FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

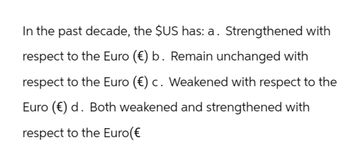

Transcribed Image Text:In the past decade, the $US has: a. Strengthened with

respect to the Euro (€) b. Remain unchanged with

respect to the Euro (€) c. Weakened with respect to the

Euro (€) d. Both weakened and strengthened with

respect to the Euro(€

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 2. Foreign exchange rate quotations Aa Aa An exchange rate is the price of one country's currency expressed in another country's currency. The exchange rates of the euro (€ ) and the Japanese yen (¥) relative to the U.S. dollar ($) are listed as follows: Spot Rate Euro € 0.7957 / $1 Yen ¥ 102.5600 / $1 When exchange rates are stated as quotation, the foreign exchange rate quotation represents the units of domestic currency that can be purchased with $1. How many euros can ¥1 purchase? € 0.007758 € 128.89 € 0.006982 € 0.009698 Direct and indirect quotations have relationship.arrow_forwardGanado Europe (B). Using facts in the chapter for Ganado Europe, assume as in Problem 11.1 that the exchange rate on January 2, 2020, in Exhibit 11.5 dropped from $1.2000 = €1.00 to $0.9000 = €1.00 (Rather than to $1.000/€). Recalculate Ganado Europe’s translated balance sheet for January 2, 2020, with the new exchange rate using the temporal rate method. What is the amount of translation gain or loss? Where should it appear in the financial statements? Why does the translation loss or gain under the temporal method differ from the loss or gain under the current rate method?arrow_forwardThe euro is quoted as EUR:USD = 1.1420-1.1425,and the Canadian dollar is quoted as USD$:CAD = 1.3540-1.3545. What is the implicit bid price and ask price of EUR:CAD quotation?arrow_forward

- Question 4a) Differentiate between the different types of foreign exchange exposure that multinationalcompanies usually face when engaging in cross-border transactions b) Assume that the one-year interest rate is 3% (per annum) in the UK and 2% (per annum)in the Euro area. Also, assume that the current spot exchange rate of one pound to the eurois €1.1500/£ and that the corresponding one-year forward rate is €1.1400/£. i) Provide calculations to show whether the Interest Rate Parity (IRP) theory holds. ii) A UK-based investor has £200,000 to invest for a year either in the Euro area or the UK.Using the above information, determine which investment will generate a higher return for iii) Discuss the extent to which your results in i) and ii) above provide support to theCovered Interest Rate Parity (CIRP) condition.arrow_forwardRolfe Company (a U.S.-based company) has a subsidiary in Nigeria where the local currency unit is the naira (NGN). On December 31, 2019, the subsidiary had the following balance sheet (amounts are in thousands [000s]): Cash Inventory Land Building Accumulated depreciation 2011 2013 NGN 15,450 10,500 4,050 40,500 (20,250) 2020 Feb. 1 Paid 8,050,000 NGN on the note payable. May 1 Sold entire inventory for 16,500,000 NGN on account. June 1 Sold land for 6,050,000 NGN cash. Aug. 1 Collected all accounts receivable. August 1, 2019 December 31, 2019 February 1, 2020 May 1, 2020 Hay NGN 50,250 The subsidiary acquired the inventory on August 1, 2019, and the land and building in 2013. It issued the common stock in 2011. During 2020, the following transactions took place: Sept. 1 Signed long-term note to receive 8,050,000 NGN cash. Oct. 1 Bought inventory for 20,050,000 NGN cash. Nov. 1 Bought land for 3,050,000 NGN on account. Dec. 1 Declared and paid 3,050,000 NGN cash dividend to parent.…arrow_forwardShort bio on the Euro (EUR) and its importance to global trade.arrow_forward

- If the U.S.DOLLAR is determined to be the functional currency, which of the following is usually used to restate to US$ monetary assets and liabilities to the reporting currency? I. The average exchange rate II. The historical exchange rate III. The current exchange rate A) III only. B) Either Il or III, depending on the nature of the item. C) I only. D) II only.arrow_forwardWhat does the term functional currency mean? How is the functional currency determined under IFRS and under U.S. GAAP?arrow_forwardGanado Europe (A). Using facts in the chapter for Ganado Europe, assume the exchange rate on January 2, 2020, in Exhibit 11.5 dropped in value from $1.2000 = €1.00 to $0.9000 = €1.00 (rather than to $1.0000 = €1.00). Recalculate Ganado Europe’s translated balance sheet for January 2, 2020, with the new exchange rate using the current rate method. What is the amount of translation gain or loss? Where should the translation gain or loss appear in the financial statements?arrow_forward

- Eurobonds are best defined as international bonds issued in _____ and denominated in ____. A. a single country; multiple currencies B. a single country; a single currency C. multiple countries; multiple currencies D. multiple countries; a single currency E. Euroland; eurosarrow_forwardAccording to the Interest Rate Parity (IRP) theory, if a country's interest rate is higher than that of another country, its currency should: A. Appreciate in the forward market. B. Depreciate in the forward market. C. Remain unchanged. D. Be more volatile.arrow_forwardRolfe Company (a U.S.-based company) has a subsidiary in Nigeria where the local currency unit is the naira (NGN). On December 31, 2019, the subsidiary had the following balance sheet (amounts are in thousands [000s]): Cash Inventory Land Building Accumulated depreciation 2020 Feb. 1 Paid 8,120,000 NGN on the note payable. May 1 Sold entire inventory for 17,200,000 NGN on account. June 1 Sold land for 6,120,000 NGN cash. 2011 2013 NGN 16,420 11, 200 4, 120 41,200 (20,600) NGN 52,340 The subsidiary acquired the inventory on August 1, 2019, and the land and building in 2013. It issued the common stock in 2011. During 2020, the following transactions took place: Aug. 1 Collected all accounts receivable. Sept. 1 Signed long-term note to receive 8,120,000 NGN cash. Oct. 1 Bought inventory for 20, 120,000 NGN cash. Nov. 1 Bought land for 3,120,000 NGN on account. Dec. 1 Declared and paid 3,120,000 NGN cash dividend to parent. Dec.31 Recorded depreciation for the entire year of 2,060,000 NGN.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education