ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

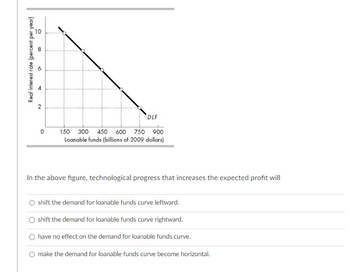

Transcribed Image Text:Real interest rate (percent per year)

10

2

0

DLF

150 300 450 600 750 900

Loanable funds (billions of 2009 dollars)

In the above figure, technological progress that increases the expected profit will

shift the demand for loanable funds curve leftward.

shift the demand for loanable funds curve rightward.

have no effect on the demand for loanable funds curve.

make the demand for loanable funds curve become horizontal.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Which of the following is an example of investment? OA. Continental buying Airbus planes O B. Mike buying an Apple iPad O C. Ron buying stocks and bonds. O D. Randy buying a BMWarrow_forwardWhat name is given to the maximum quantity that an economy can produce given its existing levels of labor, physical capital, technology, and institutions? O O Potential GDP Cheese The Wealth Effect The Interest Rate Effectarrow_forwardFigure 32-1 percent 8 10 20 30 40 50 60 70 $billions Refer to Figure 32-1. In the Figure shown, if the real interest rate is 6 percent, the quantity of loanable funds demanded is O A. $20 billion, and the quantity supplied is $40 billion. O B. $20 billion, and the quantity supplied is $60 billion. O C. $60 billion, and the quantity supplied is $20 billion. O D. $60 billion, and the quantity supplied is $40 billion.arrow_forward

- 4. Assume that the economy is described by the following equations: Y=C+l+G, Y=8490, G-2719, T-2056, C-258+ 1/2(Y-T), I-400 + 40r. Private saving and the equilibrium interest rate are O Private saving: 2959; The interest rate: 47.4 O Private saving: 2296; The interest rate: 23.7 O Private saving: 2296; The interest rate: 47.4 O Private saving: 2959; The interest rate: 23.7arrow_forwardpls also do the grapharrow_forwardPLEASE ANSWER ALL QUESTIONS NOT JUST SOME PLEASE WRITE THE EXACT NUMBERS FOR THE GRAPH. PLEASE READ CAREFULLY, THIS MAY BE A SIMILAR QUESTION, BUT ALL QUESTIONS ARE DIFFERENTarrow_forward

- 8arrow_forwardHi I want to ask what will happen to the market of loanable funds and the natural level of output in long run when the government runs a budget surplus? what will the graph of the loanable funds market look like?arrow_forwardThe outer flow in the circular flow diagram is measured in O goods and services produced inputs (factors of production) O government revenues O money MacBook Air 吕口 F3 D00 F4 F5 F6 F7 F8 2$ & 4 7 8 Y 6arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education