FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

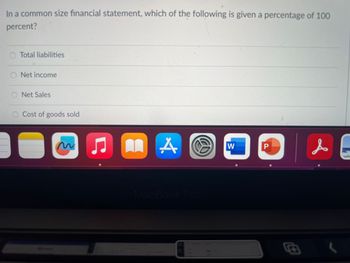

Transcribed Image Text:In a common size financial statement, which of the following is given a percentage of 100

percent?

Total liabilities

Net income

Net Sales

Cost of goods sold

MA

MacBook Pro

57

W

P

#

LE

Expert Solution

arrow_forward

Step 1: Introducing Vertical Analysis of Financial Statement

VERTICAL ANALYSIS OF FINANCIAL STATEMENTS

Vertical analysis is a proportional analysis of financial statements. Vertical Analysis is a form of financial statement analysis where the line items on a company’s income statement or balance sheet are expressed as a percentage of a base figure.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How should you compute the number that appears as "cost of good sold" in a common-size income statement?arrow_forwardConcept introduction Gross profit ratio: Gross profit ratio calculated by dividng the gross profit by sales.The formula to calculate the gross profit ratio is as follows: Gross profit = Gross profit/sales Gross profit is calculated using the following formula: Gross profit= Sales-Cost of Goods Sold To choose: The correct term for excess of sales over the cost of goods sold.arrow_forwardUse the attached information to complete the ratio analysis. The Ratio Analysis is for Profitability.arrow_forward

- I’m trying to do the debt to equity ratio. I understand that is total liabilities divided by stockholders equity. What would be my liability for the equation? Accounts receivable Inventory Net sales Cost of goods sold Total assets Total stockholders equity Net income arrow_forwardHow can I find out z-score from financial statement or balance sheet? Can you describe in detail how do i find out all the numbers i need for it? For example for gross profit ,argin I need gross profit to divide with sales. How can I do z-score? Thank youarrow_forward. Which of the following figures from a firm’s financial statements should be used as itsflow rate when computing its inventory turns?a. Sales revenueb. Cost of goods soldc. Inventoryd. Net incomearrow_forward

- Which is the formula for Gross Margin ratio? Seleccione una: a. Cost of Sales / Gross Revenues b. Revenues / Gross Expenses c. Revenues - Expenses d. Gross Profit / Sales Revenues e. Net Margin + Expenses / Gross Revenuesarrow_forwardPreparing an income statement) Prepare an income statement and a common-sized income statement from the following information. Click on the following icon in order to copy its contents into a spreadsheet.) Sales Cost of goods sold General and administrative expense Depreciation expense Interest expense Income taxes Complete the income statement below. (Round to the nearest dollar. NOTE: You may input expense acc as negative values.) Income Statement Gross profits Total operating expenses Operating income (EBIT) Earnings before taxes Net income $525,863 199,246 60,236 8,305 11,860 98,486 $ SSarrow_forwardWhich of the following is a solvency ratio? a. Times interest earned. b. Inventory turnover ratio. c. Profit margin. d. Price-earnings ratio.arrow_forward

- Which is the CORRECT order for items to appear on the income statement? Group of answer choices sales revenue, gross profit, net income, operating expenses cash, accounts receivable, inventory, property/plant/equipment, intangible assets sales revenue, operating expenses, gross profit, net income sales revenue, cost of goods sold, gross profit, operating expenses sales revenue, gross profit, cost of goods sold, operating expensesarrow_forward26. Given the following financial data for Alpha Company, calculate the ratios listed below the data. (Compute all ratios and percents to 2 decimal points.) Sales (all on credit) Cost of Goods Sold $650,000 422,500 Income before 78,000 Income Taxes Net Income 54,600 Ending Beginning Balances Balances Cash $19,500 $15,000 Accounts Receivable 65,000 59,800 (net) Merchandise 71,500 66,300 Inventory Plant and Equipment (net) 195,000 183,900 Total Assets $351,000 $325,000 Current $74,100 $100,200 Liabilities Long-Term Notes Payable 97,500 100,000 Stockholders' 179,400 124,800 Equity Total Liabilities and Stockholders' $351,000 $325,000 Equityarrow_forwardHh1.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education