ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

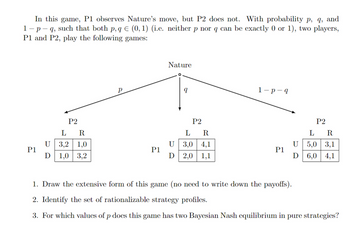

Transcribed Image Text:In this game, P1 observes Nature's move, but P2 does not. With probability p, q, and

1-p-q, such that both p, q = (0, 1) (i.e. neither p nor q can be exactly 0 or 1), two players,

P1 and P2, play the following games:

p

Nature

1-p-q

P2

P2

P2

L R

L R

L R

U

3,2 1,0

U

3,0 4,1

U 5,0 3,1

P1

P1

P1

Ꭰ

1,0

3,2

D 2,0 1,1

D

6,0 4,1

1. Draw the extensive form of this game (no need to write down the payoffs).

2. Identify the set of rationalizable strategy profiles.

3. For which values of p does this game has two Bayesian Nash equilibrium in pure strategies?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- W X Y Z 47, 15| 39, 41 45, 53 12, 56 In equilibrium, what is the probability that player 1 will use the pure strategy X in this game?arrow_forwardOnly typed answerarrow_forwardGame Theory Consider the entry game with incomplete information studied in class. An incumbent politician's cost of campaigning can be high or low and the entrant does not know this cost (but the incumbent does). In class, we found two pure-strategy Bayesian Nash Equilibria in this game. Assume that the probability that the cost of campaigning is high is a parameter p, 0 < p < 1. Show that when p is large enough, there is only one pure-strategy Bayesian Nash Equilibrium. What is it? What is the intuition? How large does p have to be? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- A small community has 10 people, each of whom has a wealth of $3,000. Each individual must choose whether to contribute $300 or $0 to the support of public entertainment for their community. The money value of the benefit that a person gets from this public entertainment is one half of the total amount of money contributed by all individuals in the community. This game has a Nash equilibrium in which 5 people contribute $300 and for public entertainment and 5 people contribute nothing. This game has a dominant strategy equilibrium in which nobody contributes anything for public entertainment. This game has no Nash equilibrium in pure strategies, but has a Nash equilibrium in mixed strategies. This game has a dominant strategy equilibrium in which all 10 citizens contribute $300 to support public entertainment. This game has two Nash equilibria, one in which everybody contributes $300 and one in which no- body contributes $300.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardIf the players play pure strategies, the game has no Nash equilibrium. But what if they choose their moves randomly? Let each player instead opt for a mixed strategy instead of a pure strategy. The first will play action Z with probability p, and the second will play action L with probability q. At which pair (p, q) are the mixed strategies of the players in equilibrium? At which pair (p, q) does neither player want to change strategy? When are both strategies simultaneously the best response?arrow_forward

- Based on the following game, what are the secure strategies for player 1 and player 2? Player 1 S1 and 12 S1 and t1 S2 and 12 S2 and 11 s1 S2 Player 2 tl 10,15 -10,7 t2 15,8 10,20arrow_forwardPlayer 1 and Player 2 will play one round of the Rock-Paper-Scissors game. The winner receives a payoff +1, the loser receives a payoff -1. If it is a tie, then each player receives a payoff zero. Suppose Player 2 is using a non-optimal strategy: he/she plays Rock with probability 35%; Paper with probability 45%; and Scissors with probability 20%. Given that Player 1 knows Player 2 is using this strategy, the best response of Player 1 is to play O a mixed strategy with probability 1/3 each (Rock, Paper and Scissors) O Scissors with probability 100% O any strategy (any strategy is a best response for Player 1) O Rock with probability 100% O Paper with probability 100%arrow_forwardQarrow_forward

- Consider the following game. Firm 1 can implement one of two actions, A or B. Firm 2 observes the action chosen by Firm 1 and then decides whether to fight it or not. (-10, 20) F2 Fight A Don't fight -(30, 10) Firm 1 (-10, 0) Fight B Don't fight -(20, 15) (a) Consider the following strategy profile: Firm 1 chooses A; Firm 2 chooses fight if A, and fight if B. • this strategy profile is [Select] (b) Consider the following strategy profile: Firm 1 chooses B; Firm 2 chooses fight if A, and don't fight if B. • this strategy profile is [Select] O (c) Consider the following strategy profile: Firm 1 chooses B; Firm 2 chooses don't fight if A and don't fight if B. • this strategy profile is [Select] 00 F2 ()arrow_forwardA game involves two players: player A and player B. Player A has three strategies a1, a2 and a3 while player B has three strategies b1, b2 and b3. Player B b1 b2 b3 a1 -40,30 70,20 -10,120 Player A a2 40,60 80,80 60,20 a3 -30,40 -50,110 150, -70 Assuming that this is a one-time game, answer the following questions: Is there any dominant strategy for each player? What is the secure strategy of each player. What is the Nash equilibrium of the game?arrow_forward8) Find the mixed strategy Nash equilibrium of the following normal form game. Player 2 T1 T2 T3 2, 3 3, 5 1, 1 Player 1 S2 1, 4 4, 3 0, 5 Player 1 attaches probability (S1, S2) = () and Player 2 attaches probability (T1, T2, T3) = ( ) Player 1 attaches probability (S1, S2) = (.) and Player 2 attaches probability (T1, T2, T3) = (qi, 42, 1 – q1 – 92) where q1 , and 0 < q2 S %3D Player 1 attaches probability (S1, S2) = (G,;) and Player 2 attaches probability (T1, T2, T1) = (qı.42, 1 – q1 – 42) where 0 < qi <, and q2 = 3. Player 1 attaches probability (S1, S) = (;, -) and player 2 attaches probability (T1, T2, T3) = (1.42, 1- q1- 42) where 0 s qı s and q2 =arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education