Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

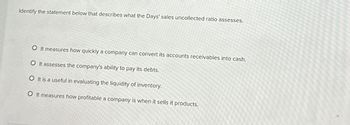

Transcribed Image Text:Identify the statement below that describes what the Days' sales uncollected ratio assesses.

O It measures how quickly a company can convert its accounts receivables into cash.

O It assesses the company's ability to pay its debts.

O It is a useful in evaluating the liquidity of inventory.

O It measures how profitable a company is when it sells it products.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- How can I find out z-score from financial statement or balance sheet? Can you describe in detail how do i find out all the numbers i need for it? For example for gross profit ,argin I need gross profit to divide with sales. How can I do z-score? Thank youarrow_forwardNeed all the required, please and thank you ! very importantarrow_forwardWhich of the following items in the balance sheet does NOT have a constant relationship with sales in general when we use the percent of sale method to construct pro forma financial statements? Retained earnings Inventory Accounts receivables Accounts payablesarrow_forward

- A bank that is examining the ratio of annual costs of goods sold to average inventory, is examining which category of ratios? a.Profit measures b.Operating efficiency measures c.Liquidity measures d.Expense control measuresarrow_forwardWhen inventory is sold on account, which of the following is true? Operating cash flows are increased at the time of sale. Total assets are increased by the amount of the gross profit. Net income is increased by the amount of the sales price. Revenue is not increased until the cash is received. Both net income and liabilities are increased by the amount of the sales price.arrow_forward1 When examining the current ratio and looking at the company's liquidity, which of the following ratios would NOT assist with evaluating liquidity? A) inventory turnover B) receivables turnover C) quick ratio D) profit marginarrow_forward

- Using this data, calculate the following ratios: return on sales, inventory turnover, inventory-on-hand period, and current ratio.arrow_forwardWhat does the inventory turnover period ratio measure? Select one: a.Profitability. b.The average time an organisation holds inventory. c.The liquidity of the firm. d.How much the firm's current assets could decrease and still leave it able to pay its current liabilities.arrow_forwardWhich of the ratios listed helps to indicate whether current liabilities could be paid without having to sell the inventory? a.Current ratio b.Profit margin c.Quick ratio d.Debt to equityarrow_forward

- 10. Choose the options to correctly complete the following statement. Some balance sheet and income statement accounts that vary directly with sales include: 1. Cost of goods sold II. Depreciation III. Accounts payable IV. Accounts receivable O I, II, III only O I, II, IV only O I, III, IV only O I, II, III, and IVarrow_forwardOn an income statement, can a company report total revenues instead of net sales? Are these the same thing?arrow_forwardWhich of the following statement is correct? O Inventory Turnover Ratio is a measure of how much the market is willing to pay (per share) for one dollar's worth of the firm's recorded earnings per share, and it is measure of the market's perception as to the future earnings potential of the firm. All the answers are incorrect. The times interest earned ratio is equal to Earnings Before Taxes (EBT) divided by Debt, and it is often used to assess a company's ability to service the interest on its debt with operating income from the current period. Asset activity ratios measure the ability of a firm to meet its short-term obligations. O When the investors have more confidence about the firm's future growth, then the higher P/E ratio is expected.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education