Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

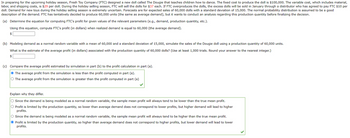

Transcribed Image Text:In preparing for the upcoming holiday season, Fresh Toy Company (FTC) designed a new doll called The Dougie that teaches children how to dance. The fixed cost to produce the doll is $100,000. The variable cost, which includes material,

labor, and shipping costs, is $29 per doll. During the holiday selling season, FTC will sell the dolls for $37 each. If FTC overproduces the dolls, the excess dolls will be sold in January through a distributor who has agreed to pay FTC $10 per

doll. Demand for new toys during the holiday selling season is extremely uncertain. Forecasts are for expected sales of 60,000 dolls with a standard deviation of 15,000. The normal probability distribution is assumed to be a good

description of the demand. FTC has tentatively decided to produce 60,000 units (the same as average demand), but it wants to conduct an analysis regarding this production quantity before finalizing the decision.

(a) Determine the equation for computing FTC's profit for given values of the relevant parameters (e.g., demand, production quantity, etc.).

Using this equation, compute FTC's profit (in dollars) when realized demand is equal to 60,000 (the average demand).

$

(b) Modeling demand as a normal random variable with a mean of 60,000 and a standard deviation of 15,000, simulate the sales of the Dougie doll using a production quantity of 60,000 units.

What is the estimate of the average profit (in dollars) associated with the production quantity of 60,000 dolls? (Use at least 1,000 trials. Round your answer to the nearest integer.)

$

(c) Compare the average profit estimated by simulation in part (b) to the profit calculation in part (a).

The average profit from the simulation is less than the profit computed in part (a).

The average profit from the simulation is greater than the profit computed in part (a)

Explain why they differ.

Since the demand is being modeled as a normal random variable, the sample mean profit will always tend to be lower than the true mean profit.

Profit is limited by the production quantity, so lower than average demand does not correspond to lower profits, but higher demand will lead to higher

profits.

Since the demand is being modeled as a normal random variable, the sample mean profit will always tend to be higher than the true mean profit.

Profit is limited by the production quantity, so higher than average demand does not correspond to higher profits, but lower demand will lead to lower

profits.

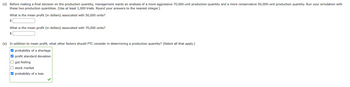

Transcribed Image Text:(d) Before making a final decision on the production quantity, management wants an analysis of a more aggressive 70,000-unit production quantity and a more conservative 50,000-unit production quantity. Run your simulation with

these two production quantities. (Use at least 1,000 trials. Round your answers to the nearest integer.)

What is the mean profit (in dollars) associated with 50,000 units?

$

What is the mean profit (in dollars) associated with 70,000 units?

$

(e) In addition to mean profit, what other factors should FTC consider in determining a production quantity? (Select all that apply.)

☐ >

probability of a shortage

profit standard deviation

gut feeling

stock market

probability of a loss

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Examine - Given details:

VIEW Step 2: a) Calculate - Net Profit:

VIEW Step 3: b) Calculate - Average Profit:

VIEW Step 4: c) Compare - Profit:

VIEW Step 5: d) Calculate - Average profit - 50000 Units:

VIEW Step 6: d) Calculate - Average profit - 70000 Units:

VIEW Step 7: e) Examine - Production quantity:

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 8 steps with 9 images

Knowledge Booster

Similar questions

- What is the impact of lead times on the implementation of the Wilson approach in supply chain management?arrow_forwardThe entry to record cost of goods sold at the end of the month is a: Debit to Work in Process Inventory and a credit to Finished Goods Inventory. Debit to Cost of Goods Sold and a credit to Finished Goods Inventory. Debit to Finished Goods Inventory and a credit to Cost of Goods Sold. Debit to Finished Goods Inventory and a credit to Work in Process Inventory.arrow_forwardIn preparing for the upcoming holiday season, Fresh Toy Company (FTC) designed a new doll called The Dougle that teaches children how to dance. The fixed cost to produce the doll is $100,000. The variable cost, which includes material, labor, and shipping costs, is $29 per doll. During the holiday selling season, FTC will sell the dolls for $37 each. If FTC overproduces the dolls, the excess dolls will be sold in January through a distributor who has agreed to pay FTC $10 per doll. Demand for new toys during the holiday selling season is extremely uncertain. Forecasts are for expected sales of 60,000 dolls with a standar deviation of 15,000. The normal probability distribution is assumed to be a good description of the demand. FTC has tentatively decided to produce 60,000 units (the same as average demand), but it wants to conduct an analysis regarding this production quantity before finalizing the decision. unit production quantity and a more conservative 50,000-unit production…arrow_forward

