Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

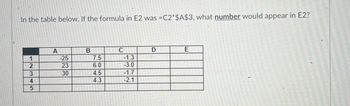

Transcribed Image Text:In the table below, If the formula in E2 was =C2*$A$3, what number would appear in E2?

A

B

C

D

E

1

2

3

223

-25

23

530

7.5

6.0

4.5

4

4.3

7644

5053

-1.3

-3.0

-1.7

-2.1

5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- a. Only whole numbers are to be entered as answers. Therefore, DO NOT put any signs in such as $, %, #, or a comma etc. In your answer. For example, if your answer is $1234 you should write 1234 as your answer and if your answer is 4%, write 4 as your answer. b. Indicate a negative number by putting a minus sign in front. Therefore, if your answer is negative 1234 you need to post -1234 as your answer. c. Round your answer to the nearest whole number, i.e. no decimal points. So if your answer is 1234.60 you should write 1235. Garden Depot is a retailer that is preparing its budget for the upcoming fiscal year. Management has prepared the following summary of its budgeted cash flows: 1st Quarter2nd Quarter3rd Quarter4th Quarter Total cash receipts $190,000 $340,000 $220,000 $240,000 Total cash disbursements$267,000 $237,000 $227,000 $257,000 The company's beginning cash balance for the upcoming fiscal year will be $25,000. The company requires a minimum cash balance of $10,000 and may…arrow_forwardIn cell E16, enter the appropriate formula to calculate the probability of either rolling a 7 or 11.arrow_forwarda,b, c and d pleasearrow_forward

- How many chiral centers are in the molecule shown below? C 3 7 05 O2 O4 06 O1arrow_forwardDocHub X D Unit 4 Project - TVM Calculator X b.com/claudiasirois1122/Xv7zYW5RnILBBINV2A9egx/unit-4-project-tvm-calculator-pdf?pg=6 > ✓Sign - O Ri + 4. Use the TVM Calculator to fill in the following table given that the APR is 6%. Round to 2 decimal places as needed. PV = PMT= FV = APR = Periods CHANGES = Compounding: CHANGES Principal Compounding Periods $1,000 D $1,000 $1,000 $1,000 $1,000 Annually Semiannually Monthly Weekly Daily 1 2 12 a. What did P represent in the compound interest formula? P = regular deposit amount 52 shift Amount after 1 year enter If we summarize the effect seen in the table, we see that more compoundings per year means that you will have more money in the account, but the amount of increase will eventually level off. Most banks publish the APY, or Annual Percentage Yield, instead of the APR to account for this effect. $1060 $1060.90 365 $1061.83 Extension 5. What are some financial goals that people save for? Some financial goals people save for are a…arrow_forward2. The date 8/9/2024 is stored in cell C5, and =WEEKDAY (C5) is stored in cell D5. What is the default function result if cell D5 has not been formatted? a. 6 b. 9 c. Friday, August 9, 2024 d. Fridayarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education