Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

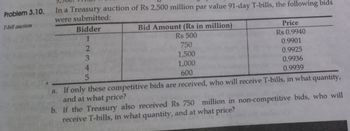

Transcribed Image Text:Problem 3.10.

T-bill auction

In a Treasury auction of Rs 2,500 million par value 91-day T-bills, the following bids

were submitted:

Bidder

1

2

3

Bid Amount (Rs in million)

Rs 500

750

1,500

1,000

600

Price

Rs 0.9940

0.9901

0.9925

0.9936

0.9939

5

a.

If only these competitive bids are received, who will receive T-bills, in what quantity,

and at what price?

b. If the Treasury also received Rs 750 million in non-competitive bids, who will

receive T-bills, in what quantity, and at what price?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Given the following bid and ask prices quoted by a dealer: Bid price of $1.1250/€ and Ask price of $1.1255/€, which of the following statements best describes the Bid-Ask Spread as a percentage? The dealer expects to make a profit of $0.005/€ on each transaction. The Bid-Ask Spread is 0.0044% of the bid price. The Bid-Ask Spread is 0.005% of the transaction value. The Bid-Ask Spread represents the dealer's margin on top of the selling price.arrow_forwardA T-bill quote sheet has 60 day T-bill quotes with a 4.38 bid and a 4.26 ask. If the bill has a $13,200 face value an investor could buy this bill for Multiple Choice $13,170.54 $13,106.28 $13,110.54 $13,606.28arrow_forwardWellington Seafood Company would like to sell 4,000 shares of stock to acquire its competitor Kapiti Crab Inc. The manager decides to use Dutch auction underwriting. The bids received are: Bidder ABCDE O $32,340 How much should bidder A need to pay if the bidder receives the allocated shares? Ⓒ $31,405 O $25,124 Quantity 1100 900 1,450 1,550 1,750 O $25,872 Price $29.40 29.05 28.90 28.55 28.35arrow_forward

- 1.arrow_forwardYou long a futures contract for 500 units of silver for $60 per unit. The initial margin is $3,000 and the maintenance margin is $2,000. What is the silver price at which you will receive a margin call? A.$62 B.$56 C.$58 D.$64arrow_forwardAssume the following information: Quoted Bid Price Quoted Ask Price Value of a Brazilian real (BRL) in $ $0.20 $0.21 Value of a Chilean peso (CLP) in $ $ .0010 $.0011 Value of a Brazilian real (BRL) in Chilean peso (CLP) CLP212.50 CLP212.75 Evan has $80,000 to conduct triangular arbitrage. What will be Evan's profit from implementing this strategy? Question 20 options: $567.29. $952.38. $631.24. $829.63.arrow_forward

- 1arrow_forward5arrow_forwardPlease show step by step how to solve this AMT is currently trading at $110/share. You bought 4 CALL-option contracts on AMT with a strike price of $100 for $26.0 each and sold 4 CALL - option contracts on AMT with a strike price of $130 for $7.0 each. a. What will be your total $ and % gain/loss if AMT price is $115 at the expiration date?b. What will be your total $ and % gain/loss if AMT price is $135 at the expiration date?c. What will be your total $ and % gain/loss if AMT price is $100 at the expiration date?arrow_forward

- AVC Auctions (AVCA) has offered its 16.6 million shares in a Dutch Auction IPO. The following bids have been received:Bidder Quantity Price 1 4,150,000 $ 25.60 2 5,500,000 $ 25.35 3 7,000,000 $ 25.00 4 2,250,000 $ 24.75How many shares will Bidder 3 be able to purchase? How much will Bidder 3 have to spend to purchase all of the shares that have been allocated to them?arrow_forward1. Swenson Markets would like to sell an additional 1,000 shares of stock using a Dutch auction. The bids received are as follows: (Table below should be interpreted as follows: Bidder A is willing to pay $31 for each share, up to 100 shares while bidder B is willing to pay $29 for each share, up to 100 shares) (Hint: Remember that for Dutch auctions, sell shares first to bidder with willing to pay the highest price and then to bidder with second highest price and so on until all shares are sold. However, every bidder will pay the price of the last bidder to receive any shares. In other words, everyone will pay the lowest price of all successful bidders receiving shares regardless of their own price bids.) Bidder Price A B с 500 D 600 E 400 What is the total amount the issuer will receive from this auction? Ignore costs. Quantity 100 100 $31 $29 $28 $27 $26arrow_forwardVijayarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education