Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Martinez consulting firm had $250,000 solve this accounting questions

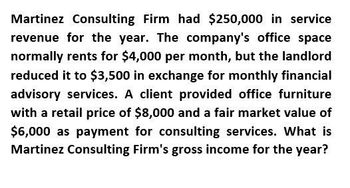

Transcribed Image Text:Martinez Consulting Firm had $250,000 in service

revenue for the year. The company's office space

normally rents for $4,000 per month, but the landlord

reduced it to $3,500 in exchange for monthly financial

advisory services. A client provided office furniture

with a retail price of $8,000 and a fair market value of

$6,000 as payment for consulting services. What is

Martinez Consulting Firm's gross income for the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- R&R Savings Bank finds that its basic transaction account, which requires a $1000 minimum balance, costs this savings bank an average of $3.25 per month in servicing costs (including labor and computer time) and $1.25 per month in overhead expenses. The savings bank also tries to build in a $0.50 per month profit margin on these accounts. Further analysis of customer accounts reveals that for each $100 above the $500 minimum in average balance maintained in its transaction accounts, R&R Savings saves about 5 percent in operating expenses with each account. (Note: If the bank saves about 5 percent in operating expenses for each $100 held in balances above the $500 minimum, then a customer maintaining an average monthly balance of $1,000 should save the bank 25 percent in operating costs) For a customer who consistently maintains an average balance of $1,200 per month, how much should the bank charge in order to protect its profit margin? 05.00 4.68 O 0.32 325arrow_forwardWestover Motors is a small car dealership. On average, it sells a car for $32,000, which it purchases from the manufacturer for $28,000. Each month, Westover Motors pays $53,700 in rent and utilities and $69,000 for salespeople’s salaries. In addition to their salaries, salespeople are paid a commission of $400 for each car they sell. Westover Motors also spends $10,500 each month for local advertisements. Its tax rate is 40%. Q1. How many cars must Westover Motors sell each month to break even? Q2. Westover Motors has a target monthly net income of $69,120. What is its target monthly operating income? How many cars must be sold each month to reach the target monthly net income of $69,120?arrow_forwardSchoenen Motors is a small car dealership. On average it sells a car for $33,000, which it purchases from the manufacturer for $29,000. Each month, Schoenen Motors pays $66,000 in rent and utilities and $73,000 for salespeople's salaries. In addition to their salaries, salespeople are paid a commission of $700 for each car they sell. Schoenen Motors also spends $12,000 each month for local advertisements. Its tax rate is 40%. Required 1. How many cars must Schoenen Motors sell each month to break even? 2. Schoenen Motors has a target monthly net income of $64,500. What is its target operating income? How many cars must be sold each month to reach the target monthly net income of $64,500? Requirement 1. How many cars must Schoenen Motors sell each month to break even? Schoenen Motors must sell cars each month to break even. (Round the number of cars up to the nearest whole number.) Requirement 2. Schoenen Motors has a target monthly net income of $64,500, What is its target operating…arrow_forward

- Schoenen Motors is a small car dealership. On average, it sells a car for $27,000, which it purchases from the manufacturer for $23,000. Each month, Schoenen Motors pays $48,200 in rent and utilities and $68,000 for salespeople's salaries. In addition to their salaries, salespeople are paid a commission of $600 for each car they sell. Schoenen Motors also spends $13,000 each month for local advertisements. Its tax rate is 40%. Read the requirements. Requirement 1. How many cars must Schoenen Motors sell each month to break even? Schoenen Motors must sell cars each month to break even Requirement 2. Schoenen Motors has a target monthly net income of $51,000. What is its targeted monthly operating income? How many cars must be sold each month to reach the target monthly net income of $51,000? The target monthly operating income is They would need to sell cars to reach the target monthly income of $51,000.arrow_forwardA real estate office handles a 40-unit apartment complex. When the rent is $540 per month, all units are occupied. For each $40 increase in rent, however, an average of one unit becomes vacant. Each occupied unit requires an average of $65 per month for services and repairs. What rent should be charged to obtain a maximum profit.arrow_forwardA company rents a building with a total of 100,000 square feet, which is evenly divided between two floors. The company allocates the rent for space on the first floor at twice the rate for space on the second floor. The total monthly rent for the building is $30,000. How much of the monthly rental expense should be allocated to a department that occupies 17,000 square feet on the first floor? (Do not round your intermediate calculations.) A. $8,500. B. $3,400. C. $10,200. D. $5,100. E. $6,800.arrow_forward

