Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

solve C

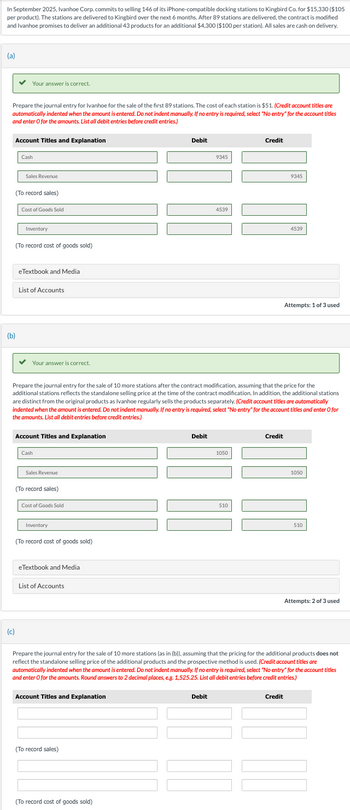

Transcribed Image Text:In September 2025, Ivanhoe Corp. commits to selling 146 of its iPhone-compatible docking stations to Kingbird Co. for $15,330 ($105

per product). The stations are delivered to Kingbird over the next 6 months. After 89 stations are delivered, the contract is modified

and Ivanhoe promises to deliver an additional 43 products for an additional $4,300 ($100 per station). All sales are cash on delivery.

(a)

Your answer is correct.

Prepare the journal entry for Ivanhoe for the sale of the first 89 stations. The cost of each station is $51. (Credit account titles are

automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles

and enter O for the amounts. List all debit entries before credit entries.)

Account Titles and Explanation

Cash

Debit

9345

Credit

(b)

Sales Revenue

(To record sales)

Cost of Goods Sold

Inventory

(To record cost of goods sold)

eTextbook and Media

List of Accounts

Your answer is correct.

4539

9345

4539

Attempts: 1 of 3 used

Prepare the journal entry for the sale of 10 more stations after the contract modification, assuming that the price for the

additional stations reflects the standalone selling price at the time of the contract modification. In addition, the additional stations

are distinct from the original products as Ivanhoe regularly sells the products separately. (Credit account titles are automatically

indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for

the amounts. List all debit entries before credit entries.)

Account Titles and Explanation

Cash

Debit

Credit

1050

(c)

Sales Revenue

(To record sales)

Cost of Goods Sold

Inventory

(To record cost of goods sold)

eTextbook and Media

List of Accounts

510

1050

510

Attempts: 2 of 3 used

Prepare the journal entry for the sale of 10 more stations (as in (b)), assuming that the pricing for the additional products does not

reflect the standalone selling price of the additional products and the prospective method is used. (Credit account titles are

automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles

and enter O for the amounts. Round answers to 2 decimal places, e.g. 1,525.25. List all debit entries before credit entries.)

Account Titles and Explanation

(To record sales)

(To record cost of goods sold)

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In September 2025, Cullumber Corp.commits to selling 155 of its iPhone-compatible docking stations to Ivanhoe Co. for $14,880 ($96 per product). The stations are delivered to Ivanhoe over the next 6 months. After 95 stations are delivered, the contract is modified and Cullumber promises to deliver an additional 40 products for an additional $3,640 ($91 per station). All sales are cash on delivery. (a) Your answer is correct. Prepare the journal entry for Cullumber for the sale of the first 95 stations. The cost of each station is $51. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Cash Debit 9120 Credit (b) Sales Revenue (To record sales) Cost of Goods Sold Inventory (To record cost of goods sold) eTextbook and Media List of Accounts 4845 9120 4845 Attempts:…arrow_forwardIn September 2025, Cullumber Corp. commits to selling 155 of its iPhone-compatible docking stations to Ivanhoe Co. for $14,880 ($96 per product). The stations are delivered to Ivanhoe over the next 6 months. After 95 stations are delivered, the contract is modified and Cullumber promises to deliver an additional 40 products for an additional $3,640 ($91 per station). All sales are cash on delivery. (a) Your answer is correct. Prepare the journal entry for Cullumber for the sale of the first 95 stations. The cost of each station is $51. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Debit Credit (b) Cash Sales Revenue (To record sales) Cost of Goods Sold Inventory (To record cost of goods sold) eTextbook and Media List of Accounts Your answer is correct. 9120…arrow_forwardIn September 2025, Cullumber Corp. commits to selling 155 of its iPhone-compatible docking stations to Ivanhoe Co. for $14,880 ($96 per product). The stations are delivered to Ivanhoe over the next 6 months. After 95 stations are delivered, the contract is modified and Cullumber promises to deliver an additional 40 products for an additional $3,640 ($91 per station). All sales are cash on delivery. (a) Prepare the journal entry for Cullumber for the sale of the first 95 stations. The cost of each station is $51. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Debit Credit (To record sales) (To record cost of goods sold)arrow_forward

