Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

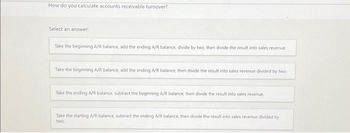

Transcribed Image Text:How do you calculate accounts receivable turnover?

Select an answer:

Take the beginning A/R balance, add the ending A/R balance, divide by two, then divide the result into sales revenue

Take the beginning A/R balance, add the ending A/R balance, then divide the result into sales revenue divided by two

Take the ending A/R balance, subtract the beginning A/R balance, then divide the result into sales revenue.

Take the starting A/R balance, subtract the ending A/R balance, then divide the result into sales revenue divided by

two.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of the statements below is TRUE? a. Receivables turnover is accounts receivable divided by sales. b. Inventory turnover is cost of goods sold divided by accounts receivables. c. Total asset turnover is profits divided by total assets. d. A higher inventory turnover ratio signifies that inventory is moving faster.arrow_forwardA customer returned damaged goods for credit. Under a perpetual system, which of the seller's accounts decreases? a. sales revenue b. sales returns c. accounts receivable d. purchase returnsarrow_forwardcalculate these (d) Current ratio :1 (e) Accounts receivable turnover times (f) Average collection period daysarrow_forward

- What is the normal balance of the contra-revenue accounts: Sales Return and Sales Discount and Allowances accounts?arrow_forwardTrue or False 1. Sales returns and allowances is a contra-revenue account 2. Sales discount is a revenue account with a credit balancearrow_forwardI know in order to find the accounts receivables analysis you first divide sales by the average accounts receivables and the average accounts receivable is the Ending balance plus the beginning balance divided by 2. Now, in order to find the number of days receivables, you must divide average accounts receivable by average daily sales and the average daily sales is the sales divided by 365. I have computed this multiple times and each time it says I am incorrect.arrow_forward

- Which of the following accounts has a normal debit balance. (Choose all that apply) feea earned accounts receivable cost of goods sold sales and returns allowances sales accounts payablearrow_forwardExplain how to calculate day’s sales in receivable.arrow_forwardHow to determine the unadjusted balances of accounts receivable by using the percent of sales method and the analysis of receivables method , please , thank You!arrow_forward

- Which of the following items in the balance sheet does NOT have a constant relationship with sales in general when we use the percent of sale method to construct pro forma financial statements? Retained earnings Inventory Accounts receivables Accounts payablesarrow_forwardA bank that is examining the ratio of annual costs of goods sold to average inventory, is examining which category of ratios? a.Profit measures b.Operating efficiency measures c.Liquidity measures d.Expense control measuresarrow_forwardBriefly explain the accounting treatment for sales returns.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education