- GRB Ltd has several product lines with a manager in charge of each product line. The managers are paid a bonus based on the net income generated by their product line. Rubica (the CEO of GRB Ltd) was going through the financial reports of the 2nd quarter of 2021 to analyse the performance of the product lines. For 'Sweets' one of the largest product lines of GRB Ltd, Rubica noted that while the sales declined from $800,000 in quarter 1 to $600,000 in quarter 2, the product line manager of Sweets received a bonus larger than the 1st quarter. The manager of Sweets division was eligible for a higher bonus due to an operating profit increase from $90,000 in the 1st quarter to $120,000 in the 2nd quarter. Rubica wondered how the product line manager was entitled to a higher bonus with a decline in sales. Rubica also wants to know how net income increased with a decline in sales. Rubica found the following data from the financial reports of 'Sweets': Particulars Quarter 2 Quarter 1 Units…arrow_forwardNkusi Incorporated, provides consulting services to city water authorities. The consulting firm’s contribution-margin ratio is 20 percent, and its annual fixed expenses are $198,000. The firm’s income-tax rate is 40 percent. Required: Calculate the firm’s break-even volume of service revenue. How much before-tax income must the firm earn to make an after-tax net income of $ 55,800? What level of revenue for consulting services must the firm generate to earn an after-tax net income of $ 55,800 Suppose the firm’s income-tax rate rises to 45 percent. What will happen to the break-even level of consulting service revenue?arrow_forwardElliott, Inc., has four salaried clerks to process purchase orders. Each clerk is paid a salary of$25,750 and is capable of processing as many as 6,500 purchase orders per year. Each clerk usesa PC and laser printer in processing orders. Time available on each PC system is sufficient toprocess 6,500 orders per year. The cost of each PC system is $1,100 per year. In addition to thesalaries, Elliott spends $27,560 for forms, postage, and other supplies (assuming 26,000 purchaseorders are processed). During the year, 25,350 orders were processed.Required:1. Classify the resources associated with purchasing as (1) flexible or (2) committed.2. Compute the total activity availability, and break this into activity usage and unused activity.3. Calculate the total cost of resources supplied (activity cost), and break this into the cost ofactivity used and the cost of unused activity.4. (a) Suppose that a large special order will cause an additional 500 purchase orders. Whatpurchasing costs are…arrow_forward

- Klee Motors is a small car dealership. On average, it sells a car for $24 000, which it purchases from the manufacturer for $20 000. Each month, Klee Motors pays $60 000in rent and utilities and $60 000 in salespeople’s salaries. In addition to their salaries, sales people are paid a commission of $500 for each car they sell. Klee Motors also spends $15 000 each month on local advertisements. a. How many cars must Klee Motors sell each month to break even? b. Will Klee Motors earns a profit if it can sell 6 cars? c. How much sales revenue shall the company earn to achieve a $100,000 profit?arrow_forwardGypsy Joe’s operates a chain of coffee shops. The company pays rent of $10,000 per year for each shop. Supplies (napkins, bags and condiments) are purchased as needed. The managers of each shop are paid a salary of $2,500 per month and all other employees are paid on an hourly basis. The costs of supplies relative to the number of customers in a particular shop and relative to the number of customers in the entire chain of shops is which kind of cost, respectively? Variable cost / fixed cost Fixed cost / fixed cost Variable cost / fixed cost Variable cost / variable costarrow_forwardElliott, Inc., has four salaried clerks to process purchase orders. Each clerk is paid a salary of $25,750 and is capable of processing as many as 6,500 purchase orders per year. Each clerk uses a PC and laser printer in processing orders. Time available on each PC system is sufficient to process 6,500 orders per year. The cost of each PC system is $1,100 per year. In addition to the salaries, Elliott spends $27,560 for forms, postage, and other supplies (assuming 26,000 purchase orders are processed). During the year, 25,350 orders were processed. Required: 1. Which of the resources associated with purchasing can be classified as flexible resources? Forms, Postage and Supplies Which of the resources associated with purchasing can be classified as committed resources? PC system and clerks 2. Compute the total activity availability, and break this into activity usage and unused activity. Activity availability: fill in the blank 3 purchase orders Activity usage: fill in the blank…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College