FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

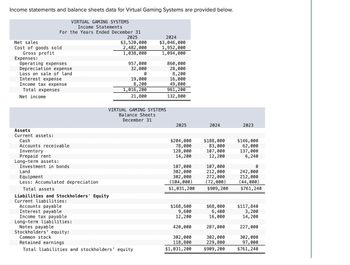

Transcribed Image Text:Income statements and balance sheets data for Virtual Gaming Systems are provided below.

Net sales

Cost of goods sold

Gross profit

Expenses:

VIRTUAL GAMING SYSTEMS

Income Statements

For the Years Ended December 31

Operating expenses

Depreciation expense

Loss on sale of land

Interest expense

Income tax expense

Total expenses

Net income

Assets

Current assets:

Cash

Accounts receivable

Inventory

Prepaid rent

Long-term assets:

Investment in bonds

Land

Equipment

Less: Accumulated depreciation

Total assets

Liabilities and Stockholders' Equity

Current liabilities:

Accounts payable

Interest payable

Income tax payable

Long-term liabilities:

Notes payable

2025

$3,520,000

2,482,000

1,038,000

957,000

32,000

0

19,000

8,200

1,016, 200

21,800

VIRTUAL GAMING SYSTEMS

Balance Sheets

December 31

2024

$3,046,000

1,952,000

1,094,000

Stockholders' equity:

Common stock

Retained earnings

Total liabilities and stockholders' equity

860,000

28,000

8,200

16,000

49,000

961,200

132,800

2025

$204,000

78,000

128,000

14, 200

107,000

302,000

302,000

(104,000)

$1,031, 200

$168,600

9,600

12,200

420,000

302,000

118,800

$1,031, 200

2024

$188,000

83,000

107,000

12, 200

107,000

212,000

272,000

(72,000)

$909, 200

$68,000

6,400

16,000

287,000

302,000

229,800

$909, 200

2023

$146,000

62,000

137,000

6,240

0

242,000

212,000

(44,000)

$761,240

$117,840

3,200

14, 200

227,000

302,000

97,000

$761,240

Transcribed Image Text:Required:

1. Assuming that all sales were on account, calculate the following risk ratios for 2024 and 2025: (Round your answers to 1 decimal

place.)

Receivables turnover ratio

Inventory turnover ratio

Current ratio

Debt to equity ratio

2024

times

times

%

2025

times

times

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Here are comparative financial statement data for Bramble Company and Debra Company, two competitors. All data are as of December 31, 2022, and December 31, 2021. Net sales Cost of goods sold Operating expenses Interest expense Income tax expense Current assets Plant assets (net) Current liabilities Bramble Company 2022 $1,896,000 1.020,048 257,856 Return on assets 7,584 54,984 322,500 520,800 O 64,200 Plant assets (net) Current liabilities Long-term liabilities Common stock, $10 par Retained earnings 2021 Return on common stockholders' equity 520,800 64,200 Debra Company $561,000 297,330 79,662 3,927 6,171 $310,000 83,500 $78,000 500,300 139,800 123,000 75,600 29,600 108,400 498,000 172,700 2022 34,400 500,300 2021 498,000 146,300 Bramble Company 75,600 90,400 67.2 % % 139,800 34,400 28,400 122,500 Compute the 2022 return on assets and the return on common stockholders' equity ratios for both companies. (Round answers to 1 decimal place, eg. 12.1%) 38,000 123,000 Debra Company 29,600…arrow_forwardThe following income statement and balance sheets for The Athletic Attic are provided. THE ATHLETIC ATTIC Income Statement For the year ended December 31, 2021 Net sales $8,740,000 Cost of goods sold 5,370,000 Gross profit 3,370,000 Expenses: Operating expenses $1,520,000 Depreciation expense 194,000 Interest expense 34,000 Income tax expense 344,000 Total expenses 2,092,000 Net income $1,278,000 THE ATHLETIC ATTIC Balance Sheets December 31 2021 2020 Assets Current assets: Cash $148,000 $198,000 Accounts receivable 710,000 730,000 Inventory 1,325,000 995,000 Supplies 94,000 69,000 Long-term assets: Equipment 1,070,000 1,070,000 Less: Accumulated depreciation (388,000) (194,000) Total assets $2,959,000 $2,868,000 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $99,000 $75,000 Interest payable 0 3,400 Income tax payable…arrow_forwardView Policies Current Attempt in Progress Assume Sunland Company has the following reported amounts: Sales revenue $1,000,000, Sales returns and allowances $29,000, Cost of goods sold $649.599, and Operating expenses $215,600. (a) Compute net sales. Net sales $ (b) Compute gross profit. Gross profit S (c) Compute income from operations.arrow_forward

