Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

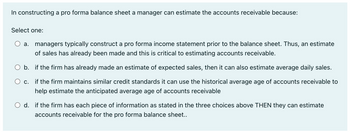

Transcribed Image Text:In constructing a pro forma balance sheet a manager can estimate the accounts receivable because:

Select one:

a. managers typically construct a pro forma income statement prior to the balance sheet. Thus, an estimate

of sales has already been made and this is critical to estimating accounts receivable.

O b.

if the firm has already made an estimate of expected sales, then it can also estimate average daily sales.

O c.

if the firm maintains similar credit standards it can use the historical average age of accounts receivable to

help estimate the anticipated average age of accounts receivable

O d. if the firm has each piece of information as stated in the three choices above THEN they can estimate

accounts receivable for the pro forma balance sheet..

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Need all the required, please and thank you ! very importantarrow_forwardAccountants at UltraTech obtain their values for inventory and total assets, calculate the balance sheet percentage by dividing inventory by total assets for each year and summarize the observations for the relative size of inventory to total assets for each year and percentage change from year-to-year. This would allow them to effectively assess: a. Inventory control compared to competitorsb. If there is an effective return on assetsc. If inventory is being properly managedd. How they are managing liabilitiesarrow_forwardHow should accounting be able to catch up with the high sales return rates, particularly on inventory management?arrow_forward

- A bank that is examining the ratio of annual costs of goods sold to average inventory, is examining which category of ratios? a.Profit measures b.Operating efficiency measures c.Liquidity measures d.Expense control measuresarrow_forwardWhich is correct with regards to the effects of restricting credit standards? a. Investment in accounts receivable will likely increase b. An increase in recognition of doubtful accounts expense will probably happen c. Positive impact on the net profit can be noted from decline in the quantity of goods sold d. Quantity of units sold will probably decrease and will result to a lower sales revenuearrow_forwardBriefly explain the accounting treatment for sales returns.arrow_forward

- Which of the following is NOT correct about the financial ratios? Select one:a. Financial ratios are based on the estimated values of balance sheet and income statement accounts.b. Financial ratios can be viewed as equalizers, allowing for relative comparisons to be made. c. Financial ratios are one of an analyst’s most powerful tools, converting financial statement information into a form that is easier to analyze.d. The examination of financial ratios provides insights into how a firm has performed historically and how it is performing relative to its competitors and its industry.arrow_forwardThe descriptive sections of the annual report that provides insight into what the company does and the types of risks it lates is felt Select one: OA management discussion and analysis. B. the industry overview. OC. the audit opinion. D. notes to the financial statements. To best interpret the accounts receivable turnover ratio, the days in accounts receivable should be compared to the company's Select one: A sales revenue. B. credit terms. OC. inventory turnover. D. accounts receivable balance. Two companies have an identical amount of current assets and current liabilities Donald Inc. has 40% of its current assets invested in whereas Mickey Corp. has 30% of its current assets invested in inventory Which of the following statements is true? Select one: OA. Donald will have the higher quick ratio. OB. Donald will have the higher current ratio. OC. The companies are equally liquid because their current ratios are the same OD. Donald is less liquid than Mickarrow_forwardWhat does a firm need to do to improve liquidity? Extend credit terms to customers in order to gain more sales Stock up on inventory in order to never run out of stock Pay all bills and payables when due Speed up collection of accounts receivable from customersarrow_forward

- Question Select three answers for changes in credit standards that are causes of changes in profits: A) Decrease in sales volume. B) Applying an aging analysis of balances C) Increase in contribution margin D) Increase in financial expenses due to an increase in the interest rate. E) Granting of discounts to incentivize prompt payment F) Increase in the investment in accounts receivable.arrow_forwardPlease help with the below minicase. Directions: The best way to do this case is to use relevant credit information and calculate some financial ratios: ROA, debt ratio, liquidity ratios, ROE, profit margin, Inventory and Asset turnover. Then look at breakeven point probability, and finally the possibility of a repeat order. What can you say about Miami Spice’s creditworthiness? What is the break-even probability of default? How is it affected by the delay before MS pays its bills? How should George Stamper’s decision be affected by the possibility of repeat orders? MiniCase: George Stamper a credit analyst with Micro-Encapsulators Corp. (MEC) needs to respond to an urgent email request from the southeast sales office. The local sales manager reported that she had an opportunity to clinch an order from Miami Spice (MS) for 50 encapulators at $10,000 each She added that she was particularly keen to secure this order since MS was likely to have a continuing need for 50 encapulators a…arrow_forwardApplication Directions: On the space provided, write your FIRST NAME if the idea being expressed is CORRECT, and your LAST NAME, if otherwise. 1. When an entity's net working capital is positive, current liabilities exceed current assets. 2. Marketing managers prefer lower inventory quantities since costs are associated with carrying inventories 3. When an entity's net working capital is negative, current liabilities exceed current assets. 4. Entities would prefer to convert inventories to cash the fastest way possible. 5. Working capital management is critical in every organization. 6. At the economic order quantity, carrying costs exceed ordering costs. 7. The higher the firm's current assets, the higher the profitability and the higher the risk. 8. The reorder point is measured as the lead time in order processing multiplied by daily inventory usage. 9. A firm's choice in the level of its working capital reflects its risk preference. 10.A safety stock prevents the occurrence of…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education