FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

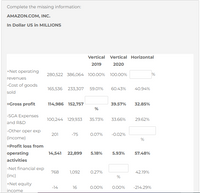

Transcribed Image Text:Complete the missing information:

AMAZON.COM, INC.

In Dollar US in MILLIONS

Vertical Vertical Horizontal

2019

2020

+Net operating

280,522 386,064 100.00% 100.00%

revenues

-Cost of goods

165,536 233,307 59.01%

60.43%

40.94%

sold

=Gross profit

114,986 152,757

39.57%

32.85%

%

-SGA Expenses

100,244 129,933

35.73%

33.66%

29.62%

and R&D

-Other oper exp

201

-75

0.07%

-0.02%

(income)

%

=Profit loss from

operating

14,541 22,899

5.18%

5.93%

57.48%

activities

-Net financial exp

768

1,092

0.27%

42.19%

(inc)

%

+Net equity

-14

16

0.00%

0.00%

-214.29%

income

Transcribed Image Text:+Net equity

-14

16

0.00%

0.00%

-214.29%

income

+Other income

203

2,371

0.07%

0.61%

1067.98%

(expense)

=Profit loss

13,962

24,194

4.98%

6.27%

73.28%

before tax

-Income tax

expense

2,374

2,863

0.85%

20.60%

continuing

%

operations

=Net income

11,588

21,331

5.53%

84.08%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help me with the attached problemarrow_forward2021 2020 2019 2018 2017 $ 394,032 199,466 19,071 $ 262,688 132,894 15,394 $ 205,225 $ 150,348 76,774 8,780 $ 112,200 56,100 Sales Cost of goods sold Accounts receivable 106,013 14,058 7,708 Compute trend percents for the above accounts, using 2017 as the base year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favorable or unfavorable. Trend Percent for Net Sales: Numerator: Denominator: Trend percent 2021: % 2020: % 2019: % %3D 2018: % = 2017: % Is the trend percent for Net Sales favorable or unfavorable? Trend Percent for Cost of Goods Sold: Numerator: Denominator: Trend percent %3D 2021: % 2020: % 2019: % %3D 2018: % = 2017: %3D Is the trend percent for Cost of Goods Sold favorable or unfavorable? Trend Percent for Accounts Receivable: Numerator: Denominator: Trend percent %3D 2021: % 2020: % %3D 2019: % = 2018: % 2017: % %3D Is the trend percent for Accounts Receivable favorable or unfavorable? II II IL || IIarrow_forwardNonearrow_forward

- Selected hypothetical comparative statement data for the giant bookseller Barnes & Noble are presented here. All balance sheet data are as of the end of the fiscal year (in millions). 2022 2021 Net sales $4,950.2 $5,700.8 Cost of goods sold 3,500.5 3,800.7 Net income 75.2 170.7 Accounts receivable 65.0 103.3 Inventory 1,150.0 1,350.1 Total assets 2,950.1 3,250.1 Total common stockholders’ equity 970.9 1,140.9 Compute the following ratios for 2022. (Round asset turnover to 2 decimal places, e.g 1.83 and all other answers to 1 decimal place, e.g. 1.8 or 2.5%) (a) Profit margin enter profit margin in percentages rounded to 1 decimal place % (b) Asset turnover enter asset turnover in times rounded to 2 decimal places times (c) Return on assets enter return on assets in percentages rounded to 1 decimal place % (d) Return on common stockholders’ equity enter return on common…arrow_forward2021 2020 2019 2018 2017 Sales $703,787 $ 463,018 $370,414 $256,342 $191,300 Cost of goods sold 361,331 237,839 192,311 132,684 97,563 Accounts receivable 33,993 27,133 25,299 14,996 13,066 Compute trend percents for the above accounts, using 2017 as the base year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favorable or unfavorable.arrow_forwardQuestion 18 Given: 2019 Sales $216,259 2020 Sales $290,149 2019 Operating Income = $102,258 2020 Operating Income = $174,701 2019 Net Income = $55,852 2020 Net Income = $83,735 Calculate DOL: (Enter your answer with 2 decimal places)arrow_forward

- Consider the following financial statement information for Hi-Tech Instruments: 2020 (Thousands of Dollars, except Earnings per Share) Sales revenue $210,000 Cost of goods sold 125,000 Net income 8,300 Dividends 2,600 Earnings per share 4.15 HI-TECH INSTRUMENTS, INC. Balance Sheets (Thousands of Dollars) Dec. 31, 2020 Dec. 31, 2019 Assets Cash $18,300 $18,000 Accounts receivable (net) 46,000 41,000 Inventory 39,500 43,700 Total Current Assets 103,800 102,700 Plant assets (net) 52,600 50,500 Other assets 15,600 13,800 Total Assets $172,000 $167,000 Liabilities and Stockholders’ Equity Notes payable—banks $6,000 $6,000 Accounts payable 22,500 18,700 Accrued liabilities 16,500 21,000 Total Current Liabilities 45,000 45,700 9% Bonds payable 40,000 40,000 Total Liabilities 85,000 85,700 Common stock* 50,000 50,000 Retained earnings 37,000 31,300 Total Stockholders’ Equity 87,000 81,300 Total Liabilities and…arrow_forwardLOGIC COMPANYComparative Income StatementFor Years Ended December 31, 2019 and 2020 2020 2019 Gross sales $ 19,000 $ 15,000 Sales returns and allowances 1,000 100 Net sales $ 18,000 $ 14,900 Cost of merchandise (goods) sold 12,000 9,000 Gross profit $ 6,000 $ 5,900 Operating expenses: Depreciation $ 700 $ 600 Selling and administrative 2,200 2,000 Research 550 500 Miscellaneous 360 300 Total operating expenses $ 3,810 $ 3,400 Income before interest and taxes $ 2,190 $ 2,500 Interest expense 560 500 Income before taxes $ 1,630 $ 2,000 Provision for taxes 640 800 Net income $ 990 $ 1,200 LOGIC COMPANYComparative Balance SheetDecember 31, 2019 and 2020 2020 2019 Assets Current assets: Cash $ 12,000 $ 9,000 Accounts receivable 16,500 12,500 Merchandise inventory 8,500 14,000 Prepaid expenses 24,000 10,000 Total current assets $ 61,000 $ 45,500 Plant and…arrow_forwardPlease helparrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education