- The following income statement and balance sheets for The Athletic Attic are provided. THE ATHLETIC ATTIC Income Statement For the year ended December 31, 2021 Net sales $8,840,000 Cost of goods sold 5,420,000 Gross profit 3,420,000 Expenses: Operating expenses $1,570,000 Depreciation expense 204,000 Interest expense 44,000 Income tax expense 354,000 Total expenses 2,172,000 Net income $1,248,000 THE ATHLETIC ATTIC Balance Sheets December 31 2021 2020 Assets Current assets: Cash $158,000 $208,000 Accounts receivable 760,000 780,000 Inventory 1,375,000 1,045,000 Supplies 104,000 79,000 Long-term assets: Equipment 1,120,000 1,120,000 Less: Accumulated depreciation (408,000) (204,000) Total assets $3,109,000 $3,028,000 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $109,000 $85,000 Interest payable 0 4,400 Income tax payable…arrow_forwardASSETS Cash Accounts receivable Inventory Net plant and equipment Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable Accrued expenses Long-term debt Common stock Paid-in capital Retained earnings Total liabilities and stockholders' equity Sales (all on credit) Cost of goods sold Gross profit Sales and administrative expenses Depreciation Operating profit Interest expense Profit before taxes Taxes (30%) Net income Multiple Choice O Refer to the tables above. What Is Megaframe Computer's total asset turnover? O MEGAFRAME COMPUTER COMPANY Balance Sheet As of December 31 MEGAFRAME COMPUTER COMPANY Income Statement For the year ended December 31 O 7.58x 3.6x 2x 1.94x $ 875,000 600,000 $ 275,000 30,000 55,000 $ 190,000 25,000 $ 165,000 49,500 $ 115,500 $ 50,000 70,000 110,000 220,000 $ 450,000 $ 70,000 50,000 130,000 70,000 40,000 90,000 $ 450,000arrow_forwardPortions of the financial statements for Peach Computer are provided below. PEACH COMPUTER Income Statement For the year ended December 31, 2024 Net sales Expenses: Cost of goods sold Operating expenses Depreciation expense Income tax expense Total expenses Net income Cash Accounts receivable Inventory Prepaid rent Accounts payable Income tax payable $1,100,000 610,000 55,000 45,000 PEACH COMPUTER Selected Balance Sheet Data December 31 2024 $107,000 45,500 80,000 3,500 50,000 5,500 2023 $87,500 51,500 57,500 6,000 39,500 12,500 $1,925,000 1,810,000 $115,000 Increase (I) or Decrease (D) $19,500 (I) (D) 6,000 22,500 (I 2,500 (D) 10,500 (I) 7,000 (D)arrow_forward

- Use the information above to calculate cash flows from operating activities using the indirect method. Note: Amounts to be deducted should be indicated by a minus sign. Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash Changes in current operating assets and liabilities $ 42,000 S 42.000 42.000arrow_forwardQuestion Content Area Use the information provided for Harding Company to answer the question that follow. Harding Company Accounts payable $31,654 Accounts receivable 69,987 Accrued liabilities 6,524 Cash 16,364 Intangible assets 38,210 Inventory 80,832 Long-term investments 90,451 Long-term liabilities 73,398 Notes payable (short-term) 26,425 Property, plant, and equipment 659,739 Prepaid expenses 1,697 Temporary investments 38,252 Based on the data for Harding Company, what is the amount of quick assets?arrow_forwardThe following income statement and additional year-end information is provided. SONAD COMPANY Income Statement For Year Ended December 31 Sales $ 1,710,000 Cost of goods sold 837,900 Gross profit 872,100 Operating expenses Salaries expense $ 234,270 Depreciation expense 41,040 Rent expense 46,170 Amortization expenses—Patents 5,130 Utilities expense 18,810 345,420 526,680 Gain on sale of equipment 6,840 Net income $ 533,520 Accounts receivable $ 26,000 increase Accounts payable $ 15,650 decrease Inventory 27,075 increase Salaries payable 3,850 decrease Prepare the operating activities section of the statement of cash flows using the direct method. Note: Amounts to be deducted should be indicated with a minus sign.arrow_forward

- The comparative statements of Waterway Company are presented here. Waterway CompanyIncome StatementsFor the Years Ended December 3120222021Net sales$1,813,300 $1,753,100 Cost of goods sold1,008,900 983,000 Gross profit804,400 770,100 Selling and administrative expenses516,800 477,800 Income from operations287,600 292,300 Other expenses and losses Interest expense18,900 14,800 Income before income taxes268,700 277,500 Income tax expense78,224 77,700 Net income$ 190,476 $ 199,800 Waterway CompanyBalance SheetsDecember 31Assets20222021Current assets Cash$60,200 $64,500 Debt investments (short-term)70,600 49,200 Accounts receivable (net)117,800 102,700 Inventory123,600 114,700 Total current assets372,200 331,100 Plant assets (net)602,200 517,900 Total…arrow_forwardCABOT CORPORATION Income Statement For Current Year Ended December 31 Sales $ 448,600 297,150 151,450 98,600 5,000 47,850 19,276 $ 28,574 Cost of goods sold Gross profit Operating expenses Interest expense Profit before taxes Income tax expense Net profit Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Property, plant and equipment, net Total assets Req 1 and 2 Req 3 Req 4 CABOT CORPORATION Balance Sheet December 31 Liabilities and Equity Req 5 8,000 Accounts payable 8,800 Accrued wages payable 32,400 Income taxes payable 2,750 Share capital 150,300 Retained earnings $ 238,400 Total liabilities and equity Complete this question by entering your answers in the tabs below. Compute the current ratio and acid-test ratio. 36,150 Long-term note payable, secured by mortgage on property, plant and equipment Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days'…arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education