- Boston Company use a special part in manufacturing of its finished products. The unit cost thisspecial part is $ 35, and details of its manufacturing cost is as follows. The $35 unit productcost of this part is based on average 25,000 number of parts produced each year.An outside supplier has offered to supply the 25,000 parts at a cost of $30 per part. The specialequipment used to manufacture the above part. This equipment can only be used formanufacturing of this part and if not used it has no resale value.The total amount of general factory overhead, which is allocated based on direct labor-hours,would be unaffected by this decision because it is fixed cost..Suggest the management whether to stop producing internally and buy them from theoutside supplier?Description CAD Direct Materials 10Direct Labor 6Variable overheads…arrow_forward6. Laura is trying to decide whether to sell her knitted hats on Etsy, at a holiday bazaar, or in a local boutique. Demand could be 0 hats/month, 10 hats/month, or 20 hats/month. Given the payoff matrix below, what is her decision under equally likely? Demand = 0 Demand = 10 Demand = 20 Etsy -$70 $80 $230 Bazaar -$60 $90 $240 Boutique -$80 $70 $220 Select one: a. Etsy and boutique. b. Etsy only. c. Etsy and bazaar. d. Bazaar and boutique. e. All 3 are equally good. f. Bazaar only. g. None of them are good options. h. Boutique only.arrow_forwardYou are the buyer for a major U.S. health care company. As buyer, your job is to procure and buy parts for the production of X-Ray machines. The buyer from your sister plant in Paris, France has contacted you to supply them with 5 center sections, (a major component used in the X-Ray tube), because they will run out of these parts within 3 days. The center section is procured from a single source supplier in England, weighs approximately 40 pounds, is made of lead and has a 6-week lead time, (the time your supplier requires to manufacture the center section). Based on this criterion, answer the following questions: What mode of transportation is appropriate for shipping this part to Paris, France? What carrier will you use? Which carrier offers the best value?arrow_forward

- Inventory Management You are the store manager at a local branch of DigiLife, a large electronics retail chain. A new version of a popular consumer electronics device called the Amulet is coming out this year. It is your job to sell as many Amulets as you can while minimizing your costs in order to maximize your store's profits. Your Goal Earn $1,000,000 in net profits of Amulet sales.arrow_forwardBased on the following sensitivity report, what would be the impact of changing the objective function coefficient for Product_1 to 12 and changing the objective function coefficient for Product 3 to 18?arrow_forwardRay Holt seeks an investment for his new business. The investor will bear all the costs(fixed + variable) and wants a rate of return of at least Y%. For the business fixed cost is Fc, selling price of a unit is Sp, and Cost of production of a unit is Cp. How many units, x, should Ray Holt maketo meet the investor’s rate of return requirement? If the requested rate of return is 10%, fixed cost is $10,000, selling price is $5, and cost of production is $3, how many units should be made?arrow_forward

- Florida Citrus produced 40000 boxes of fruit that sold for OMR 3 per box. The total variable costs for the 40000 boxes were OMR 60000, and the fixed costs were OMR 75000. (a) What was the break-even quantity? (b) How much profit (or loss) resulted? (Ans. (a) 50000 boxes and (b) OMR 15000 loss) Draw a graph for the above question. Take appropriate scale on x and y axes. Label axes. Show Break-even point, break-even cost and break even quantity.arrow_forwardCompany XYZ, Inc. purchases widgets from a supplier at a cost of $20 per unit and sells the widgets for $30 per unit. By the end of Spring, demand for these widgets subsided considerably and all widgets that weren't sold during the Spring can be sold at a discounted price of $18 per unit. The company estimates demand during quarter two (Q2) to be normally distributed with mu = ? = 10,000 and sigma = ? =1525 boxes What is the optimal stockout probability for company XYZ, Inc.?arrow_forward1) Assume that you are a manager of one of the hotels in the UAE. As you know, UAE has an excellent weather from October to April, so the room occupancy rate is high during this period. However, the occupancy rate becomes low during the period from May to September due to the hot weather and this happens every year. Based on the above information: 1- What is type of demand state that you face in this situation? Explain it? 2- And explain how can you manage this demand state in detail? 2) In this course, you were requested to provide relevant recommendations to intensive growth strategies for a selected hotel of your choice in the UAE, write a report to explain each one of them and show their relevant recommendations as follows: 1- Market penetration strategy (explain and write recommendations) 2- Market development strategy (explain and write recommendations) 3- Product development strategy (explain and write recommendations) 4- Related diversification strategy (explain and write…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.