Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

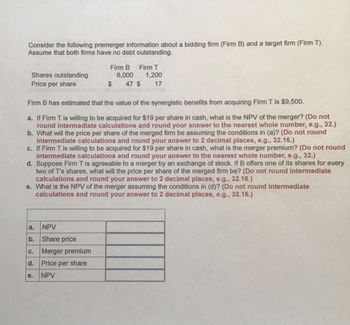

Transcribed Image Text:Consider the following premerger information about a bidding firm (Firm B) and a target firm (Firm T).

Assume that both firms have no debt outstanding.

Firm B

Firm T

Shares outstanding

Price per share

6,000

1,200

$

47 $

17

Firm B has estimated that the value of the synergistic benefits from acquiring Firm T is $9,500.

a. If Firm T is willing to be acquired for $19 per share in cash, what is the NPV of the merger? (Do not

round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)

b. What will the price per share of the merged firm be assuming the conditions in (a)? (Do not round

intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

c. If Firm T is willing to be acquired for $19 per share in cash, what is the merger premium? (Do not round

intermediate calculations and round your answer to the nearest whole number, e.g., 32.)

d. Suppose Firm T is agreeable to a merger by an exchange of stock. If B offers one of its shares for every

two of T's shares, what will the price per share of the merged firm be? (Do not round intermediate

calculations and round your answer to 2 decimal places, e.g., 32.16.)

e. What is the NPV of the merger assuming the conditions in (d)? (Do not round intermediate

calculations and round your answer to 2 decimal places, e.g., 32.16.)

a.

NPV

b.

Share price

C.

Merger premium

d. Price per share

e.

NPV

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 7 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Zang Industries has hired the investment banking firm of Eric, Schwartz, & Mann (ESM) to help it go public. Zang and ESM agree that Zang's current value of equity is $57 million. Zang currently has 4 million shares outstanding and will issue 1.2 million new shares. ESM charges a 6% spread. What is the correctly valued offer price? Do not round intermediate calculations. Round your answer to the nearest cent. $ How much cash will Zang raise net of the spread (use the rounded offer price)? Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answer to the nearest dollar. $arrow_forwardKT corporation has announced plans to acquire MJ corporation. KT is trading for $45 per share and MJ is trading for $25 per share, with a premerger value for MJ of $3 billion dollars. If the projected synergies from the merger are $750 million, what is the maximum exchange ratio that KT could offer in a stock swap and still generate a positive NPV? It is closest to: Answer choices: A) 0.75 B) 3.30 C) 2.25 D) 1.30arrow_forwardSuppose that the price of the target firm 43 is after the announcement. The acquirer's share price is 74 after the announcement, and it is 82 on the deal completion date. The acquirer offers to exchange 0.679 shares of the acquirer for each share of the target at the completion of the deal. Compute the return for a merger arbitrageur assuming that the deal is successful. The answer should be given in decimal form with three decimals. For example, write 0.105 instead of 10.5 or 10.5 % when the correct answer is 10.5 %.arrow_forward

- Company A has a market capitalization of $2410539999 and 22833777 shares outstanding. It plans to distribute $35977773 through an open market repurchase. Assuming perfect capital markets: What will the price per share of the firm be right after the repurchase?arrow_forwardAs an analyst of Firm A, you are investigating the possible acquisition of Firm T. You estimate that investors currently expect a 6% growth in A's earnings and dividends. Under new management this growth rate would be increased to 8%, without any additional capital investment. You are considering a stock swap merger. What is the maximum exchange ratio that you can afford? EPS Dividend/Share Number of Shares Stock Price Firm A $5 $3 1000000 $90 Firm T $1.5 $0.8 600000 $20arrow_forwardFor the following four IPOs, please find the total amount raised, the amount that went to the firm, and the amount that went to the underwriters/investment banks, and the gross spread. This information is available on the SEC Edgar database. Total S Amount S Raised by the SAmount Paid to S Offer S Bid Gross Raised Investment Banks Price Price Issuer Spread % Wingstop Shake Shack Alibaba Wingstoparrow_forward

- ABC would like to repurchase 50,000 of its ordinary shares. Investor X offered to sell his 20,000 shares at P20 per share. Investor Y offered to sell his 30,000 shares at P21 per share. Lastly, Investor Z offered to sell his 50,000 shares at P22 per share. ABC eventually paid Investors X and Y P21 per share to complete the repurchase. This is a/an *A. Fixed price tender offerB. Dutch auction self-tender repurchaseC. Open market operationD. Selective buy-backarrow_forwardHoobastink Mfg. is considering a rights offer. The company has determined that the ex- rights price will be $61. The current price is $68 per share, and there are 10 million shares outstanding. The rights offer would raise a total of $60 million. What is the subscription price?arrow_forwardConsider the following premerger information about a bidding firm (Firm B) and a target firm (Firm T). Assume that both firms have no debt outstanding. Firm B Firm T 1,300 $23 Shares outstanding 5,400 Price per share $53 Firm B has estimated that the value of the synergistic benefits from acquiring Firm T is $7,900. Firm T can be acquired for $25 per share in cash or by exchange of stock wherein B offers one of its share for every two of T's shares. Are the shareholders of Firm T better off with the cash offer or the stock offer? O Share offer is better O Cash offer is better At what exchange ratio of B shares to T shares would the shareholders in T be indifferent between the two offers? (Do not round intermediate calculations and round your answer to 4 decimal places, e.g., 32.1616.) Exchange ratioarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education