- In September 2025, Ivanhoe Corp. commits to selling 146 of its iPhone-compatible docking stations to Kingbird Co. for $15,330 ($105 per product). The stations are delivered to Kingbird over the next 6 months. After 89 stations are delivered, the contract is modified and Ivanhoe promises to deliver an additional 43 products for an additional $4,300 ($100 per station). All sales are cash on delivery. (a) Prepare the journal entry for Ivanhoe for the sale of the first 89 stations. The cost of each station is $51. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Debit Credit (To record sales) (To record cost of goods sold)arrow_forwardIn September 2020, Gaertner Corp. commits to selling 150 of its iPhone-compatible docking stations to Better Buy Co. for $15,000 ($100 per product). The stations are delivered to Better Buy over the next 6 months. After 90 stations are delivered, the contract is modified and Gaertner promises to deliver an additional 45 products for an additional $4,275 ($95 per station). All sales are cash on delivery. Instructions a. Prepare the journal entry for Gaertner for the sale of the first 90 stations. The cost of each station is $54. b. Prepare the journal entry for the sale of 10 more stations after the contract modification, assuming that the price for the additional stations reflects the standalone selling price at the time of the contract modification. In addition, the additional stations are distinct from the original products as Gaertner regularly sells the products separately. c. Prepare the journal entry for the sale of 10 more stations (as in (b)), assuming that the pricing…arrow_forwardharrow_forward

- Vipukarrow_forwardGadubhaiarrow_forwardHeadland Company sells custom-made windows to Carla Vista Inc. for a new office building. The sale price for the windows is $270,000. Headland requires customers to provide a down payment of 20% before it designs and manufactures the windows to customer specifications. Carla Vista makes the down payment on December 10, 2025, and the windows are completed and delivered on April 3, 2026. (a) Prepare the entry for Headland when it receives the down payment. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record entries in the order displayed in the problem statement. List all debit entries before credit entries.) Date December 10, 2025 Account Titles and Explanation Debit Creditarrow_forward

- I-SEE-U Inc., a maker of CCTV cameras, is considering a hardware marketing chain to sell its cameras. As per the deal,I-SEE-U will be paid $35,000 and $10,000 at the end of years 1 and 2 and to make annual year-end payments of $5,000 in years 3 through 9. A final payment of $20,000 would be due at the end of year 10. A second company has offered to market the cameras for a one-time payment of $80,000 right away. If I-SEE-U uses a 12% required return, Which offer should it accept? Support your asnwer with relavent calculations.arrow_forwardI-SEE-U Inc., a maker of CCTV cameras, is considering a hardware marketing chain to sell its cameras. As per the deal, I-SEE-U will be paid $35,000 and $10,000 at the end of years 1 and 2 and to make annual year-end payments of $5,000 in years 3 through 9. A final payment of $20,000 would be due at the end of year 10. A second company has offered to market the cameras for a one-time payment of $80,000 right away. If I-SEE-U uses a 12% required return, Which offer should it accept?Show calculations with a financial calculatorarrow_forwardCaratini Company sells custom-made windows to Bryant Inc. for a new office building. The sale price for the windows is $275,000. Caratini requires customers to provide a down payment of 15% before it designs and manufactures the windows to customer specifications. Bryant makes the down payment on December 10, 2025, and the windows are completed and delivered on April 3, 2026.Instructions Prepare the entry for Caratini when it receives the down payment.Prepare the entry (or entries) for Caratini on April 3, 2026. The cost of the windows is $200,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning