FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

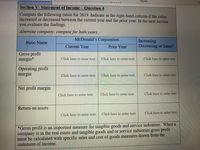

Transcribed Image Text:**Section V: Statement of Income — Question 4**

**Instructions:**

Compute the following ratios for 2019. Indicate in the right-hand column if the value increased or decreased between the current year and the prior year. In the next section, you evaluate the findings.

Alternate company: compute for both years.

| **Ratio Name** | **McDonald's Corporation** | **Increasing, Decreasing or Same?** |

|-----------------------------|----------------------------|------------------------------------|

| | **Current Year** | **Prior Year** | |

| **Gross profit margin*** | Click here to enter text. | Click here to enter text. | Click here to enter text. |

| **Operating profit margin** | Click here to enter text. | Click here to enter text. | Click here to enter text. |

| **Net profit margin** | Click here to enter text. | Click here to enter text. | Click here to enter text. |

| **Return on assets** | Click here to enter text. | Click here to enter text. | Click here to enter text. |

**Note:**

*Gross profit is an important measure for tangible goods and service industries. When a company is in the real estate and tangible goods and/or service industries, the gross profit must be calculated with specific sales and cost of goods measures drawn from the statement of income.

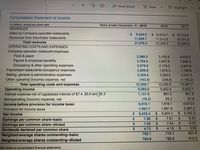

Transcribed Image Text:**Consolidated Statement of Income**

*In millions, except per share data*

**Years ended December 31,**

- **2019**

- **2018**

- **2017**

---

**REVENUES**

- **Sales by Company-operated restaurants:**

- 2019: $9,420.8

- 2018: $10,012.7

- 2017: $12,718.9

- **Revenues from franchised restaurants:**

- 2019: $11,655.7

- 2018: $11,012.5

- 2017: $10,101.5

- **Total revenues:**

- 2019: $21,076.5

- 2018: $21,025.2

- 2017: $22,820.4

---

**OPERATING COSTS AND EXPENSES**

- **Company-operated restaurant expenses:**

- **Food & paper:**

- 2019: $2,980.3

- 2018: $3,153.8

- 2017: $4,033.5

- **Payroll & employee benefits:**

- 2019: $2,704.4

- 2018: $2,937.9

- 2017: $3,528.5

- **Occupancy & other operating expenses:**

- 2019: $2,075.9

- 2018: $2,174.2

- 2017: $2,847.6

- **Franchised restaurants-occupancy expenses:**

- 2019: $2,200.6

- 2018: $1,973.3

- 2017: $1,790.0

- **Selling, general & administrative expenses:**

- 2019: $2,229.4

- 2018: $2,200.2

- 2017: $2,231.3

- **Other operating (income) expense, net:**

- 2019: $(183.9)

- 2018: $(236.8)

- 2017: $(1,163.2)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company reported the following data for the year ending 2018: Description Amount Sales $400,000 Sales discount $16,000 Sales returns and allowances $13,000 Cost of goods sold $117,000 Operating expense $153,000 Income tax expense $23,750 There are 25,000 shares outstanding throughout the year. What is the earnings per share? $2.08 per share $4.04 per share $3.09 per share $3.01 per sharearrow_forwardGulay ni Marites Vegetables Shop Income Statement For the year ended Dec 31, 2022 Net Sales 739,200.00 100.00% COGS (540,600.00) 73.13% Gross Income 198,600.00 26.87% ОРЕХ (120,000.00) 16.23% Net Income before Tax 78,600.00 10.63% Tax Paid (3% of Sales) (22,176.00) 3.00% Net Income After Tax 56,424.00 7.63% The vertical analysis is correct. A False; error for VA of gross income B False; error for VA of net income after tax c) False; error for VA of net income before tax D Truearrow_forwardSteele Inc. Consolidated Statements of Income (in thousands except per share amounts) 2023 2022 2021 Net sales $7,245,088 $6,944,296 $6,149,218 Cost of goods sold (5,286,253) (4,953,556) (4,355,675) Gross margin $1,958,835 $1,990,740 $1,793,543 General and administrative expenses (1,259,896) (1,202,042) (1,080,843) Special and nonrecurring items 2,617 0 0 Operating income $701,556 $788,698 $712,700 Interest expense (63,685) (62,398) (63,927) Other income 7,308 10,080 11,529 Gain on sale of investments 0 9,117 0 Income before income taxes $645,179 $745,497 $660,302 Provision for income taxes 254,000 290,000 257,000 Net income $391,179 $455,497 $403,302 Steele Inc. Consolidated Balance Sheets (in thousands) ASSETS Dec. 31, 2023 Dec. 31, 2022 Current assets: Cash and equivalents $320,558 $41,235 Accounts receivable 1,056,911 837,377 Inventories 733,700…arrow_forward

- (Profitability Ratio)What is the Earnings Per Share in 2020?arrow_forwardA 2 A === Aäl Ccl AaBbCc AаBb( AaВЬС АаВЬСс Heading 1 Heading 2 Heading 3 Heading 4 Heading 7 Paragraph Styles Section V: Statement of Income-Question 5 Identify McDonald's EPS-basic amounts. You can find this value at the bottom of the statement of income. Basic EPS Current year, 2019? Click here to enter text. Preceding year 1? Click here to enter text. Preceding year 2? Click here to enter text. Does it appear that McDonald's EPS-basic improved over the prior years? Click here to enter text. McDonald's Consolidated Statement of Cash Flows (SCF) Alternate company: Statement of Cash Flows found in SEC Form 10-K. Section V: SCF Question 1 Review the heading of McDonald's SCF. Does its SCF include two or three years of comparative information? Click here to enter text. Yrs.arrow_forwardBhaarrow_forward

- Please helparrow_forwardTable 1: Gress Income Levels Amount (Millions) Beta Factor Disaggregate Gross Income 2020 2021 0.2 2.0 1.2 2.2 2.2 2018 2019 No Business Line/Year Corporate finance Trading and sales Retail banking Commercial banking 5 0.7 0.6 2.2 18% 2.2 2.4 18% 12% 2.2 0.5 1.3 4.1 1.1 2.0 0.5 3.2 15% 18% 0.4 Payment and settlement 6. 1.6 Agency services 7. 0.5 1.1 3.2 1.4 15% 12% 2.0 5.7 0.5 0.8 Asset management Retail brokerage 8. 0.2 0.4 3.9 1.6 12% Aggregate Gross Income 2019 2020 2021 16.0 14.0 15% 2018 Bank Level 14.2 10.0 Using the information in the table above, calculate the minimum capital requirement for the years 2021 and 2022 for operational risk under Basel II using the i) Basic Indicator Approach (BIA) ii) Standardised Approach (SA)arrow_forwardWalmart Revenue The annual revenue of Walmart is given in the table below (source ). Walmart Annual Revenue (Billions of US dollars) 559.151 Year 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 523.964 514.405 500.343 485.873 482.130 485.651 476.294 468.651 446.509 421.849 408.085 404.254 377.023 348.368 312.101 284.310 Apply linear regression to the data in the table to find a model y = mx + b, where y is Walmart's annual revenue in billions of US dollars, and a is the number of years since 2000. Use the model y = mx + b with m rounded to the nearest tenth and 6 rounded to the nearestarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education