,000arrow_forward21. Kinsella Corporation's statement of financial position showed the following amounts: current liabilities, $75,000; total liabilities, $100,000; total assets, $200,000. What is the total long-term debt to total equity ratio? a.0.375 b.0.125 c.0.75 d.0.25arrow_forward

- The comparative accounts payable and long-term debt balances for a company follow. Current Year Previous YearAccounts payable $114,240 $102,000Long-term debt 127,200 120,000 Based on this information, what is the amount and percentage of increase or decrease that wouldbe shown on a balance sheet with horizontal analysis?arrow_forwardDurable Plastics Company had the following total assets, liabilities, and equity as of December 31. Total Assets Total Liabilities Total Equity $440,000 133,000 307,000 What is the company's debt ratio as of December 31? (Round your percentage answer to two decimal places.) OA. 30.23% OB. 43.32% O C. 100.00% O D. 69.77%arrow_forward69 )arrow_forward

- Debt-to-Total-Assets Ratio Ruby Company's balance sheet reports the following totals: Assets = $40,000; Liabilities = $25,000; Stockholders' Equity = $15,000. What is the the company's debt-to-total-assets ratio? 9% Note: Round answer to one decimal place (ex: 60.8%)arrow_forward22. McLaughlin Corporation's statement of financial position showed the following amounts: current liabilities, $75,000; total liabilities, $100,000; total assets, $200,000. What is the total debt to total assets ratio? a.1 b.2 c.0.50 d.0.875arrow_forwardThe balance sheet for Solomon Corporation follows: Current assets $ 237,000 Long-term assets (net) 752,000 Total assets $ 989,000 Current liabilities $ 156,000 Long-term liabilities 450,000 Total liabilities 606,000 Common stock and retained earnings 383,000 Total liabilities and stockholders’ equity $ 989,000 Required Compute the Debt-to-assets ratioarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education